A friend asked for my thoughts on investing with margin in his brokerage account. And since this is an important — and sometimes controversial — topic for investors, I wanted to share some thoughts.

Hopefully today’s alert will give you some ideas for how to grow your wealth more quickly in the market, while still protecting the savings you’ve worked so hard to set aside.

What IS Margin Anyway?

Margin investing is simply borrowing extra cash from your broker to buy more shares of stock. This option is available for most brokerage accounts.

When you use margin to buy more stock, the process accelerates your returns (both positive and negative). That’s why many investors and traders call this process “leveraging.” Because you’re moving more stock with less capital – the way you might move a heavier load with less effort by using a lever.

Brokerage accounts make it very easy to start this process. And typically, these brokerages offer great interest rates on the margin loans.

That’s because if you borrow money to buy or sell more shares, you’ll naturally generate more commissions and fees for the brokerage. In other words, brokerages typically make more money off customers who use margin.

But is this process good for you? Will it help you increase your wealth more quickly?

Well, that depends…

Potential Benefits from Investing With Margin

Investing with margin can be a tool that helps grow your wealth much more quickly.

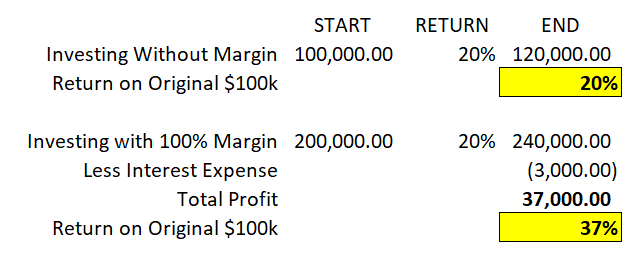

Let’s look at an example of an investor who locks in a 20% return on his stock portfolio.

If this investor starts with $100,000 in cash and grows that wealth by 20%, he’ll wind up with a gain of $20k.

But if the investor borrows an additional $100,000 and invests with margin, he’ll be able to generate a 20% return on a portfolio of $200,000 in stock.

That basket of stocks would end the year with $40,000 in profit. And even if the investor had to pay a 3% interest rate on the $100,000 borrowed, the investor using margin would walk way with a 37% return.

So when things are going well, this investment tool can help accelerate profits and grow your wealth much more quickly.

But to understand whether investing with margin is right for you, it’s important to understand the risks as well.

The Downside of Investing With Margin

When markets become more turbulent and uncertain, the appeal of investing with margin starts to fade. That’s because investing with margin also amplifies negative returns if your investments lose value.

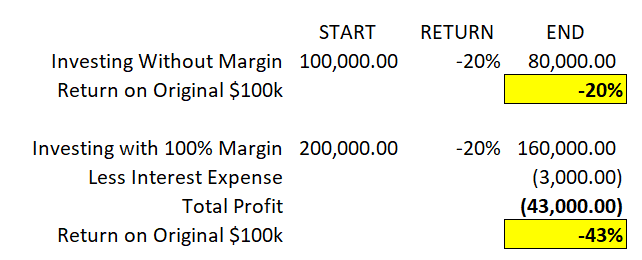

Suppose instead of a 20% gain, a bear market causes your investments to drop by 20%. What would that do to the value of your investment account?

For a normal $100k brokerage account, a drawdown of 20% would drag the value of the account down to $80,000. You would then need a 25% positive return to get back to breakeven.

But if an investor were to borrow and invest an additional $100,000 — and then be hit with a 20% decline, the full $200,000 portfolio would lose $40k in value.

Tack on interest charges of another 3% or so and you’ve got a $43k decline. So after paying off the loan, this investor will only have $57,000 of his original $100,000 remaining.

Now it will take a 75% return just to get this investor back to breakeven!

Using This Investment Tool Wisely

Understanding the risk and potential reward of investing with margin can help you make a much wiser decision with your own account. And while some might say you should never use margin, I think it’s a tool that can be used carefully if the situation is right.

Here are some points to consider when making your own decision.

How aggressive is your strategy? If you are investing in very stable companies with stocks that tend to rise steadily over time, margin may make a lot of sense. But using margin to invest in more volatile plays can be like adding gasoline to an already blazing fire. Dangerous!

What other assets or income do you have? Investing with margin with your entire life’s savings after retiring from your full time job would open yourself up to a lot of risk. But if you’ve got income from a steady job, a growing investment in your home, and other opportunities to grow your wealth, the picture is different.

What is “at risk” and what benefits could you enjoy? When making my own decision about investing with margin I think about my family situation. After all, the risks (and potential returns) don’t just matter to me. I don’t want a potential loss to cause us to change the way we live. But I do like the idea of growing my wealth so that I can enjoy more special occasions with my family. That’s how I personally think of balancing these dynamics.

Here’s one last thing to consider… Using a more conservative strategy like selling put contracts for income can be a better way to invest with margin.

When you sell a put contract, you’re able to collect income in exchange for your promise to buy stock. As part of this process your broker will set aside cash in your account in case you’re required to buy those shares.

Using margin with a strategy like this will allow your broker to set aside additional borrowed cash to back up the put contracts you sell. But since this strategy has less risk than buying shares outright, using margin can be more appropriate for some investors.

Bottom line, this investment tool can make a big difference in your returns over time. But be sure to use it wisely as any tool can be dangerous if used recklessly.