A few key mega-cap stocks are rolling over, creating significant risks for investors. Here are the three names I’m watching closely…

tech stocks

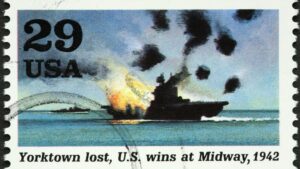

The Fed’s “Battle of Midway”

Today’s Fed decision is a lot like the WWII Battle of Midway. The outcome could shape the course of the market for months to come.

Speculative Tech Stocks Face a Double-Dose of Risk

Speculative tech stocks had a great first quarter. But these growth stocks now face two major risks.

Here’s Why Bear Market Rallies are So Powerful

Bear market rallies can be frustrating for BOTH bullish and bearish traders. Here are some catalysts behind these powerful market moves.

Tech Stocks Vs. the Fed: Who Wins?

I’m in Las Vegas for the Consumer Electronics Show. While tech stocks are exciting, the Fed has picked a fight with many of these plays.

No Time to Be A Hero

Speculative stocks have traded sharply lower. Is it time to buy these cheap stocks for a bear market rally? (Hint: Don’t be a hero…)

Three Charts to Watch This Week

Here are three charts to watch for a new week in the market. Now that earnings season is over, investors will be watching these indicators.

Three Reasons to Buy Meta Ahead of Earnings

Facebook’s parent Meta Platforms is scheduled to release earnings this week. Here are three reasons I chose to buy Meta ahead of the report.

It’s Time to Start Buying Speculative Tech Stocks

Speculative tech stocks spent the last year trading sharply lower. But today, these oversold stocks are poised to rebound!

Nasdaq Death Cross Means its Time to Play Defense!

The Nasdaq Composite is about to complete a bearish pattern, telling investors its time to play defense. Here’s how to do it!