“More isn’t always better, Linus. Sometimes it’s just more.” ~Sabrina

When it comes to investing in “the market” big stocks get all the attention.

Apple, Microsoft and Alphabet all have stock valuations above $1 trillion.

And when you add in other large names like Amazon, Tesla and Meta Platforms, the total valuation of these stocks is nearly $7 trillion. (According to Bespoke Investment Group, their peak market values used to be $11.8 trillion.)

It’s hard to wrap our heads around these numbers. But suffice it to say, the largest stocks have become massive influencers for the direction of the overall market.

This was great when big stocks were trading higher (pulling the rest of the market with them).

But now these mega-cap growth stocks are trading lower. And families invested in “the market” are taking more than their fair share of losses.

In fact, the six stocks mentioned above represent more than half of the market losses so far this year.

Yikes!

The Problem with Big Stock Indices

Many investors put money into the S&P 500, the Nasdaq 100, or some other large-cap index.

They think they’re “diversified” because these indices have dozens — sometimes hundreds — of different stocks.

But these investments aren’t as “balanced” or diversified as you think.

The big stocks carry so much weight, that these investments are really just plays on a handful of “Wall Street darling” stocks.

When these stocks fall out of favor (like they’re doing this year), you’re out of luck!

Fortunately, there are some great alternatives. You don’t have to concentrate your investments in the biggest stocks and hope for the best.

One of the easiest ways to balance your investments is to buy the Invesco S&P 500 Equal Weight ETF (RSP).

This fund invests in all 500 of the stocks included in the S&P 500 index.

But instead of putting most of the capital into big stocks like Apple, Microsoft and Google, RSP puts an equal amount into each stock.

That’s probably closer to what you would do if you picked out 20 different investments for your own account. Why would you put ten times more money into Apple just because it’s bigger than another company you’re investing in?

While I’m definitely a fan of picking your own favorite stocks, an investment in RSP is a great step in the right direction.

Less Concentration, Better Returns

Sure, RSP may be more balanced. But is this fund really better than a traditional S&P 500 investment?

Of course there are seasons when big stocks outperform smaller plays. And times when being more diversified can hand you better returns.

Let’s look at two different time frames.

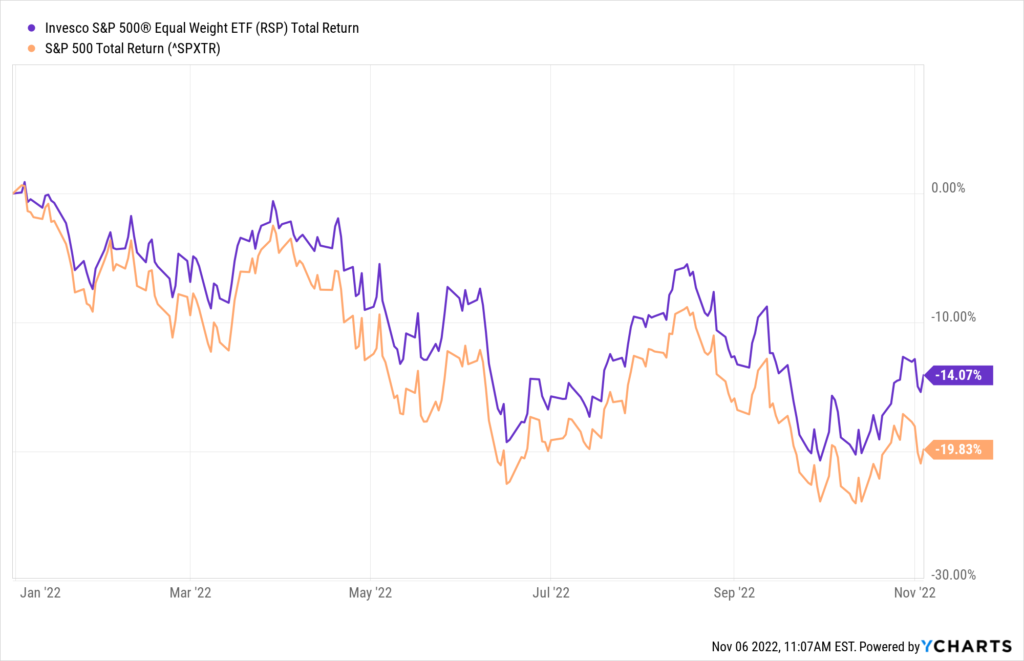

First, I’ll show you this year’s returns: The purple line is the “equal weight” RSP. And the orange line is the more traditional “cap-weighted” (or big stock) S&P 500.

While both indices have traded lower during the current bear market, buying the diversified RSP would have lessened the bear market blow by nearly 6%.

That’s a material amount!

Let’s look at a longer timeframe to see if this trend holds up.

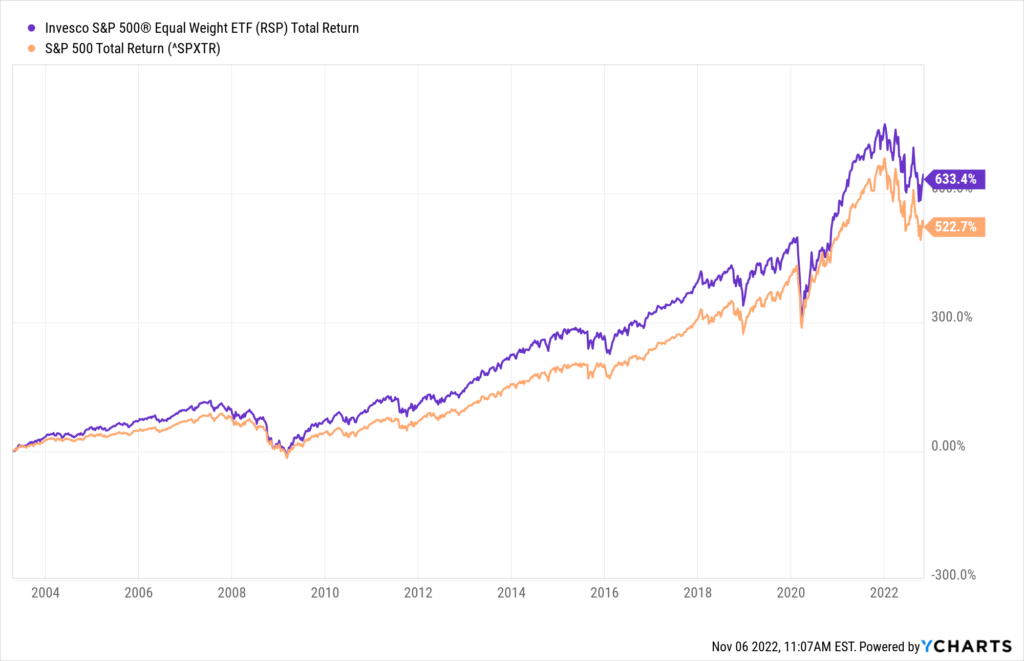

The chart below shows the total return for both indices since the equal weight RSP was created:

Over nearly 20 years, RSP gave investors significantly more profit — beating the S&P 500 by more than 110 percentage points.

The difference really adds up over time!

Today’s Lesson: Balance Your Approach!

I don’t think the equal weight RSP fund is a “perfect” investment.

But it’s certainly a step in the right direction!

The most successful investors keep a diversified list of ideas that span multiple areas of the market.

-Different industries…

-Big and small companies…

-Other asset classes (metals, real estate, even crypto)…

-Different countries…

-And even multiple strategies…

Concentrating too much of your capital on a handful of large-cap stocks can lead to big wins when you’re right. But it also causes big losses when you’re wrong.

I invest my own family’s savings using a barbell approach.

Most of my capital uses a conservative income-generating strategy. It has less risk than a “buy and hold” approach, and typically has reliable long-term profits.

A smaller portion of our investments go into my speculative trading program. This is a high-risk / high potential return approach that can profit from stocks trading higher OR lower.

And for each of these strategies, I keep a diversified watch list of stocks that I’m tracking. That way I’m never highly concentrated in a few big stocks that all trade with a similar pattern.

If you’ve got a big position in the S&P 500 or the Nasdaq 100, consider balancing your approach with a more diversified approach.

And if you’d like to download a complementary copy of my watch list (updated this weekend), you can get your copy here. (No strings attached — just please let me know what you think!)

Here’s to growing and protecting your wealth!

Zach