My friends and family know that I hate most shopping trips.

Maybe it’s tied to childhood memories of “back to school” clothes shopping with all of my brothers and sisters. Since I had 10 siblings growing up, those trips could be marathon events!

Of course it probably depends on what I’m shopping for. These days I don’t mind spending an hour or two browsing through running shoes or cycling gear.

But I digress…

In today’s market, there are essentially two classes of shoppers with two very different perspectives.

As investors, we need to understand how these shoppers think. That way, we know which companies are likely to profit from the current retail landscape.

Let’s take a look at what’s working right now…

Budget Shoppers Are Focused on Value…

Thanks to rising inflation, many lower-income families are finding it more difficult to pay for day-to-day expenses.

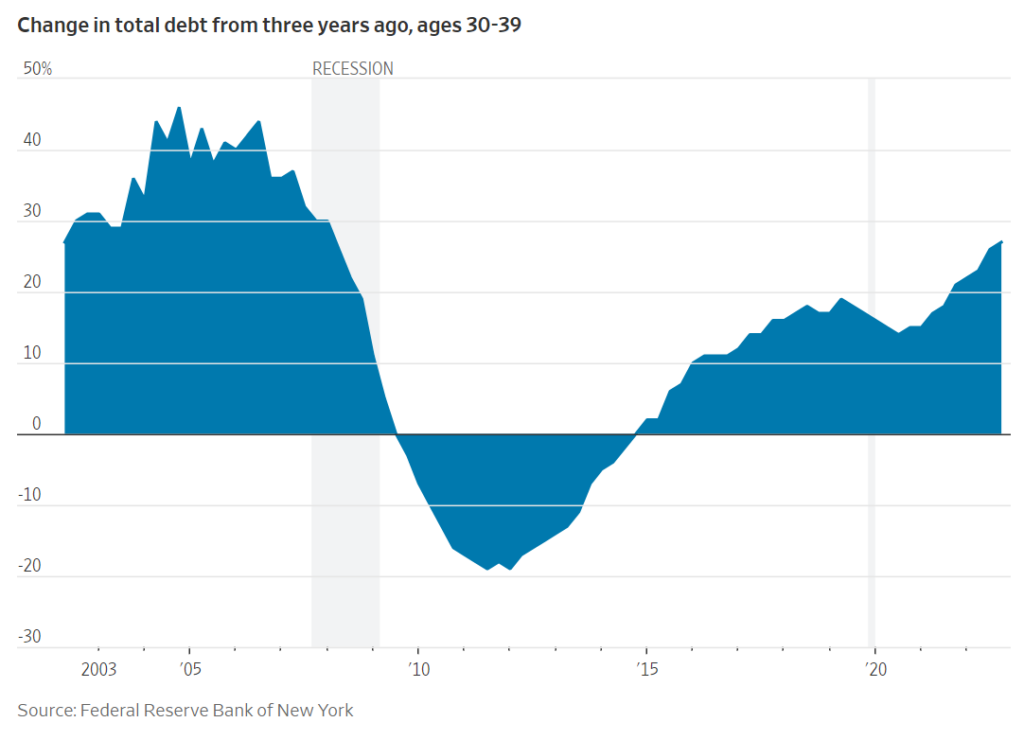

A recent Wall Street Journal article reported that debt for consumers age 30-39 is rising fast.

As a group, these consumers now owe more than $3.8 trillion. And as interest rates rise, monthly payments are becoming more challenging.

Shoppers with more debt and less wiggle room in their budgets are looking for value. So retailers like TJX Companies (TJX) and Ross Stores (ROST) have built a competitive edge.

Remember, these retailers also benefited from supply chain challenges — and now have inventories of name brand merchandise to sell at a discount.

As long as inflation continues to challenge mainstream consumers, we’ll be keeping a close eye on discount retailers that offer great values for shoppers.

But Affluent Shoppers Have Cash to Spend…

On the OTHER end of the spectrum, affluent shoppers still have plenty of money to spend.

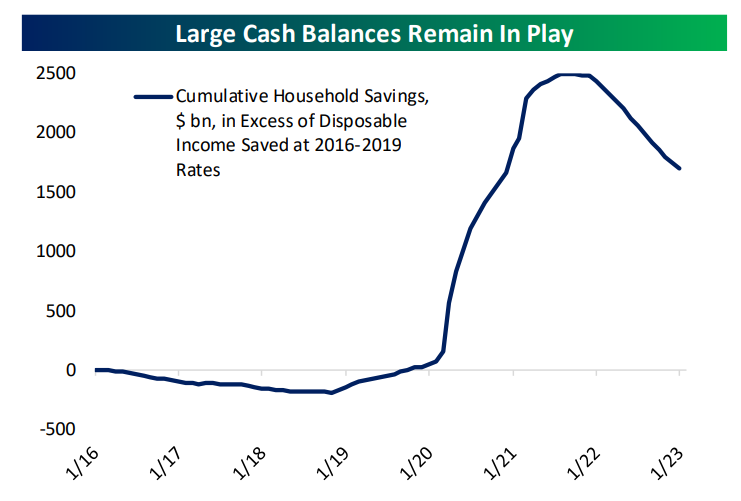

Take a look at this chart from Bespoke Investment Group. It shows that total cash balances are still elevated following the pandemic saving period.

Much of this cash is held by high-earning consumers or retirees with plenty saved for day-to-day expenses.

These consumers are much more likely to spend on vacations, trips to see family members, or more expensive experiences.

The stock market rally in early 2023 will also help to drive spending.

After all, with investment values rising, these consumers now feel more confident about their long-term prospects. So it’s easier to splurge on a weekend getaway when their investment account is growing.

That’s one of the reasons I’m very bullish on travel stocks right now.

(Other catalysts include China’s reopening and a return to business travel.)

My Accelerated Income Model currently holds a position in Norwegian Cruise Lines (NCLH) and I’ve got my eye on a few other travel stocks to profit from this trend.

>> More info on the Accelerated Income Model here <<

The broad stock market is in a challenging spot right now. Investors face a number of challenges as well as opportunities.

Quite frankly, it’s hard to make a definitive call on which way the overall market will trade from here.

But there plenty of specific opportunities like these consumer stocks that are poised for profit.

Stay tuned and I’ll keep you posted on what I’m shopping for in the market — and how I’m avoiding those shopping trips I hate.

Here’s to growing and protecting your wealth!

Zach