[Editor’s Note: This is Part III of our series on Cathie Wood’s ARKK Innovation ETF. In Part I, we discussed how fund managers are sometimes forced to sell, even when they still believe in their positions. And in Part II, we covered five charts including a “buy” and a “maybe”.

Today, we’ll review the market shift as fear sets in, and then check out three more ARKK positions that are reacting to these new dynamics.]

Things are shifting quickly in the market this week.

As fear sets in for investors, many of the key stocks included in Cathie Woods’ ARKK Innovation Fund (ARKK) have been affected.

Today, we’ll look at our next three names on our list. In particular, we’ll be looking at the risks for these companies, the current trend for the stock, and whether these names are tradable from either the long or the short side.

Interest Rates as a Catalyst

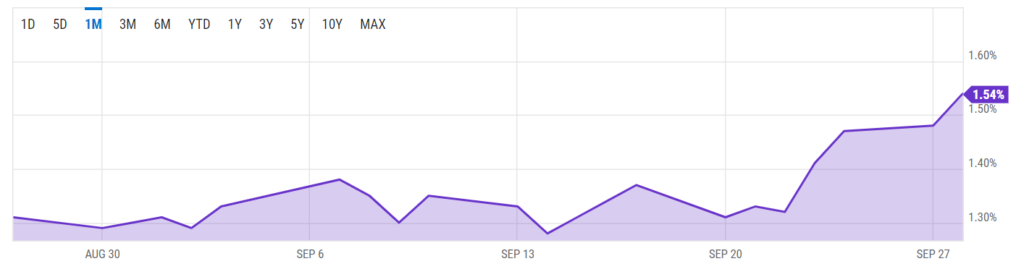

Throughout this series, I’ve been reminding you that interest rates have a direct effect on growth stock prices.

As rates start to move higher, Wall Street’s “present value” calculation spits out lower target prices for stocks. Especially stocks of companies that are not profitable today and expecting profits to hit in the distant future.

Interest rates have started to move higher following Fed Chairman Jerome Powell’s press conference last week. And those higher rates have become a key catalyst for the changes we’re seeing in many of the stocks held in the ARKK fund.

The surge in rates has been a bit of a shock to investors who have grown accustomed to artificially low rates over the last decade or more. But looking back over history, it’s clear that market interest rates could have much higher to go just to get back to a “normal” level.

So the recent rise in interest rates looks more like the start of a long-term trend, and less like a temporary spike. Something to keep in mind as you make decisions on which stocks you’ll be trading in the weeks ahead.

Let’s take a look a the next three names in the ARKK portfolio and see what opportunities we can find.

Unity Software: A “Golden” Setup

Unity Software (U) is known for its tech development platform.

This platform helps companies create media-rich content for mobile devices, computers and even virtual reality devices.

As devices like the iPhone and iPad become more advanced, content creators will need better tools to create the streaming, gaming, and even productivity apps that so many of us use. So demand for Unity’s platform should continue to grow.

Quite frankly, I’ve got mixed feelings about this stock.

On the positive side, Unity is growing quickly. The company is expected to increase sales by 37% this year and by another 26% in 2022.

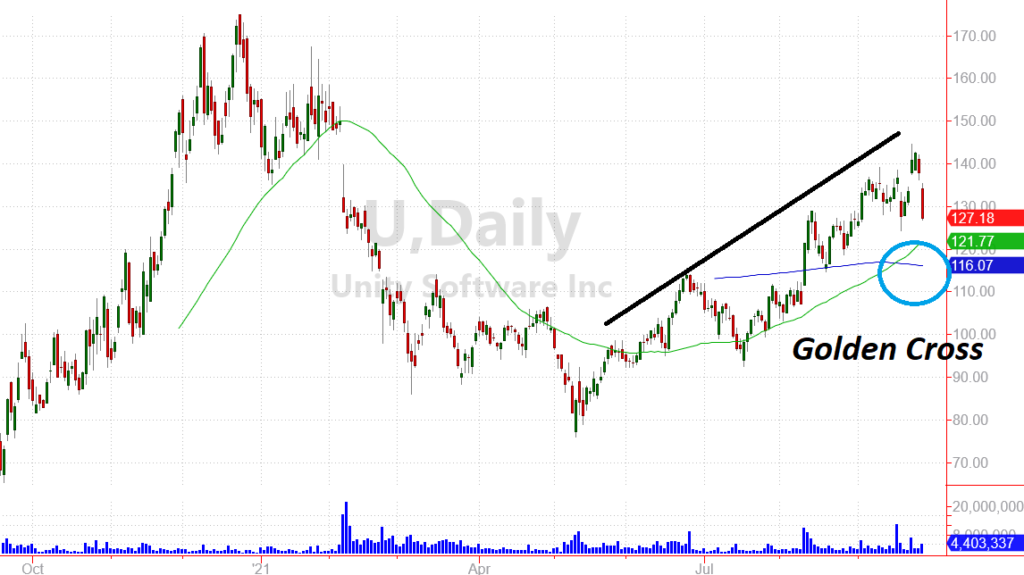

Shares have also been moving higher (although the ride has been a roller coaster for investors). Take a look at the chart below and notice the steady pattern of higher highs over the last several weeks.

It’s also important to note the stock’s “golden cross.” This happens when a short-term moving average (the green line is the 50-day moving average) crosses over a long-term moving average (the blue line is the 200-day average).

While there’s nothing “magical” about this pattern, it is typically viewed as a key signal that the trend has changed. And in this case, the trend for Unity is positive.

On the negative side, the company is still not profitable. Unity is expected to lose $0.23 per share this year and lose $0.13 per share next year as well. Yet, despite these losses, the market has given Unity a valuation north of $35 billion.

That’s a lot to pay for a money-losing enterprise!

Losses and valuations often don’t matter to investors focused on the long-term potential of the company.

But there has been a shift over the last couple of weeks. As interest rates start to cause investors to take a closer look at the fundamentals for their favorite growth stocks, Unity could be vulnerable.

As long as the trend remains positive, I’ll give Unity the benefit of the doubt. But a break of its bullish trend could land the stock squarely on my bearish watch list (for a potential short position).

Zoom Video: No Moat, No Bueno

Zoom Video Communications (ZM) was a major winner during the coronavirus crisis. The tech firm was able to expand it’s user base exponentially as companies scrambled to figure out how to keep communication open between employees stuck at home.

As a service, Zoom’s video conferences are wonderful. I’m an active user and I appreciate the reliability and easy interface that Zoom offers.

But as an investor, I struggle to understand how ZM can continue to be relevant — or profitable — in the long-run.

After all, the company’s primary product is a feature that is offered by many different competitors. And these are big competitors with plenty of capital to build and market their own brands.

Microsoft Teams, Google Hangouts, Apple’s FaceTime — and others — all offer similar video conferencing tools. That makes Zoom’s conference calls a bit of a commodity, and it’s difficult to see how Zoom will grow profits for the long-term while competing against these large established players.

The stock shows that other investors may share the same perspective. The stock has been in a steady downtrend for much of the last few months.

In addition to the trend of lower highs and lower lows, Zoom’s chart features a “death cross” of the 50 and 200 day average. This is the opposite situation from the “golden cross” we saw in Unity’s chart.

Zoom currently as a $79 billion valuation even after dropping more than 50% from its October high.

Wall Street analysts expect the company to earn $4.83 per share next year. So with a stock price near $265 this morning, shares are trading at about 55 times next year’s earnings.

That’s not an extreme valuation in today’s world.

But with interest rates moving higher and the potential for Wall Street to start lowering expectations, ZM still looks very vulnerable.

Full Disclosure: The Arete Trading Program (currently in beta testing) currently holds put contracts on ZM. This means I currently hold a bearish position in my personal portfolio.

Shopify: Expensive… But Worth It?

The last stock we’ll cover today is Shopify Inc. (SHOP), a commerce company that provides a “turn key” platform for many small businesses.

I love the way SHOP has empowered small businesses — especially during the coronavirus crisis when new business formations surged.

Thanks to platforms like the one SHOP offers, it’s become easier than ever to set up a business, sell products and services online (or in person), and to keep track of key business metrics.

SHOP has managed to build it’s own business, building a truly global customer base and allowing many individuals to replace incomes that were lost during the crisis.

The stock has been a wild success, surging from about $400 at the end of 2019 to a high of $1,650 this summer. But now as interest rates start to rise and tech investors become a bit more cautious, SHOP’s momentum has stalled.

It’s true that SHOP’s run has helped investors accumulate a tremendous amount of wealth. But the path from $400 to $1,650 has been very volatile. So it should be no surprise that SHOP started to trade lower as interest rates picked up this week.

In the past, the stock’s 200-day average has turned out to be a good support area for shares. And while there’s nothing magical about these moving averages, traders and investors often use them as a “line in the sand.”

For long-term investors, this may mean buying shares whenever the stock pulls back to this level. And for short-term or bearish traders, a break of this “support” line could give the green light to sell.

SHOP is currently trading at about 188 times expected earnings for next year — which is quite expensive. In total, the market values SHOP at nearly $175 billion, which also seems expensive (despite the company’s key role in helping small businesses get started).

I don’t currently have a position in SHOP. But I’ll be adding the stock to my 20/20 Watch List as a potential short position. Given the sky-high valuation and the current shift on Wall Street, it’s more likely SPOT will give up some of the last two years’ gains before finding support.

We’ll cover a few more of ARKK’s positions in our next installment so stay tuned!