Selling VALE puts and WYNN puts for income.

VALE S.A. (VALE) is the world’s largest iron ore producer and should benefit from both rising inflation and a rebound in global manufacturing.

Wynn Resorts (WYNN) will benefit from a rebound in travel, especially as international travel begins to pick back up again. Occupancy rates are rising and WYNN has tremendous pricing power.

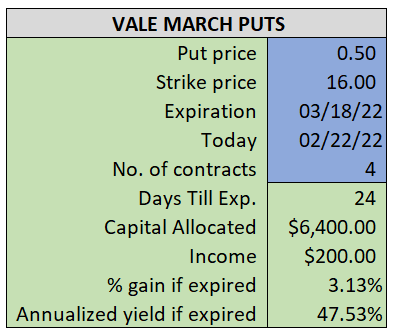

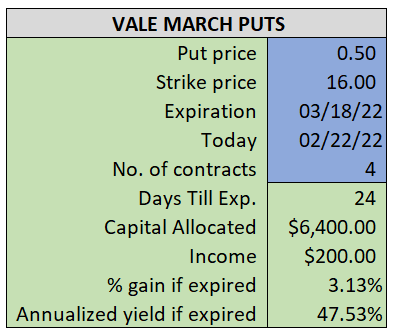

By selling the VALE March $16 puts near $0.50, we’re able to collect an annualized yield near 48%, while also giving us roughly $1.20 per share in cushion between the current market price for VALE and our strike price.

- Sell (to open) 4 VALE March 18th $16 puts

- Limit: $0.50 or more

- The new position will represent roughly 6.5% of our model.

~~~~~~~~~ - 10:50 Executed

- Sold 4 VALE March 18th $16 Puts @ $0.58

ALSO

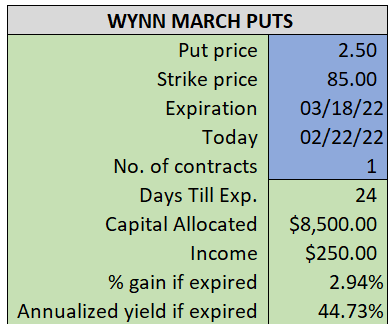

By selling the WYNN March $85 puts near $2.50, we’re able to collect an annualized yield near 45%, while also giving us roughly $4.75 per share in cushion between the current market price for WYNN and our strike price.

- Sell (to open) 1 WYNN March 18th $85 put

- Limit: $2.50 or more

- The new position will represent roughly 8.7% of our model.

~~~~~~~ - 10:50 Executed

- Sold 1 WYNN March 18th $85 Put @ $2.75