Housing stocks are some of the most misunderstood investments in the market right now.

The financial media has been painting the industry in a bad light, focusing on two key themes.

First, homes are expensive.

Strong demand for homes led to low supplies, competitive bidding wars, and higher transaction prices. In many suburban markets, home prices have doubled or more over just a couple of years.

Second, interest rates are rising.

This makes it tougher for families to afford monthly mortgage payments. And it also makes it more difficult for existing homeowners to move. After all, who wants to give up a house with a low mortgage rate knowing that the next home will come with a 6% mortgage (or higher)?

These are very real challenges for home buyers.

As a result, the number of transactions (new home purchases and existing home purchases) has dwindled.

But does that mean the real estate market is in trouble? And does it mean you should avoid homebuilder stocks?

The truth is, many homebuilder stocks actually look like great investments right now. And over the last few weeks, these stocks have been moving steadily higher.

Let’s take a look at why…

A Supply / Demand Imbalance

Home prices continue to be high because of an imbalance between supply and demand.

There simply aren’t enough homes available compared to the number of potential buyers. The Millennial generation is the largest generation so far, and these young adults are now entering the peak household formation stage of their lives.

Meanwhile, we’re coming out of a “lost decade” of home building activity following the Great Financial Crisis. Many home construction companies went out of business, while others scaled back significantly to minimize risk.

As a result, home construction hasn’t kept up with rising demand.

And as economics 101 tells us, when there is a shortage of an important commodity (housing in this case), prices naturally rise.

At the same time, homebuilders are now worried that rising interest rates will hurt demand for homes. So these homebuilders are scaling back future plans — which all but ensures that we will continue to have a shortage of homes for years to come.

Homebuilders that are still in the market — and still building new homes — can profit from this trend. Because limited supplies and strong organic demand will continue to support home prices. So profits from building new homes will continue to be attractive.

Charting the Course for Homebuilders

Despite widespread skepticism, homebuilder stocks have been moving higher in recent weeks.

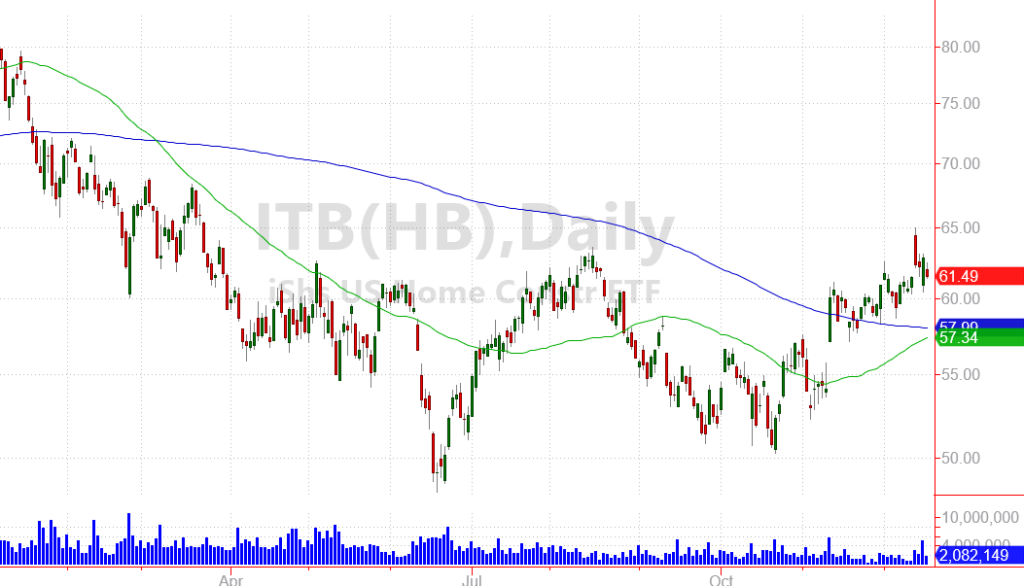

Just take a look at the iShares US Home Construction ETF (ITB).

After pulling back at the beginning of this year, homebuilder stocks found a bottom in June, tested that bottom in October, and are now trending higher.

Just this morning, I recommended an income play on one of my favorite homebuilder stocks.

Subscribers to my Accelerated Income Model were able to collect an instant $270.66 from shares of KB Home (KBH).

To collect this income, we sold put contracts on KBH, agreeing to buy 200 shares at $31 if the stock winds up trading below that level when the market closes on January 20th.

While I expect shares to continue higher between now and our expiration date, this trade requires investors to set aside $6,200 in case they are required to buy 200 shares of KBH at the agreed upon price.

This trade has the potential to generate an annualized yield of 46%. And while not all of our trades turn out the way we expect, this strategy can be very lucrative — especially in a choppy or uncertain market.

For more information on how this strategy works, check out my Accelerated Income Blueprint — a free report I put together to explain how to collect instant cash payments from some of your favorite stocks.

>>Download your copy of the blueprint here<<

Despite higher interest rates and a slowing economy, homebuilder stocks continue to look very attractive. These stocks are inexpensive compared to earnings, have less competition (as second-tier builders exit the market), and are currently trending higher.

Consider investing in ITB — or your favorite home construction company — before the stocks move any higher!

Here’s to growing and protecting your wealth,

Zach