Selling OPEN puts for income.

Opendoor Tech (OPEN) operates a digital platform to enable only residential real estate transactions.

Although rising interest rates will certainly cause some headwinds for home prices, strong demand and limited supply should keep this market strong.

Shares of OPEN have moved sharply lower as interest rates began to rise. But the stock appears to have found support and may be an attractive takeover target at this level.

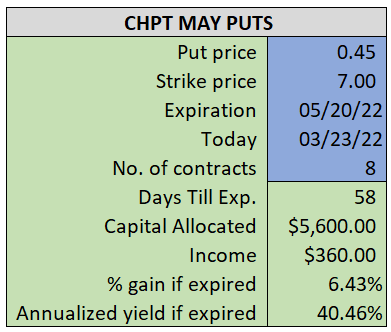

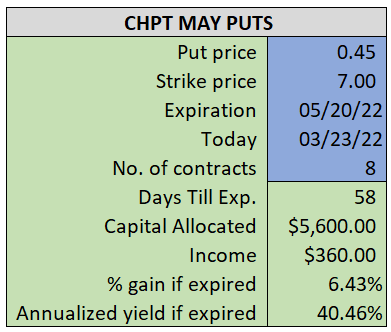

By selling the May $7 puts near $0.45, we’re able to collect an annualized yield near 40%, while also giving us roughly $2.20 per share in cushion between the current market price for OPEN and our strike price.

- Sell (to open) 8 OPEN May 20th $7 puts

- Limit: $0.45 or more

- The new position will represent roughly 5.7% of our model.

~~~~~~~~~ - 15:32 Executed

- Sold 8 OPEN May 20th $7 Puts @ $0.50