“Hey Zach, I’m too busy to research and trade individual stocks. Is there a good fund I can just buy and hold for the long-haul?”

Last week I was on a Zoom call with Aaron — a good friend and colleague of mine.

Aaron is a smart guy…

He’s built a multi-million dollar business that is thriving — even in this challenging environment.

Aaron is also a great dad with a healthy work / life balance. He loves spending time growing his business and taking care of his family. And doesn’t want to spend too much time thinking about his investments.

Maybe you’ve got similar feelings!

I absolutely love researching markets, individual stocks, and finding the best ways to grow and protect your wealth. But I know that not everyone feels the same way.

If you can’t spend the time (or don’t want to spend the time) looking at individual stocks, there IS one fund that can do a great job of growing your wealth in good times and bad.

A “Noble” Fund to Grow Your Wealth

My suggestion to Aaron was to consider the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

The fund invests only in companies that have grown their dividend payments for at least 25 years.

Now I’m not licensed to offer individual investment advice. And I can’t give you — or Aaron — specific advice without understanding your full financial picture.

But for many busy investors, NOBL is a great way to diversify your investment capital between some of the best dividend-paying stocks in the market.

These companies have paid reliable (and growing) dividends for more than two decades. So at least in the past these companies have been able to keep growing their business through both good and bad market periods.

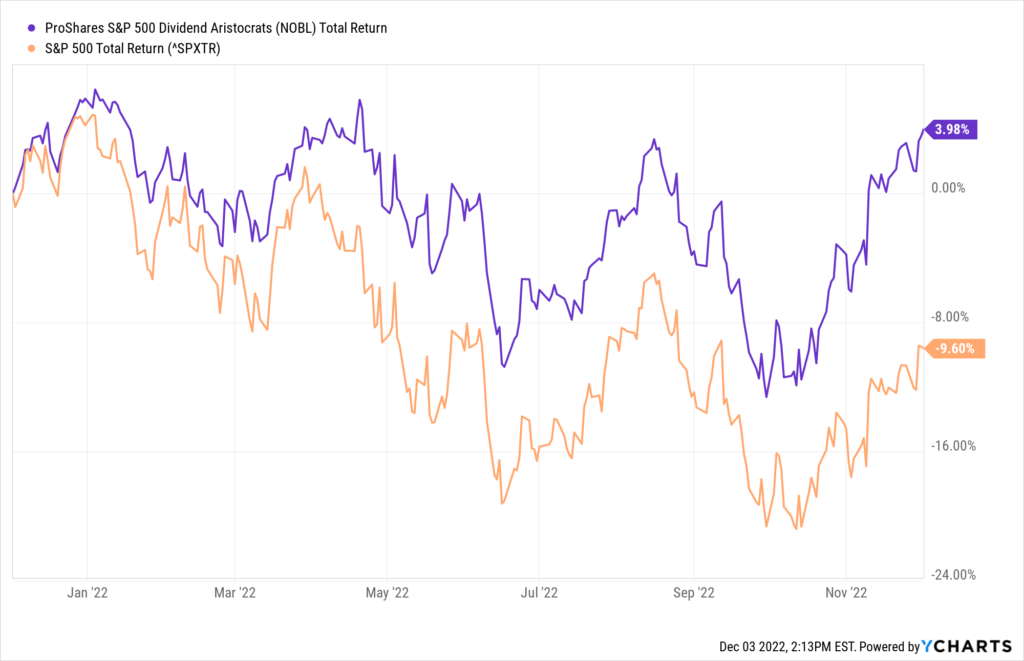

That track record of success is especially important during bear markets. And as you can see in the chart below, NOBL (the purple line) has helped investors preserve wealth this year. Even while the broad market (orange line) is down on the year.

Many of the stocks included in NOBL are based in the U.S. and have customers around the world. So as the U.S. dollar trades lower, these stocks are growing profits!

I love stocks that send reliable dividend payments to you. Of course, the dividend payments help to cover day-to-day expenses. But even better, these payments can free up cash for you to buy more shares — sometimes at cheap prices thanks to the overall bear market.

Using NOBL to Find New Stocks

I don’t typically by ETFs like NOBL in my own account.

That’s because I prefer to single out the best stocks and buy shares directly.

The list of stocks included in NOBL can be a great starting point for finding the best names to invest in. Here is a link to NOBL’s fact sheet — which includes a “top ten” list of stocks included in the fund.

You can also see which sectors of the market make up the largest portion of the fund.

This is helpful because it shows us which areas of the market generate the most reliable profits — which then fund the reliable dividends paid by each company.

Historically, consumer staples stocks have paid some of the most reliable dividends These companies sell the things most people buy in both good times and bad. So profits are much more reliable.

And while energy stocks make up the smallest weight in the NOBL fund, many energy stocks are actually in a great position to grow earnings and dividends for years to come.

I recommend looking through the stocks this fund invests in to find some great “set and forget” dividend stocks to invest in.

Meanwhile, my “Profit Watch” list of stocks can also be a good resource for zeroing in on the stocks I’m trading with my own family’s money.

You can download a free recent copy of my watch list here. And stay tuned for some dividend stock news in the next week or two — I think you’ll be excited to see what I’m putting together for you!

Here’s to growing and protecting your wealth!

Zach