The Federal Reserve’s “dot plot” will be an important market driver. Here’s what to watch as the market responds to Fed day.

interest rates

It’s Time to Take Profits on Homebuilder Stocks

Homebuilder stocks had a great run! But as investors prepare for interest rate cuts, these stocks could fall.

Profit From Fed Rate Cuts in 2024

The Federal Reserve will be cutting interest rates in 2024. Here’s how to profit.

Bonds are No Longer Boring

Boring bonds may not be on your radar right now. But today’s market offers some great potential returns from fixed income opportunities.

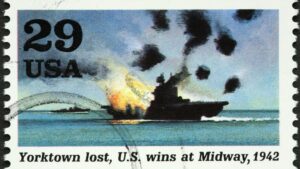

The Fed’s “Battle of Midway”

Today’s Fed decision is a lot like the WWII Battle of Midway. The outcome could shape the course of the market for months to come.

How I’m Positioned for Today’s Fed Announcement

Today’s Fed announcement could be an important turning point for the market. After a January stock market rally, Powell has some work to do!

Tech Stocks Vs. the Fed: Who Wins?

I’m in Las Vegas for the Consumer Electronics Show. While tech stocks are exciting, the Fed has picked a fight with many of these plays.

Add Guaranteed Income to Your Investments

The bear market has hurt aggressive and conservative investors alike. But after a sharp drop, treasury bonds now offer safety and profit!

The Fed Pivot is Real — But Not What You Think

The Fed Pivot was based on hopes the Fed would change direction. Instead the Fed changed it’s definition of inflation

Lower Mortgage Rates Could Trigger a New Surge for Stocks!

Lower mortgage rates create a unique opportunity for homeowners — and investors! Here are some stocks that benefit from a new refinance wave.