Stocks are on the move this December, with many popular names selling off sharply. That sets up a perfect opportunity for you to cash in on key December income plays.

While the market action can be discouraging for some investors, volatility actually creates unique (and lucrative) income opportunities. Over the past few weeks, I’ve introduced you to my favorite income strategy that allows you to generate instant payments from your favorite stocks.

And when markets are more volatile (like they are today), the strategy gives you even larger payments.

So today, I wanted to share three income opportunities that you can consider for your account today.

[Editor’s Note: If you like these income ideas — or would like to see a live portfolio of actively managed income plays, please fill out the short form below.

I’m putting the finishing touches on a live trading service that gives you actionable trades throughout the week — with alerts for when to enter, when to exit and exactly how to manage a portfolio of income plays.

If you’d like to be first to know when this service is available — and help test out this brand new trading service, sign up for notifications below!

(Of course there’s no obligation. When you sign up, you’ll also receive periodic market insights from me.)

Now, let’s jump into three income plays you can put in your account today!

December Income Play #1: The Trade Desk

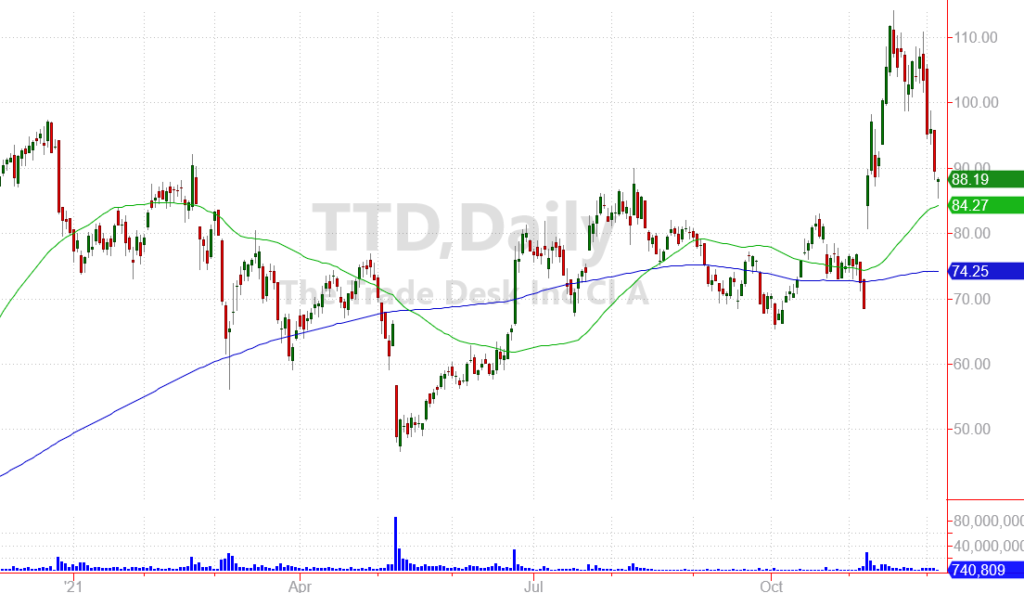

Shares of The Trade Desk Inc. (TTD) broke to a new all-time high in November before pulling back with the market’s recent selloff.

The company offers a cloud-based marketing platform that helps small businesses build and manage advertising campaigns. And in today’s environment with many new small businesses starting up, this service is incredibly valuable.

That’s why I expect the stock to find support near the 50-day moving average (the green line you can see in the chart above).

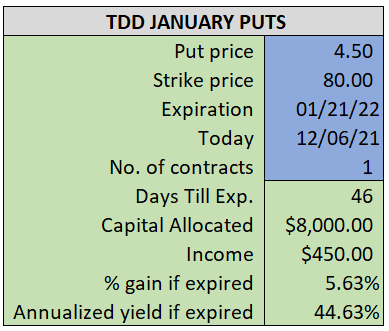

If you sell January $80 put contracts for TTD, you can receive up to $4.50 (or more) per share in income. And by selling these contracts, you’re agreeing to buy shares of TTD at $80 — more than 10% below where the stock is trading right now.

The table to the left shows some important information about this income play.

- If you sell one put contract, you can expect to receive $450 of income.

- You’ll have to set aside $8,000 in case you’re required to buy shares of the stock.

- There are 46 days until January expiration.

- Your $450 in income represents a 5.63% return on the $8,000 set aside.

- The annualized yield (if successful) is 44.63%.

For more information on how income trades like this work, make sure you check out the series on this income strategy here.

As long as TDD closes above $80 on January 21st, you’ll get to keep your income and the put contracts should expire and disappear from your account. Please make sure you keep enough buying power in your account in case you’re required to buy shares at $80.

December Income Play #2: Marathon Digital

Marathon Digital Holdings (MARA) is a Bitcoin mining company tied to the cryptocurrency market. Since cryptocurrencies have pulled back in recent weeks, shares of MARA have come under pressure.

The stock is likely to find support near the 200-day average (the blue line in the chart below). This has been a key support level throughout the year for MARA.

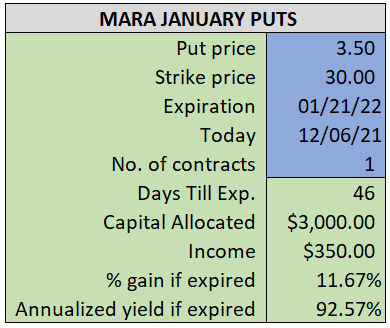

If you sell the January $30 put contracts for MARA, you can receive up to $3.50 (or more) per share. In exchange for this income, you’re agreeing to buy shares of MARA for $30 (well below the current market price.

The table to the left shows the statistics for this income play:

- If you sell one put contract, you’ll receive $350 of income.

- You’ll need to set aside $3,000 in case you’re required to buy shares of MARA.

- There are 46 days left until January expiration.

- Your $350 in income represents an 11.67% return on the $3,000 set aside

- The annualized yield (if successful) is 92.57%

Keep in mind this is a particularly speculative play. Shares of MARA could continue to fall. But at the same time, the amount of income you’re receiving from this play gives you a significant amount of cash to offset your potential risk.

As long as MARA closes above $30 on January 21st, you’ll get to keep your income and the put contracts should expire and disappear from your account. Make sure you keep $3,000 in available buying power in case you’re required to buy shares.

December Income Play #3: Zillow Group

Zillow Group (ZG) has struggled this year after the company decided to bail out of it’s home buying venture.

Still, the company’s core business should continue to grow in a strong residential real estate market. And shares moved higher Friday as it now appears the company’s exit from its home buying business should be less costly than many anticipated.

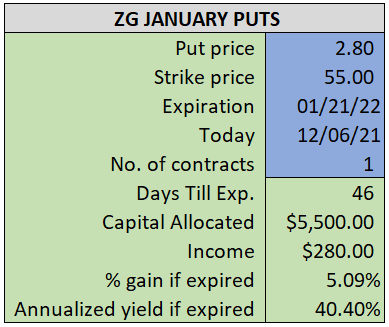

If you sell the January $55 put contracts for ZG, you can receive up to $2.80 (or more) per share. In exchange for this income, you’re agreeing to buy shares of ZG for $55 (about $5 per share below the current price).

The table to the left shows the metrics for this income play:

- If you sell one put contract, you’ll receive $280 of income.

- You’ll need to set aside $5,500 in case you’re required to buy shares of ZG.

- There are 46 days left until January expiration.

- Your $280 in income represents a 5.09% return on the $5,500 set aside.

- The annualized yield (if successful) is 40.40%

As long as ZG closes above $55 on January 21st, you’ll get to keep your income and the put contracts should expire and disappear from your account. Make sure you keep $5,500 in available buying power in case you’re required to buy shares.

Three Rules for Selling Puts

Selling put contracts can be a reliable way of collecting income from the market, which increases your investment wealth over time.

To make sure I’m getting the most out of this strategy (and carefully managing the risk from these plays) I always follow these three rules:

- Sell puts on stocks I’m willing to buy — Make sure you do your research on individual stocks, and pick companies with healthy businesses.

- Agree to buy shares at a discount to the current market price — This way, you create a buffer of safety in case the stock pulls back.

- Sell puts that offer lucrative amounts of income — You’re getting paid for your agreement to buy shares. Make sure that payment is enough to make the trade worthwhile.

Once again, these are three examples for collecting income from stocks in today’s market. They’re not specific recommendations, but the trades do show how you can use this strategy to collect income.

If you would like to keep track of trades like this in a live — actively managed — investment account, make sure you fill out the form below. I’ll keep you posted on when this service is available and give you the chance to be first to try it out!

Here’s to growing and protecting your wealth!