Today’s shortened stock market session is already full of volatility.

Thanks to an emerging coronavirus mutation, investors are cutting back on speculative positions — especially those tied to the travel and leisure industry. As I write this note on Friday morning, the Dow is down more than 900 points, and both the S&P 500 and Nasdaq Composite indices are approaching 2% losses.

At times like this, it’s tempting to hit the sell button for your positions and bail out of your investments.

But for investors who use my favorite income strategy, today actually creates an exceptional opportunity.

Stock Market Volatility and Income Investing

When markets pull back like they are doing today, investors naturally look for ways to protect their investments. Speculative traders also start to increase their bets on lower stock prices.

This action naturally leads to higher prices for option contracts.

In particular, traders buy put option contracts which give them the right to sell shares at a specific price. The farther stock prices fall, the more valuable these put contracts become.

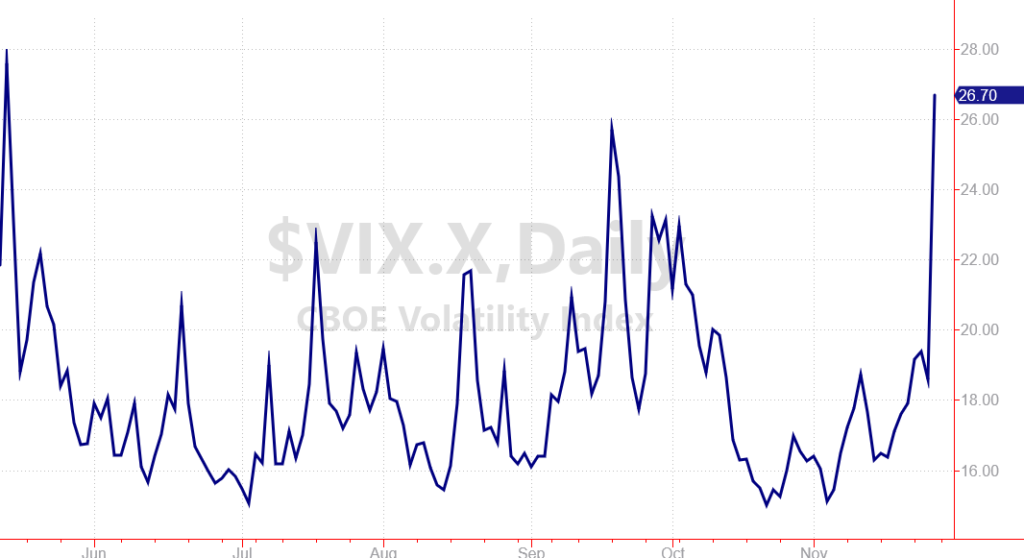

The CBOE Volatility Index (VIX) — pronounced “Vick’s” — measures the premium price traders are willing to pay for these option contracts. And as you can see in the chart below, prices for option contracts are spiking sharply higher!

A few weeks ago, I shared my favorite income strategy with you. This strategy lets us collect cash payments from our favorite stocks by selling put option contracts for these shares.

When prices for these put contracts spike higher (like we’re seeing today), we can collect even more income from these opportunities.

So even though Black Friday is creating stock market volatility and sending share prices lower, there’s a big opportunity for income investors!

If you haven’t yet tried out this income strategy, today might be a perfect day to pick a favorite income play. This way you can take advantage of this temporary spike in stock market volatility.