Selling CLF puts for income.

Cleveland Cliffs (CLF) is a U.S. Steel and iron ore company operating in the great lakes region.

The company has a geographical advantage, with mines and factories located in close proximity to auto plants and other manufacturing companies in the region.

While the stock has been volatile this year, shares surged to a new 52-week high last week. Higher inflation has benefited the company’s iron ore business and Wall Street analysts strong profits this year.

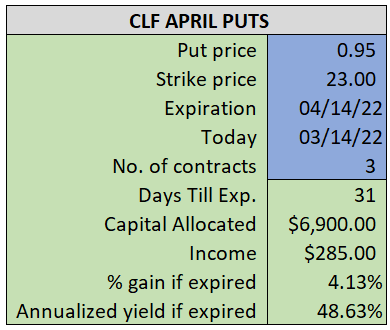

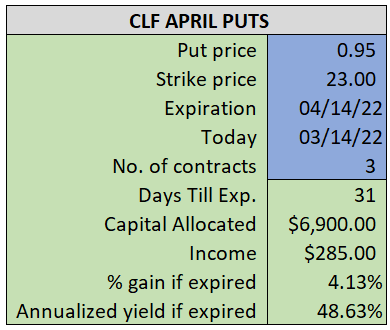

By selling the April $23 puts near $0.95, we’re able to collect an annualized yield near 49%, while also giving us roughly $2.50 per share in cushion between the current market price for AU and our strike price.

- Sell (to open) 3 CLF April 14th $23 puts

- Limit: $0.95 or more

- The new position will represent roughly 7.3% of our model.

~~~~~~~ - 11:56 Executed

- Sold 3 CLF Apr 14th $23 Puts @ $1.07