Selling SSRM puts for income.

SSR Mining Inc. (SSRM) is a precious metal producer with mines in North and South America.

After treading water for the last two years, precious metals like gold and silver may be ready to break out. Both gold and silver have traditionally been good hedges against inflation so as inflation levels rise, more investors are likely to move capital into gold and silver pushing prices higher.

Higher prices will naturally lead to better profits for SSRM. The stock broke higher in November before pulling back last month. SSRM found support above $16 and now appears ready to start trading higher.

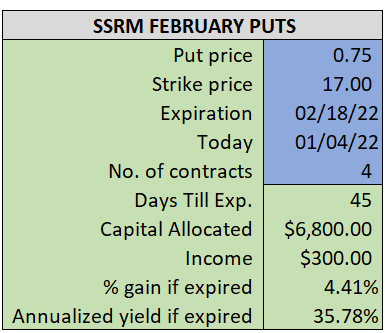

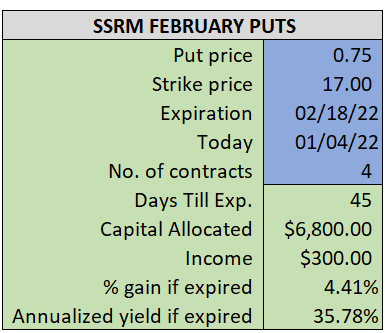

By selling the February $17 puts near $0.75, we’re able to collect an annualized yield near 36%, while also giving us roughly $0.50 per share in cushion between the current market price for SSRM and our strike price.

- Sell (to open) 4 SSRM February 18th $17 puts

- Limit: $0.75 or more

- The new position will represent roughly 6.8% of our model.

~~~~~~~~~ - 15:11 Executed

- Sold 4 SSRM Feb 18th $17 Puts @ $0.79