Selling BTU puts for income.

Peabody Energy Corp. (BTU) produces coal which is in high demand as the world’s energy crisis continues.

While coal-fired electricity is certainly a declining business, BTU continues to generate lucrative profits in today’s market.

And thanks to evolving technology, coal can now be used without causing as much damage to the environment.

We’ve used BTU to successfully generate income in the past, and today we’re going back to the name to lock in more cash for our income model.

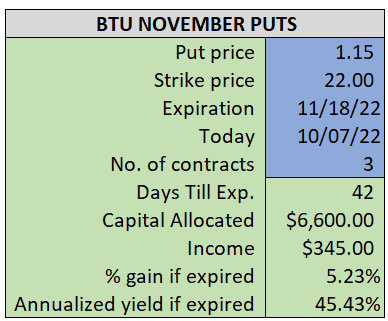

By selling the November $22 puts near $1.15, we’re able to collect an annualized yield near 45%, while also giving us roughly $4.70 per share in cushion between the current market price for BTU and our strike price.

- Sell (to open) 3 BTU November 18th $22 puts

- Limit: $1.15 or more

- The new position will represent roughly 7.6% of our model.

~~~~~~~

- Executed 11:58

- SOLD 3 BTU Nov 18 $22 Puts @ $1.25