Is it time to hunt for bargains in the stock market? And if so, are growth stocks cheap enough to buy?

It’s been a brutal start to the year for many investors. And that’s especially true if you’ve held big positions in many of the growth stocks that were so popular during the post-pandemic bull market.

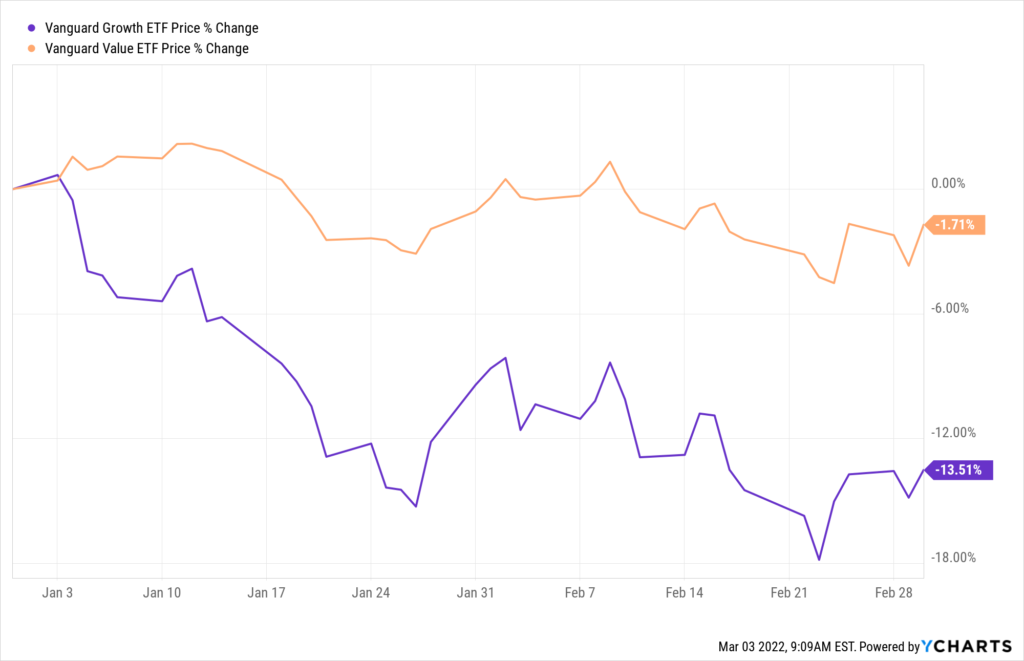

So far this year, growth stocks — as measured by the Vanguard Growth ETF (VUG) — are down 13.5%. And that’s after a rebound over the last few trading sessions.

Meanwhile, value stocks — as measured by the Vanguard Value ETF (VTV) — are only down 1.7%.

Following such a sharp decline, it may seem like growth stocks have the best shot at rebounding from this level. And there are some great opportunities that I’ve been watching in this area.

But as a group, growth stocks still could have a long way to fall before they become “cheap.” After all, many of these stocks spent 18 months or more climbing steadily higher as an army of novice investors jumped in to momentum plays regardless of underlying fundamentals.

In today’s turbulent market, it’s more important than ever to look at what you actually get for the cash you invest. In other words, how much do you have to pay for every dollar per share a company generates.

The “forward price/earnings ratio” is one of my favorite tools for determining whether a stock is attractive or not. This ratio tells us how much we’re paying for ever dollar a company is expected to earn over the year ahead.

When you consider this number, alongside the expected long-term profit growth of a company you’re interested in, you’ll be able to understand which stocks are very expensive and which ones may actually be more of a bargain.

Growth Stocks are Still Too Expensive

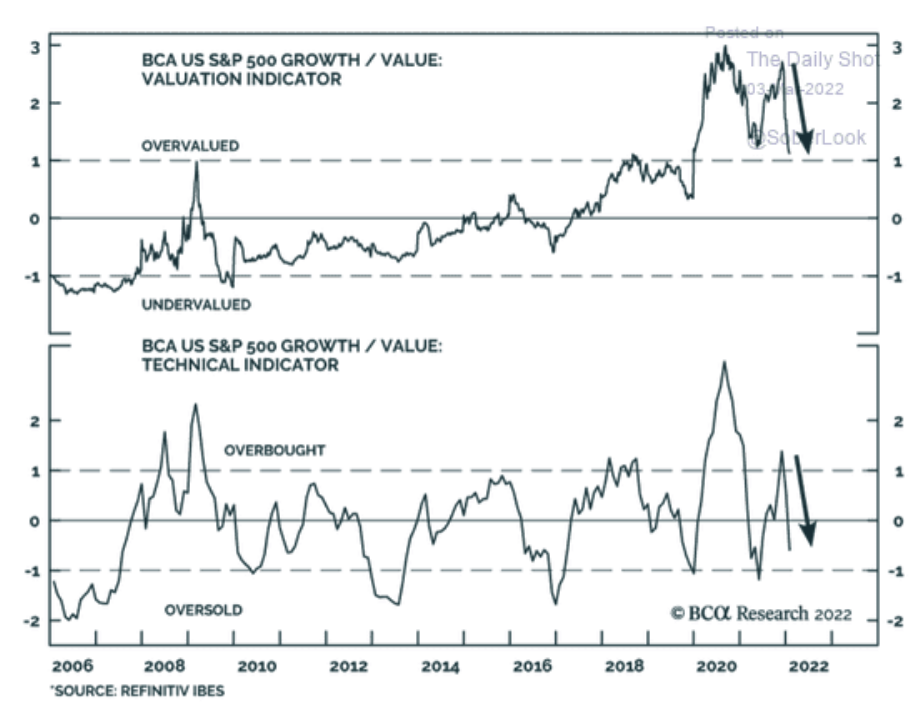

This morning, I came across a very interesting chart from BCA Research.

The top section shows how much more investors are paying for growth stocks compared to what they pay for value stocks.

Even though the chart has pulled back this year (thanks to the selloff in growth stocks), these “exciting” investments are still significantly overvalued.

This tells us that growth stock could still have much farther to fall.

Another possible scenario is that growth stocks could stall out and trade in a range, while value stocks steadily rise in price.

Either way, the current advantage goes to investors who look more carefully at the fundamental profits for companies they invest in. Being picky about what you buy, and what you’re willing to pay can help to reduce your risk and grow your profits over the long run.

For my own trading models, I’m making bullish bets on real companies with reliable profits. And I’m also buying select put contracts (bearish bets) on stocks that are still expensive compared to what they earn — that is IF they earn any profits at all!

Be careful out there… We’ve still got a long way to go before it’s safe to buy speculative growth stocks again.

Now, let’s take a look at some research on my reading list today.

Inflation, Uncertainty and the U.S. Economy

- WSJ: US Should withstand economic shock from Ukraine.

- U.S. economic activity has picked up in the last few weeks.

- Challenges from the omicron variant are declining.

- Travel has picked up with TSA reporting a surge in passengers.

- MW: Yields edge lower as investors parse Powell.

- Fed Chair Jerome Powell will appear before a Senate Committee.

- Yesterday he told the House he would support a 0.25% hike.

- The Fed is expected to continue to raise rates throughout the year.

- WSJ: A new brand of sticker shock hits the car market.

- Supply chain problems have led to a shortage of new vehicles.

- In some cases, dealerships are charging $35-40K over MSRP.

- New car prices are 17.9% above last year, used cars up 27.3%.

Russian Headlines Continue to Weigh on Wall Street

- Bloomberg: Russia bans coupon payments on $29 Billion in bonds.

- This is a “temporary step” to provide stability after sanctions.

- Foreign investors who held $29 billion may be unable to collect.

- Trading in the Russian ruble debt market has yet to reopen.

- Wellington: Russia/Ukraine and the commodity challenge.

- Record high energy prices have been driven by record-low storage.

- The pandemic continues to disrupt production and distribution.

- Global demand for metals is growing with population & GDP.

- Reuters: China’s Russian coal purchases stall.

- The Chinese are buying less Russian coal due to bank sanctions.

- Russia accounted for 15% of China’s total coal imports.

- Most banks have stopped issuing letters of credit for purchases.

- Barron’s: “Uninvestable” Russian stocks removed from indices.

- MSCI and FTSE Russel will axe Russian equities from benchmarks.

- The London Stock Exchange suspended trading in 27 companies.

- NYSE and the Nasdaq already halted trading in Russian companies.

- Axios: France seizes yacht owned by Russian Energy oligarch.

- Igor Sechin is the CEO of Rosneft, Russias oil & gas company.

- The 280-foot vessel was in a shipyard on the south side of France.

- Sechin considered “one of the most powerful members” of Russia’s elite.

As Energy Surges, Countries Scramble

- Reuters: Nuclear, coal, LNG: “no taboos” in Germany.

- Germany floats the possibility of extending coal and nuclear plants.

- The country will also increase its natural gas storage by 2bil bcm.

- Scrapped plans to build an LNG terminal are being revived.

- Bloomberg: Worlds top battery maker urges China to secure lithium.

- As demand for EVs surges, there is a risk of lithium shortages.

- The price of lithium has surged this year after quadrupling in 2021.

- Reuters: Oil prices hit multi-year highs as supply tightens.

- Brent crude oil climbed close to $120 per barrel on Thursday.

- U.S. crude stockpiles are at multi-year lows.

- A fresh round of U.S. sanctions target Russia’s oil refining sector.

Important Investing Headlines.

- MW: Abercrombie & Fitch sinks after profit and sales miss.

- The company earned $1.14 per share versus expectations for $1.27.

- Sales were $1.161 billion compared to an estimated $1.183 billion.

- Barron’s: ChargePoint crushed guidance. Shares Rise.

- Quarterly sales for CHPT hit $80.7 million versus $75.9m expectations.

- For the year ahead, CHPT expects sales of $450m to $500m.

- The company has 174k EV charging ports in the U.S. and Europe.

- CNBC: Wall Street praises Ford’s EV plans but questions targets.

- Ford plans to separate its electric and traditional fuel auto businesses.

- The firm is targeting 10% profit margins and 2 million EVs by 2026.

- Shares of Ford were up 8.4% on Wednesday.