The banking crisis that started with Silicon Valley Bank’s failure is causing ripple effects through the global financial system.

Savers are worried about their deposits.

Investors are worried about their stocks.

And economists are now worried that this crisis could cause a quick recession.

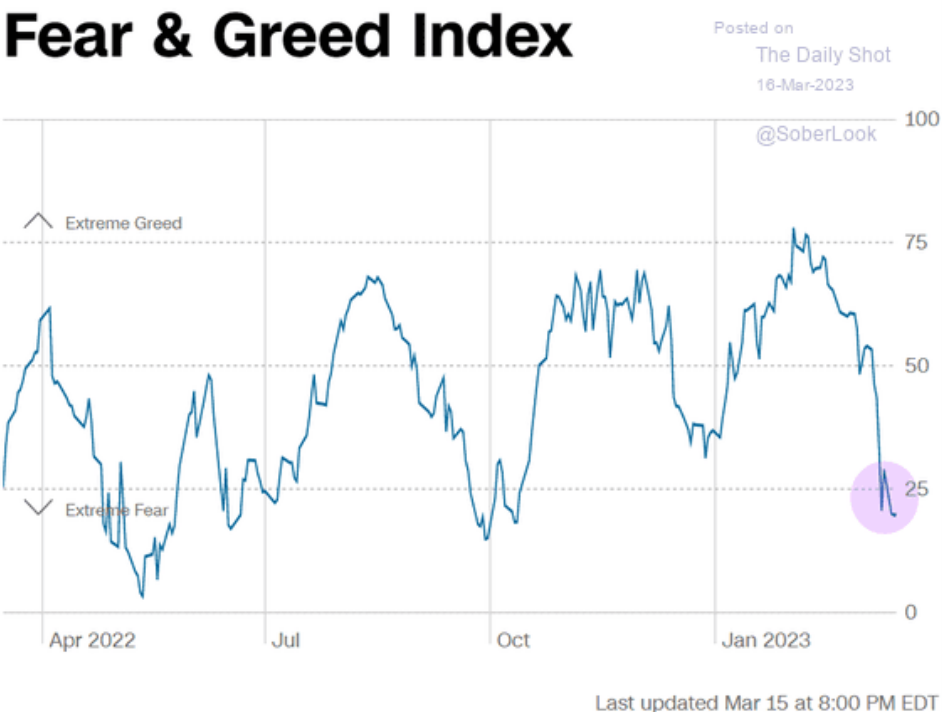

Wall Street’s “Fear and Greed” indicator has dipped sharply into “fear” territory. And this, after an optimistic start to the year for most investors!

Ironically, all of this fear actually creates a lucrative opportunity for income investors. And one of my favorite strategies is in great shape to capitalize on this situation.

Collecting Income from the Banking Crisis

One of my favorite indicators tracks the level of fear in the market. It’s called the CBOE Volatility Index (VIX). Most traders refer to the index by it’s “VIX” symbol (calling it “The VIX”).

Take a look at today’s VIX chart – which shows rising fear in today’s market:

Here’s what’s happening behind the scenes…

Fearful traders are willing to pay more for certain option contracts which help to protect (or “insure”) their investments. So you can think of the VIX as measuring the price of insurance for a typical investment portfolio.

Just like you would pay more for property insurance when a storm is approaching, investors pay more for insurance when a banking crisis or other major event hits the market.

The good news for you is that you can collect these insurance payments and actually lock in some lucrative income payments from these fearful traders.

Selling Puts for Income

One of my favorite investment strategies is to sell “put contracts” on my favorite stocks.

When you sell a put contract, you’re entering an agreement to buy shares of stock. That agreement includes a specific price you’re willing to pay, and a specific time period for the contract.

The best part is that you get paid up front to enter the contract.

The cash you receive from selling the put contract will be in your account immediately. Meanwhile, your broker will set aside cash (or margin buying power) in case you’re required to buy shares at your agreed upon price.

When the contract expires, two things can happen:

If the stock is trading below your agreement price, you’ll be required to buy shares. Your broker will automatically purchase the stock at the agreed upon price.

But please understand: You still get to keep the income from selling your put contract.

I only sell put contracts on stocks I would like to own. And I only use put contracts with a fair price that I would be willing to pay for that stock.

The second outcome occurs if the stock is trading above your agreement price.

In this case, the put contract will “expire” and disappear from your account. And once again, you still get to keep the income from selling your put contract.

And now that the contract is expired, you may want to go back to the same stock AGAIN and start the process all over again.

A Quick Primer on This Income Strategy

If you’re interested in learning how to use this strategy in your own account, I’ve got a special gift for you.

I created the Accelerated Income Trading Blueprint to teach YOU how to collect your own income payments. (It’s a free report – no strings attached.)

The blueprint covers all the details you need to start using this strategy in your OWN account.

Some people I talk to have been intimidated by the idea of selling put contracts. But once they see how easy the transaction can be, they love using the new investment strategy!

If you’re interested in learning this approach, please feel free to download my free blueprint.

>> Download the Accelerated Income Trading Blueprint here <<

Once you place your first income trade, I’d love to hear what you think about this process!

Send me an email or drop me a comment.

Here’s to growing and protecting your wealth!

Zach