Selling SQ puts for income.

Block Inc. (SQ) — formerly Square Inc. — is a profitable payment processing company that has traded sharply lower this year.

For Months, SQ has been on my bearish watch list and the stock has fallen sharply from last year’s highs. SQ was a speculative play several months ago, but is now starting to look a lot more like a decent fintech investment.

Block is expected to earn $1.30 per share this year and grow profits to $2.18 next year. So there is legitimate value in this business.

Shares hit a low near $82.70 last month but rebounded sharply from that level. This price point is now a key support level for the stock and I don’t expect to see SQ trade below this level.

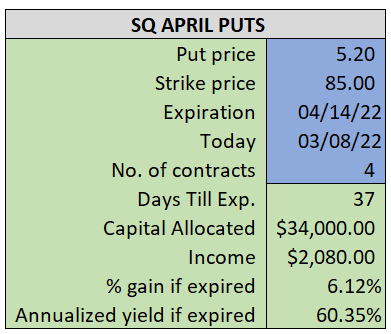

Thanks to SQ’s significant volatility, put prices are very high. Higher put prices allow us to collect more income while still using a strike price that is well below SQ’s current price.

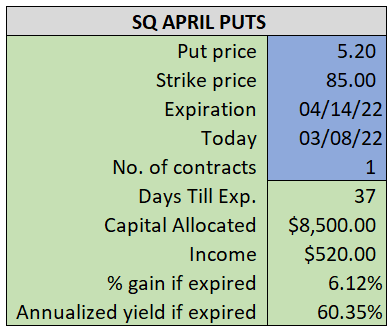

By selling the April $85 put near $5.20, we’re able to collect an annualized yield near 60%, while also giving us roughly $13 per share in cushion between the current market price for SQ and our strike price.

- Sell (to open) 1 SQ April 14th $85 put

- Limit: $5.20 or more

- The new position will represent roughly 9.0% of our model.

~~~~~~ - 11:47 Executed

- Sold 1 SQ April 14th $85 Put @ $5.45