[Editor’s Note: This is Part II of our series on Cathie Wood’s ARKK Innovation ETF. In Part I, we discussed how fund managers are sometimes forced to sell, even when they still believe in their positions.

Today, we’ll take a quick look at the market environment, and then look at the top three ARKK positions listed in the table from last week.]

Volatility is back, bringing both opportunity and risk.

This week started off with a sharp decline on fears of global financial contagion coming from China. But halfway through the week, markets found their footing, working their way back towards recent highs.

For it’s part, the ARKK Innovation Fund (ARKK) held up relatively well!

For a few weeks, it looked as if ARKK was in the process of breaking lower. This could have been especially troubling for Cathie Woods’ ARKK positions.

If investors in the fund decided to pull capital out, Woods could have been forced to sell some of her biggest positions. This could have set off a vicious cycle of lower prices pressured by selling — and more redemptions driven by lower prices.

For now, the fund appears to have stabilized. So the immediate risk to ARKK holdings is muted.

Keep an Eye on Interest Rates…

As we look through the key positions included in Woods’ fund, keep in mind that interest rates play a key role in how these stocks are priced.

When rates eventually move higher, it will become harder for Wall Street institutional investors to justify holding growth stocks with long runways before profits accumulate.

For now, interest rates continue to be exceptionally low. And this week’s Fed announcement didn’t trigger any increase.

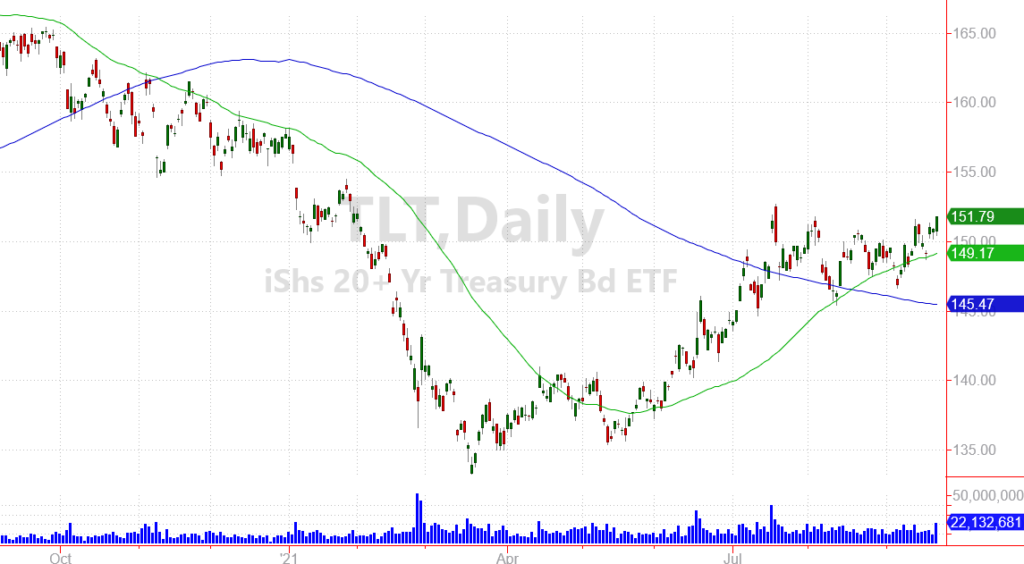

One easy way to keep your eye on market interest rates is by watching treasury bond prices. The iShares 20+ Yr Treasury Bond ETF (TLT) is a fund you can keep on your watch list to monitor long-term U.S. interest rates.

Just remember that bond prices move in the opposite direction as interest rates. So if you see shares of TLT rising, it means that interest rates are generally falling.

A sharp drop in TLT (and corresponding rise in long-term interest rates) would be a warning sign for many of the growth and tech stocks included in the ARKK Innovation portfolio.

Tesla: The Right Side of Momentum

In the past, I’ve referred to Tesla Inc. (TSLA) as a “cult stock.”

The popularity of the company, its eccentric founder Elon Musk, and it’s high-quality electric vehicles has led to an investor base of “true believers.”

These investors have historically been willing to pay any price for the stock — with little to no regard for fundamental earnings or traditional investment metrics.

That sentiment has helped to support the stock’s premium price following a ten-fold run during the 2020 coronavirus crisis.

Today, shares are trading near $750, which gives Tesla a market value north of $700 billion. This, despite the fact that TSLA is expected to earn just $5.29 per share this year, and $7.07 per share in 2022.

(In other words, shares of TSLA are trading at more than 100 times next year’s expected profits.)

Normally, I would be wary of such a premium price.

But in today’s market, investor optimism is much more important than valuation — especially for a popular stock like TSLA.

With individual investors continuing to move more money into stocks, and brokerages like Robinhood Markets (HOOD) allowing investors to buy fractional shares of just about any company, we should continue to see more capital driving shares of TSLA higher.

The stock has traded steadily above it’s 200-day and 50-day moving averages for the last several months. This helps to give the stock a bit more stability (making it easier for investors to feel comfortable buying — and even taking leveraged positions).

As long as this momentum continues, TSLA can be a great ticker to trade from the long side.

In fact, TSLA call options represent one of the largest positions in the Arete Trading Program (currently in beta testing).

For now, TSLA looks like a good speculative play, as long as the trend is intact. You could use the 50-day and 200-day average lines as key support levels, and consider reducing a position — or even going short — if these levels are broken.

Over time TSLA’s valuation will certainly contract to a more reasonable level (well below 100 times expected earnings). But it’s tough to tell whether that will happen because the company grows into this premium valuation, or through a market pullback.

“The trend is your friend” says the famous Wall Street proverb. And for now, TSLA’s trend is very positive.

Teladoc Health: Hard to Make a Case…

Teladoc Health Inc. (TDOC) was extremely popular with retail investors during the coronavirus crisis.

By making physician appointments available online, it was easy to see how TDOC’s business could grow.

The wave of new rookie investors piled into the stock, driving it as high as $300 per share. This gave the company a valuation of nearly $45 billion!

There’s one big problem… (actually two!)

First, TDOC doesn’t generate a profit. And the company isn’t EXPECTED to generate a profit any time in the foreseeable future. So the stock is largely trading based on the whims of retail investors and the popularity of the company’s brand.

Second, TDOC does not appear to have a “moat” for its underlying business. It wouldn’t be all that difficult or expensive for another company to set up a competing portal for doctors and patients to connect.

Without the ability to defend its territory — and without fundamental earnings to justify its sky-high valuation it’s very difficult to make a case for investing in TDOC.

Even after losing more than 50% of its value, TDOC still looks expensive. The market value for this company is still above $20 billion and shares have been in a slump.

Trapped investors who bought at higher levels are more likely to sell any time the stock rebounds. This selling pressure should keep the stock from staging much of a rally.

TDOC is one of the names on the short side of our 20/20 watch list. (I’m putting the final touches on this list and should have the first version ready by the end of September.)

I don’t have a current position in TDOC. But I would be more interested in shorting (or buying put contracts) on a breakdown or after a failed rally attempt.

Roku: Let’s See What Happens…

The third stock on last week’s ARKK holdings is Roku, Inc. (ROKU).

This streaming entertainment company certainly benefited from the coronavirus crisis. Customers stayed at home due to widespread lockdowns and turned to services like ROKU for entertainment.

At the end of last year, the company had 51.2 million active accounts. And in contrast to DOCU, these customers have generated enough revenue to help ROKU turn a profit!

The company is expected to earn $1.28 per share this year, and grow profits by 28% to $1.64 per share in 2022. Revenue is expected to grow from $2.84 billion this year to $3.89 billion next year.

ROKU has profits, a loyal customer base and growth on its side.

But the stock still has a valuation problem. At a price near $325 shares of ROKU are valued at nearly 200 times next year’s expected profits!

This is not a sustainable valuation for the long-term. There are basically two ways this can play out:

- ROKU profits can grow quickly, allowing the company to “grow into” it’s premium stock valuation.

- Or shares can fall sharply, driving the stock price to a more reasonable multiple of earnings.

For now, it’s a tough call.

Investor optimism continues to be very strong and there is a lot of cash on the sidelines in today’s market.

That sideline cash could be put to work in speculative stocks like ROKU, helping to drive shares higher. And Cathie Woods’ stamp of approval on this company would certainly help to drive enthusiasm.

But if the stock breaks below $300, investors will likely feel “trapped” in a sinking ship and may start bailing out quickly. After breaking support, it would be tough for institutional investors to make a case to step in and support the stock until it got closer to 50 times expected profits (somewhere close to $80 per share).

As always, it’s extremely important to use discipline and only risk capital you can afford to lose.

We’ll take a look at the next three stocks on the ARKK roster when this series continues! In the meantime, I’d love to hear what you think about these names!