Rolling our WYNN puts to a higher strike price and November expiration.

Shares of WYNN broke above resistance this week after a summer basing period.

The company should benefit from the strong dollar (which drives international travel) and also from less restrictive pandemic regulations in Chinese-controlled Macau.

Our October put contracts will expire in two weeks and are now trading at a low price thanks to strength in WYNN’s stock price.I continue to be bullish on this stock.

The most recent rally gives us a chance to close out our October $62.50 put contracts while locking in a large portion of the income we received from entering this trade.

We’ll then use that cash to set up a new income play by selling put contracts with a higher “strike price” (or agreement price).

This way we can continue to generate income from shares of WYNN.

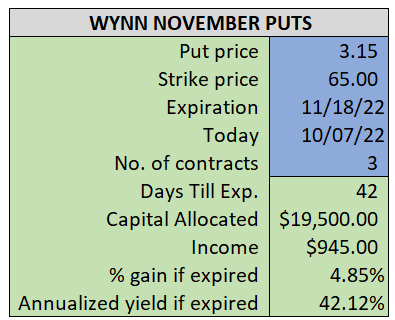

By selling the WYNN November $65 puts near $3.15, we’re able to collect an annualized yield near 42%, while also giving us roughly $7.00 per share in cushion between the current market price for WYNN and our strike price.

- Buy (to close) our WYNN October 21st $62.50 put

- Limit: $0.70 or less

ALSO

- Sell (to open) one WYNN November 18th $65 put

- Limit: $3.15 or more

- The new position will represent roughly 7.5% of our model.

~~~~~~~~

- Executed 14:41

- BOT 1 WYNN Oct 21 $62.50 put @ $0.62

- SOLD 1 WYNN Nov 18 $65 put @ $3.15