This might sound crazy coming from someone who makes a living investing and educating people about financial markets.

But I think you should avoid the stock market.

Or at least avoid “the market” that you read about in your news feed or hear about on TV.

To borrow a clip from The Princess Bride...

You keep using that word. I do not think it means what you think it means.

Inigo Montoya

The financial industry has built a huge business around the idea of “indexing.”

The concept is simple… If you invest in fund that tracks a market index — like the S&P 500 — you’ll diversify your investments with one single purchase. This way is easier… requires fewer transactions… and theoretically you’ll pay lower fees.

Sounds good right?

But what do you really get when you invest in the S&P 500? Is your investment really diversified as much as you think? And are you really exposed to all the areas of the market so that you can profit when one group surges?

Unfortunately, most people don’t realize how few of these benefits they’re actually getting. Which is why I’m encouraging you to avoid the stock market. (Or at least avoid Wall Street’s “indexed” version of the market).

“The Market” Missed a Big Opportunity

Over the last few weeks, “the market” has traded lower… You probably saw the headlines.

But you may not have seen one group of stocks that made a tremendous run! This area of strength shot up more than 15% over the last ten days — while the S&P 500 index traded lower.

Can you guess what area this is?

It’s the energy sector which has been one of the highlights of the market this year. In fact, over the last 12 months, energy stocks have advanced by more than 55%.

If you invested in the S&P 500 — or one of the funds that tracks this index — you would have profited from this move right?

WRONG!!

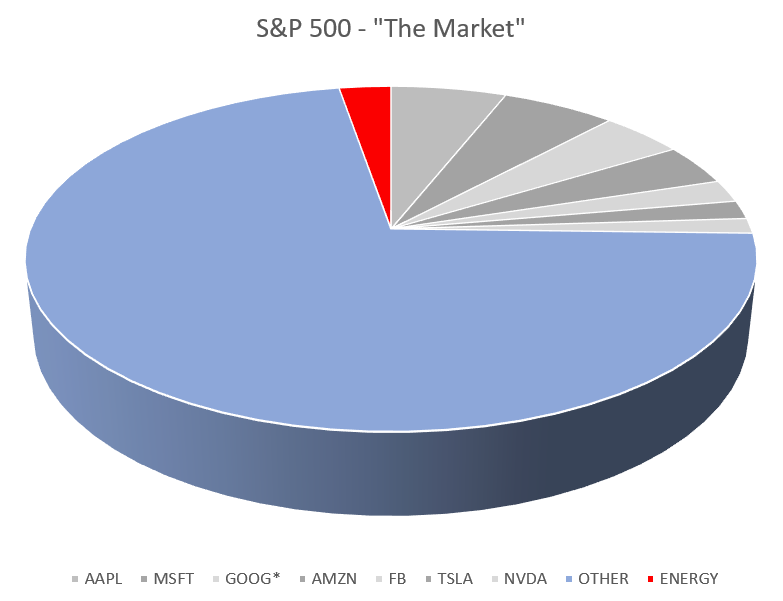

Because of the way the S&P 500 is put together, only a tiny sliver of your money would have been invested in energy stocks. Just take a look at the graph below! (Apologies for my Excel presentation skills)

While the S&P 500 is comprised of 500 stocks, the weightings of each stock vary. Larger companies get a much bigger piece of the S&P 500. And smaller companies make up just a tiny fraction.

The grey part of the pie shows the seven biggest companies in the index. These companies represent the most popular tech and social media stocks that market reporters love to talk about.

The red sliver at the top is the entire energy sector.

So this entire group — which is still very important to our economy — only represents 2.7% of “the market”

That’s a tragedy! Especially when you think about the 15% gains this group has enjoyed over the last couple of weeks. If the energy sector had been a larger portion of the S&P 500 index, our “market” could have rebounded much more quickly!

Avoid the Market and Invest Intentionally

Wall Street’s “index” plan doesn’t do as much as it should to keep you diversified.

At best, this index approach concentrates your money in the “most popular” stocks in the market. That’s because popular stocks trade higher — giving the stock a larger market value. And stocks with more value get heavier weightings in the S&P 500.

The problem with this approach comes when investors get fearful. (And fear is one of human nature’s strongest motivators.)

When fear sets in, investors run for the exits. And that means Wall Streets “most popular” stocks become the most vulnerable stocks.

Instead of mindlessly putting your money into an index, spend some time picking out your favorite stocks in different areas of the market.

Buy some retail stocks… energy plays… and spread your investment money into airlines, manufacturers, precious metals, financial firms — and of course tech stocks too!

It doesn’t have to take a long time. And you can do a bit at a time — investing in 15 to 30 different companies over a few months.

If you take this approach, you can keep a balanced approach to your wealth. And then, if one sector surges by 55%, you’ll have a more meaningful amount of your money invested in that area!

At the very least, consider the Invesco S&P 500 Equal Weight ETF (RSP). This fund invests in the 500 companies that are included in the S&P 500. But instead of heavily weighting Apple, Microsoft and Google, the fund invests equally in each stock.

Here’s a breakdown of RSP’s holdings.

I’d love it if you signed up for my free market insights. In a few days, you’ll also get a copy of my watch list — a great place to start looking for quality investments in different areas of the market.

Here’s to your success!