Selling GDXJ puts for income.

VanEck Junior Gold Miner ETF (GDXJ) is a fund made up of small gold mining companies that should benefit from rising gold prices.

As global inflation continues, investors are looking for ways to protect the value of their wealth. And this protection is driving the price of gold above a recent consolidation range and could lead to new all-time highs in the coming months.

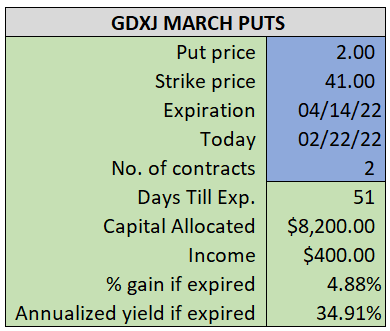

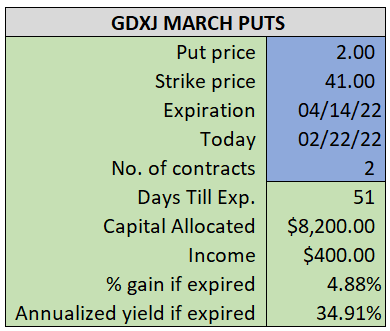

By selling the April $41 puts near $2.00, we’re able to collect an annualized yield near 35%, while also giving us roughly $1.10 per share in cushion between the current market price for GDXJ and our strike price.

- Sell (to open) 2 GDXJ April 14th $41 puts

- Limit: $2.00 or more

- The new position will represent roughly 8.4% of our model.

~~~~~~~~~ - 14:46 Executed

- Sold 2 GDXJ April 14th $41 Puts @ $2.00