Selling MU puts for income.

Micron Tech (MU) is a computer chip stock that has held up very well during much of the recent market selloff.

Shares are down today as the Nasdaq 100 breaks through a heavily watched support level. But MU is still a great company with strong earnings and a very cheap stock price compared to earnings. This selloff will likely be temporary and it gives us a chance to collect income from a quality stock in a short-term pullback.

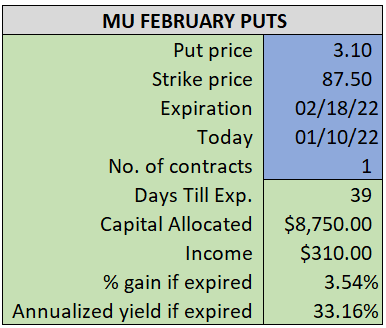

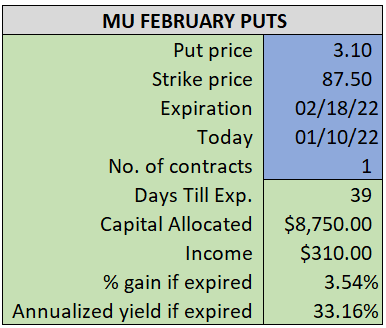

By selling the February $87.50 puts near $3.10, we’re able to collect an annualized yield near 33%, while also giving us roughly $3.75 per share in cushion between the current market price for MU and our strike price.

- Sell (to open) 1 MU February 18th $87.50 put

- Limit: $3.10 or more

- The new position will represent roughly 8.8% of our model.

~~~~~~~~~ - 12:49 Executed

- Sold 1 MU Feb 18th $87.50 Put @ $3.10