Selling SSRM puts for income.

SSR Mining Inc. (SSRM) is a U.S. silver and gold producer with mines in Nevada, Canada and Argentina.

Gold and silver prices have been under pressure thanks to a strong U.S. dollar. So even though inflation would normally drive gold and silver prices higher, currency pressures have kept that from happening.

There are signs the U.S. dollar’s advance may be overdone.

Any dollar weakness would likely drive gold and silver prices higher, meanwhile the strength seems to already be priced in to commodity prices and the stock price of miners like SSRM.

Bottom line, the probabilities now favor higher prices, and SSRM should rebound after finding support over the last few weeks.

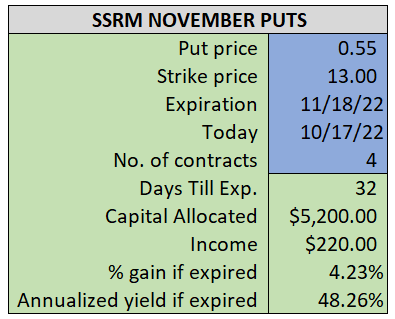

By selling the November $13 puts near $0.55, we’re able to collect an annualized yield near 48%, while also giving us roughly $0.65 per share in cushion between the current market price for SSRM and our strike price.

- Sell (to open) 4 SSRM November 18th $13 puts

- Limit: $0.55 or more

- The new position will represent roughly 6.0% of our model.

~~~~~~~

- Executed 14:16

- SOLD 4 SSRM Nov 18 $13 puts @ $0.59