Selling MU puts and NEM puts for income.

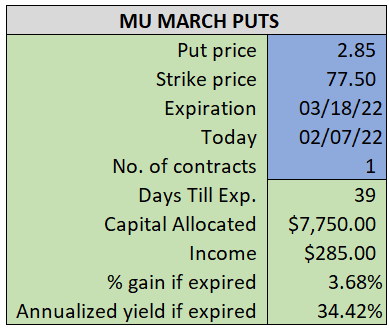

Micron Tech (MU) is a profitable computer chip manufacturer that has sold off as the stock market moved lower.

The stock has a lot of value at this price point, trading for less than 7 times expected earnings. Higher volatility allows us to collect a lucrative income payment while still keeping a buffer between the current market price for MU and our agreement price to buy shares.

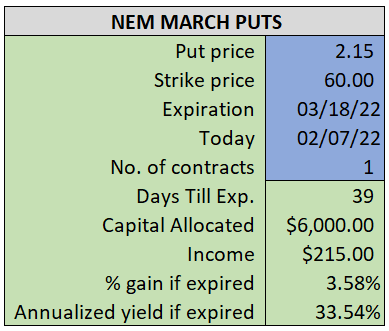

NEM is a blue-chip gold and silver miner that should benefit from rising inflation.

As inflation drives prices higher, NEM’s profits should increase. At the same time, the value of the company’s underground resources also benefits. Both profits and the value of NEM’s resources should push the stock price higher.

By selling the MU March $77.50 puts near $2.85, we’re able to collect an annualized yield near 34%, while also giving us roughly $3.75 per share in cushion between the current market price for MU and our strike price.

- Sell (to open) 1 MU March 18th $77.50 put

- Limit: $2.85 or more

- The new position will represent roughly 8.0% of our model.

~~~~~~ - 10:11 Executed

- Sold 1 MU March 18th $77.50 Put @ $2.87

ALSO

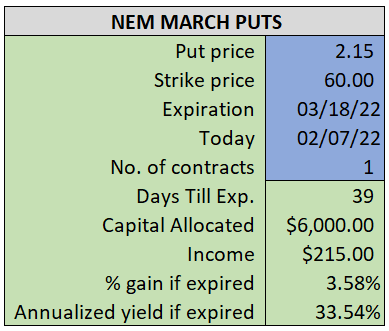

By selling the NEM March $60 puts near $2.15, we’re able to collect an annualized yield near 34%, while also giving us roughly $1.50 per share in cushion between the current market price for NEM and our strike price.

- Sell (to open) 1 NEM March 18th $60 put

- Limit $2.15 or more

- The new position will represent roughly 6.2% of our model.

~~~~~~~ - 10:12 Executed

- Sold 1 NEM March 18th $60 Put @ $2.15