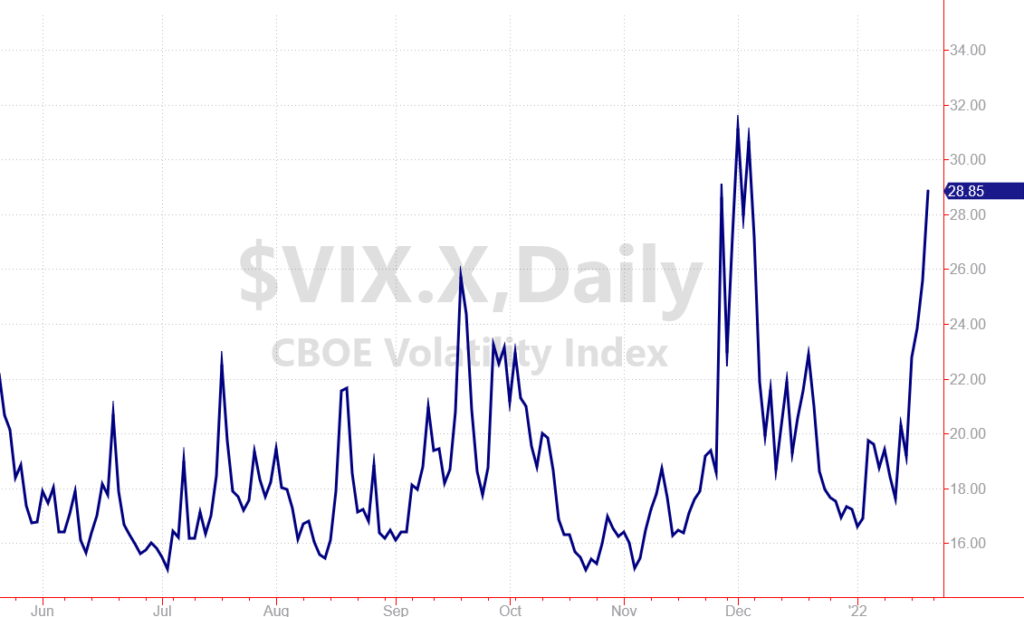

After last week’s sharp selloff, investors could use some good news. And Wall Street’s fear index is signaling a great opportunity setting up.

The CBOE Volatility Index (VIX) is often referred to as Wall Street’s fear index.

It measures how much investors are willing to pay for option contracts which are often uses as “insurance” against a market decline.

When the stock market gets rocky, demand for these option contracts increase. Prices naturally move higher. And the VIX measures what investors are willing to pay.

Take a look at where the VIX stands as of Friday’s close:

Spikes in the Wall Street Fear Index typically coincide with at least short-term lows in the market. So last week’s surge higher gives us a good indication that selling may have reached its peak with cooler heads set to prevail.

More importantly, the spike for Wall Street’s fear index also opens the door for us to collect more income from my favorite put-selling strategy.

Let’s take a look at three ways this spike can improve the income you collect starting this week!

More Income From the Same Setups

When Wall Street’s fear index spikes higher, prices for put contracts do too!

And if you sell these put contracts for income, you’ll collect more income from selling your puts at a higher price.

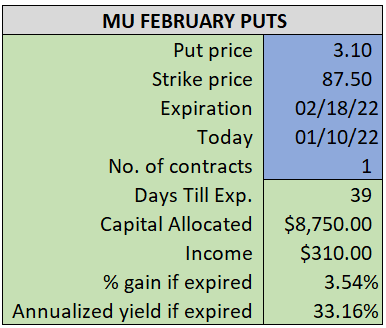

Let’s take the stock Micron Tech (MU) as an example. On January 10th, I sent an income alert that recommended selling MU February $87.50 put contracts. At the time, shares of MU were trading near $91.25, so we were agreeing to buy shares a full $3.75 below the current market price.

For that agreement, we expected to receive at least $3.10 per share, giving us a 33% annualized yield for the trade. Not bad, especially considering the extra buffer to help offset any potential pullback for the stock.

(Incidentally, we were able to close out this position a few days later locking in a winning trade and freeing up capital for new plays.)

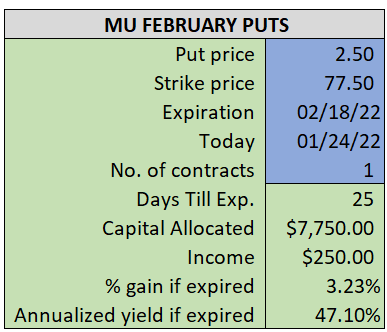

But now that Wall Street’s fear index has spiked, let’s take a look at what we could be paid for a similar agreement with the same stock.

Shares of MU closed at $81.91 on Friday. So the contract with a similar amount of buffer would be the February $77.50 put contract.

As of Friday’s close, you could have sold this put contract for $2.50. At that price, you’re able to generate an annualized yield closer to 47%. That’s quite a bit higher than the yield before Wall Street’s fear index spiked. And in this case income investors are actually getting more protection than we received before the VIX spike.

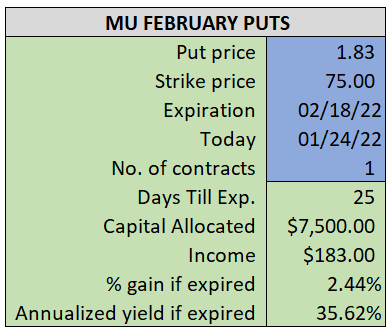

Similar Income With Less Risk

With volatility picking up, our focus naturally shifts to protecting our wealth. That’s why I love the versatility of this income approach.

Some income investors may choose to use a lower strike price when using this put-selling strategy. When you use a lower strike price (or agreement price), you’re agreeing to buy shares at a lower price. And this gives you even more of a buffer to reduce your potential risk.

Remember, shares of MU closed at $81.91 on Friday.

You could opt to sell the February $75 put contracts which give you a safety buffer of $6.91. In other words, MU would have to drop another $6.91 (or 8.4 percent) before you’d be obligated to buy shares. Meanwhile, the February $75 put contract is priced at $1.83 — meaning you’ll receive $1.83 per share of MU if you agree to buy at $75.

That income adds up to a 35.6% yield which is very similar to our original setup for MU. Except, thanks to the spike in Wall Street’s fear index, you’re building in protection of $6.91 per share instead of the original $3.75 buffer.

Not bad!

More Attractive Income From Stable Stocks

One final advantage of the VIX spike is that you can often set up income plays from stocks that would normally be less lucrative.

Our put-selling income strategy has a natural trade off between risk and potential return. If you sell put contracts on very stable stocks that don’t have much risk, you’ll typically be paid less for your agreement.

Ford Motor (F) is a good example of this concept.

Ford is a profitable value stock that typically trades in a stable pattern. So put contracts for Ford’s stock usually carry a low price.

But in today’s market environment with Wall Street’s fear index spiking, that’s not the case!

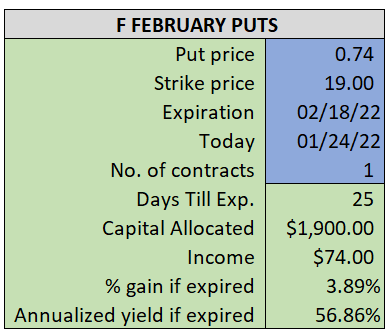

Shares of Ford closed at $20.64 on Friday. And thanks to the uncertainty in the market, the February $19 put contracts are priced near $0.74 per share.

Selling those put contracts gives investors a nearly 57% annualized yield while still giving income investors a $1.64 buffer from where the stock was trading on Friday to the price investors are agreeing to pay.

So the spike in Wall Street’s fear index can actually be very lucrative for us as income investors, as long as you act quickly while put prices are still high.

It’s important that I mention all examples in this alert are for illustrative purposes only. I’m not recommending any of these specific trades at this time and you should do your own homework on any income plays you decide to enter.

If you would like to see real-time trade alerts and a model portfolio of open income opportunities, check out my Accelerated Income Trading Model here.

Tomorrow, we’ll talk about investor sentiment (and why we could be on the verge of a sharp market rebound!)

Here’s to growing and protecting your wealth!