Whew! We made it to the end of another week. And what a week it was for investors!

Watching the stock market pull back can be a bit nerve-wracking. Stocks hit a new all-time high on February 19th, but it’s been downhill since then. And while there’s certainly a risk that the market could keep sliding, there are some encouraging signs that suggest a rebound is on deck.

In fact, the market may even be poised to resume its sustained uptrend!

Today, I wanted to share three reasons why I believe the stock market is poised for a bounce. And stick around, because at the end, I’ll share a specific idea for potentially capturing some significant gains.

Reason #1: The 200-Day Moving Average: A Line in the Sand

Okay, let’s talk technicals for a second, but I promise to keep it simple.

You’ve probably heard of the 200-day moving average. It’s basically a long-term trendline that smooths out daily price fluctuations, giving us a clearer picture of the overall market direction. Think of it like a long-term weather forecast, rather than a minute-by-minute update.

Right now, major market indices like the Dow Jones Industrial Average, the S&P 500 and even the Nasdaq 100 have pulled back to this crucial 200-day moving average. This isn’t just some random line on a chart; it’s a metric that a lot of big-time investors, like hedge funds and investment advisors pay close attention to.

Historically, when the market dips to this level, they tend to step in and buy.

Why? Because it’s often seen as a sign that the long-term uptrend is still intact. This is the first time in over a year that we’ve seen this kind of test, so it’s highly likely we’ll see buyers emerge, pushing stocks back up.

Reason #2: We’re Officially in Oversold Territory

Let’s face it, the recent sell-off has been pretty sharp. Since mid-February, we’ve seen a significant pullback. And when stocks drop that quickly, it often leads to what’s called an “oversold” condition.

Basically, it means the market has dropped too far, too fast, and is due for a correction.

Think of it like a rubber band stretched too tight. It’s bound to snap back. And in the stock market, that snap back comes in the form of a bounce.

When investors see their favorite stocks suddenly trading at a discount, it triggers that “buy the dip” mentality. Plus, oversold markets have a tendency to “overshoot” on the downside, meaning they drop further than they probably should, creating even more potential for a rebound.

After nearly three weeks of selling pressure, the odds of a short-term bounce are definitely increasing.

Reason #3: Retail Investors Are Singing the Blues

Now, let’s talk about the sentiment of individual investors, the “mom and pop” crowd.

History has shown that retail investors often get overly enthusiastic at market peaks and overly pessimistic at market bottoms. It’s just human nature.

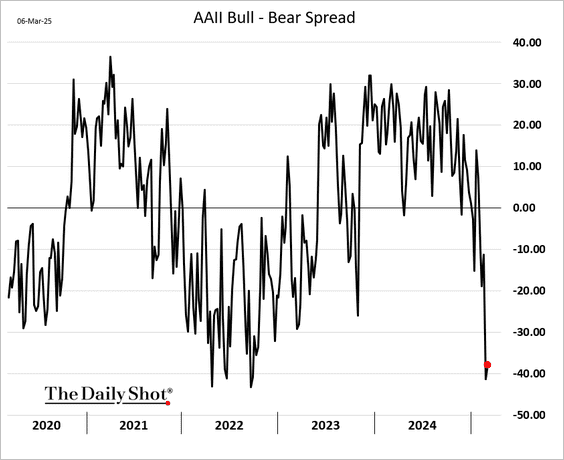

Right now, data from the American Association of Individual Investors (AAII) shows that retail investors are extremely bearish. In fact, they haven’t been this fearful in almost three years. This is actually a good sign for those looking for a rebound.

Why? Because when retail investors are bearish, it usually means they’ve already sold their stocks and are sitting on the sidelines. They’re out of the market. This creates a pool of potential buyers just waiting for the market to show signs of life.

And here’s the kicker: any hint of a rebound could trigger a wave of “fear of missing out” (FOMO).

Suddenly, those sidelined investors will start worrying they’re missing out on gains, and they’ll rush back into the market, driving prices even higher. It’s like a self-fulfilling prophecy.

So, What’s the Play?

Full disclosure, I’m not saying the market is guaranteed to go straight up from here. Investing always involves uncertainty.

But the odds of a meaningful rebound are definitely looking better.

Personally, I’m positioning my own investments to take advantage of this potential bounce. I’m adding a few more aggressive positions to my portfolio, looking for stocks that could see a significant surge if the market turns around.

For example, consider Goldman Sachs (GS). As a major player in the financial sector, GS tends to do well when the overall market is strong. A broad market rebound could easily push GS to new highs.

One way to play this could be by buying call options on GS. That way you can limit your risk, while having large upside potential.

GS is just one of the more aggressive positions in my Speculative Trading Program. Subscribers to this program receive real-time alerts whenever I add a new position to my own account.

So if you want to follow along with my personal trades next week, be sure to sign up! You can even try out the program for 30 days and ask for a refund if it’s not for you.

After a few weeks of selling, the outlook is good for stocks next week. And I’ll be in touch to let you know what I’m seeing as the week goes on.

Here’s to growing and protecting your wealth!

Zach