Selling WYNN puts for income.

Wynn Resorts (WYNN) is a clear “reopening trade” stock, with potential to benefit from a pickup in travel.

Shares moved lower on fears of the omicron variant, but have found support near $80. At this point, it looks like the worst-case-scenario is priced in for WYNN with plenty of room for positive surprises.

Meanwhile, the put contracts for WYNN give us plenty of income along with room for our triple-play defense strategy to absorb a small pullback if the ebb and flow of the market pushes shares a bit lower.

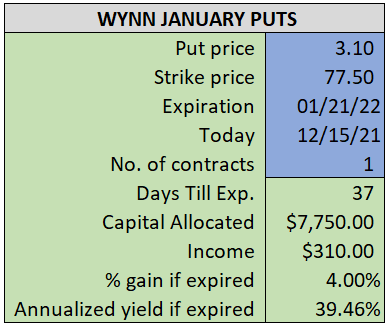

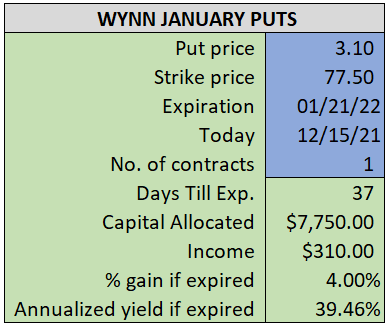

By selling the January $77.50 puts near $3.10, we’re able to collect an annualized yield near 39% while also giving us roughly $4.00 per share in cushion between the current market price for WYNN and our strike price.

- Sell (to open) 1 WYNN January 21st $77.50 put

- Limit: $3.10 or more

- The new position will represent roughly 8.4%% of our model.

~~~~~~~~~ - 14:30 Executed

- Sold 1 WYNN Jan 21st $77.50 Put @ $3.30