It’s ironic, but Thursday’s sharp selloff into the close may turn out to be exactly what the market needs to find support.

As the closing bell rang, the S&P 500 finished off 1.1% and the Nasdaq Composite fell 1.3%. This after the tech-heavy index already entered “correction territory” yesterday.

But despite the selling, there are a few good reasons to be optimistic about the market. And even more reasons to be optimistic about YOUR investment returns this year.

Weak Sentiment and Washout Trading

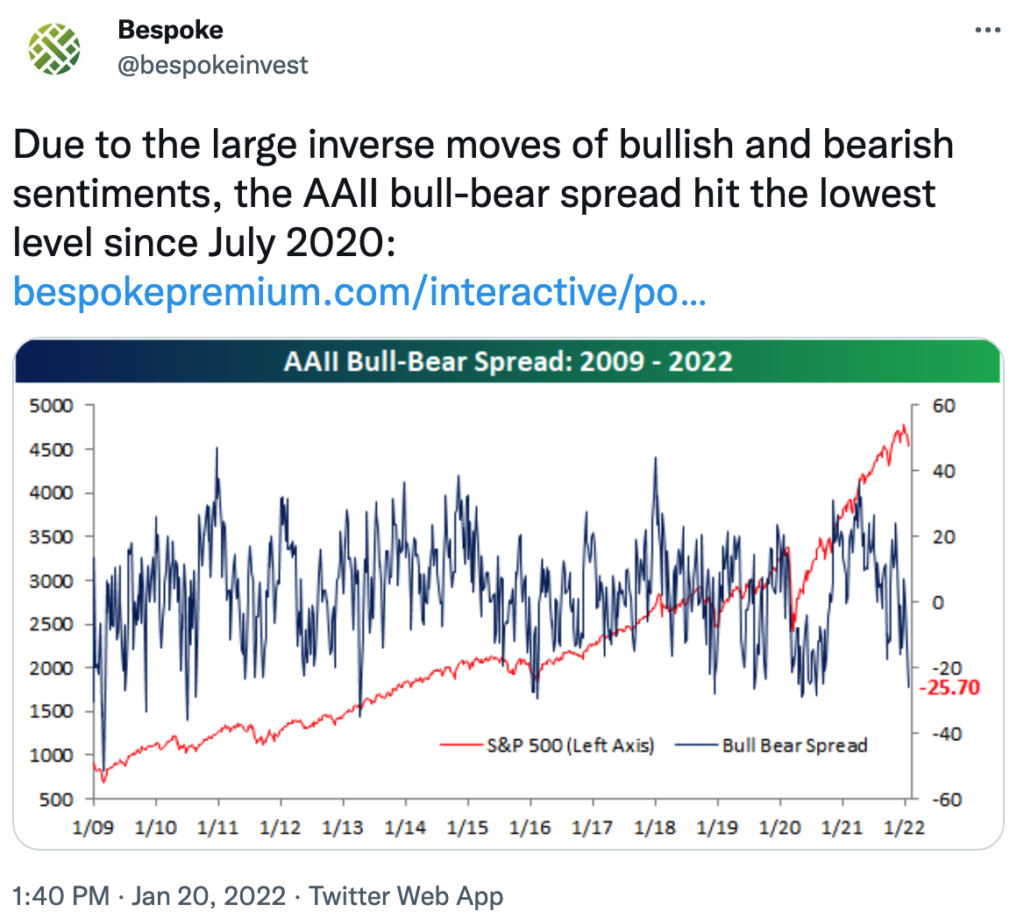

Prior to today’s selloff, the American Association of Individual Investors released their widely followed reading on investor sentiment.

Bespoke Investment Group (a great research service worth tracking) noted that individual investors are more bearish than an any time in the last 18 months.

While it may sound “bad” for investors to be so pessimistic, sentiment readings tend to be contrarian indicators.

Remember the old quote: “Buy to the sound of cannons and sell to the sound of trumpets.”

The best investors start to buy when everyone else is selling. And when individual investors are most fearful, it has historically been a good time to buy.

Today’s selloff on top of the negative sentiment is likely to shake some of the last weak holders out of the market. And when the fickle traders have finished selling, more dedicated investors will be the ones left holding shares of stock.

On balance this creates a much more positive backdrop for the overall market.

A Selloff Into a Key Support Level

The daily chart for the S&P 500 shows another reason this selloff may be nearing an end.

Prior to the coronavirus crisis, the market consistently found support at the 200-day moving average.

And while there’s nothing magical about this line, many traders view this as a dividing line between a positive trend a negative trend for the broad market.

In a bull market, it typically pays to buy when the market or individual stocks pull back to a key trend line. And while there are concerns about what higher interest rates will do to the broad market, we’re still technically in a bull market.

So don’t be surprised if this pullback to the 200-day average leads to a new leg higher.

With Changing Leadership Comes New Opportunity

Finally, remember that the current market selloff doesn’t affect all stocks the same.

Rising interest rates high growth stocks harder than other areas of the market. That’s because investors must wait longer for corporate profits to accumulate. And with higher interest rates, the opportunity costs for waiting pile up.

Value stocks are holding up well despite the market selloff. Shares of the Vanguard Value ETF (VTV) pulled back a bit over the last week. But the decline looks much more like a normal pullback instead of a full-fledged selloff.

Owning value stocks — companies that produce reliable profits with stock prices that are low compared to earnings — is a great way to insulate your wealth against the volatility in today’s market.

And heading into the rest of the year, I expect value stocks to outperform growth stocks as investors continue to adjust to a higher interest rate environment.

All told, the current market pullback may not be fun to watch. But a bit of selling like we had today may help the market find support and start generating returns for your investments again.

Here’s to growing and protecting your wealth!