Selling AU puts for income.

Anglogold Ashanti (AU) is a gold and precious metal mining company that benefits from higher gold prices.

Gold has been trading higher as investors look for ways to protect their wealth against inflation. And with the price of many different natural resources soaring, inflation concerns will likely last for some time.

Shares have moved sharply higher throughout the month of March, but are pulling back today. This pullback creates an opportunity for us to collect income while using a lower strike price (helping to reduce our potential risk).

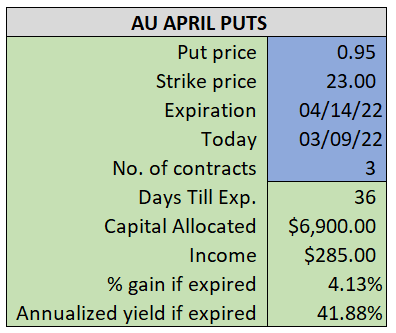

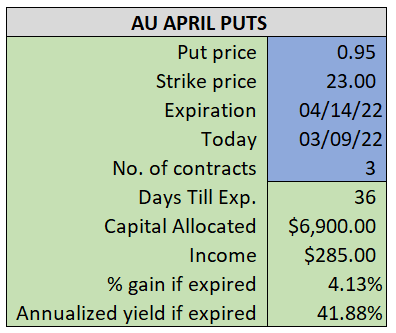

By selling the April $23 puts near $0.95, we’re able to collect an annualized yield near 42%, while also giving us roughly $1.50 per share in cushion between the current market price for AU and our strike price.

- Sell (to open) 3 AU April 14th $23 puts

- Limit: $0.95 or more

- The new position will represent roughly 7.2% of our model.

~~~~~~~ - 12:56 Executed

- Sold 3 AU April 14th $23 Puts @ $1.09