Tech stocks have traded sharply lower over the last year. And the carnage hasn’t been limited to speculative stocks with negative earnings.

Most recently, even mega-cap tech stocks like Facebook parent Meta Platforms (FB) have been taken behind the woodshed and shot. And along with these declines, too many investors have watched large amounts of wealth evaporate.

Sure, there are reasons for some of these stocks to trade lower.

With the Fed on the path to raise interest rates, speculative tech stocks must trade lower. It simply doesn’t make sense to pay a premium price for companies that aren’t generating profit yet.

And there are other challenges in the works as well.

Apple’s shift in the way they collect user data has made it more difficult for companies like Meta to effectively target ads. And that challenge could dampen future profits (at least in the short-term).

But at some point, the selling for popular tech stocks like FB has to be enough!

There has to be a price point that represents true value for investors… a price that makes sense for new buyers to step in to the stock… and a price point that ensures profits for investors over the long run.

I think we’re very close to that level.

And that’s why this week, I bought into FB with a new bullish position.

Here are three reasons I’m buying FB ahead of this week’s earnings announcement.

Reason #1: Value for Small (and Larger) Businesses

Despite its challenges, FB still has an amazing reach with consumers.

Around the word, people check their Facebook feeds throughout the day. They also scroll through Instagram feeds, and FB owns this platform as well.

These social media platforms are incredibly valuable to advertisers who are paying big bucks to get ads in front of users.

This is an especially important service in today’s covid-recovery market.

After all, record numbers of new businesses have been formed over the last several quarters. And a large portion of those small businesses are counting on social media platforms like Facebook and Instagram to attract new customers.

It’s not just small businesses using FB’s social media platforms for advertising either. Many big corporations are spending tens of millions in advertising to get their products and services in front of FB and Instagram users.

Recently I’ve had a few conversations with media buyers (individuals who buy ad space on platforms like Facebook). The number one complaint I’ve heard from multiple professionals in this industry is that prices are just too high.

That’s tough for small businesses — but very positive for FB. Demand for advertising space is high and FB is in the perfect position to profit from this demand.

Reason #2: Stock Valuation

On Wall Street, professional investors use specific metrics to find a “fair value” for specific stocks.

During the meme stock craze and speculative days following the initial coronavirus outbreak, valuation skills became a lost art.

But now investors are once again pulling out their calculators and spreadsheets. They’re paying more attention to fundamental pricing models. And they’re buying stocks that are trading at reasonable prices.

Thanks to the stock’s decline shares of FB now trade at a reasonable (if not cheap) valuation.

Let’s look at how much FB is expected to earn per share in the coming years:

- This year, analyst expect FB to earn $12.15 per share

- In 2023, profits should hit $14.33

- And in 2024, Wall Street expects $16.03 in profit.

Based on Meta’s current stock price near $185, investors are paying just over 15 times expected earnings for this year. And they’re paying only 11.5 times 2024 expected profits!

That’s a very low valuation for a company with a stable business, growing profits and potential new business lines to come! (We haven’t even talked about the metaverse, oculus, or many of the company’s other potential profit centers.)

Reason #3: Technical Trading Pattern

The final reason I’m excited about FB right now is because of the stock’s recent trading pattern.

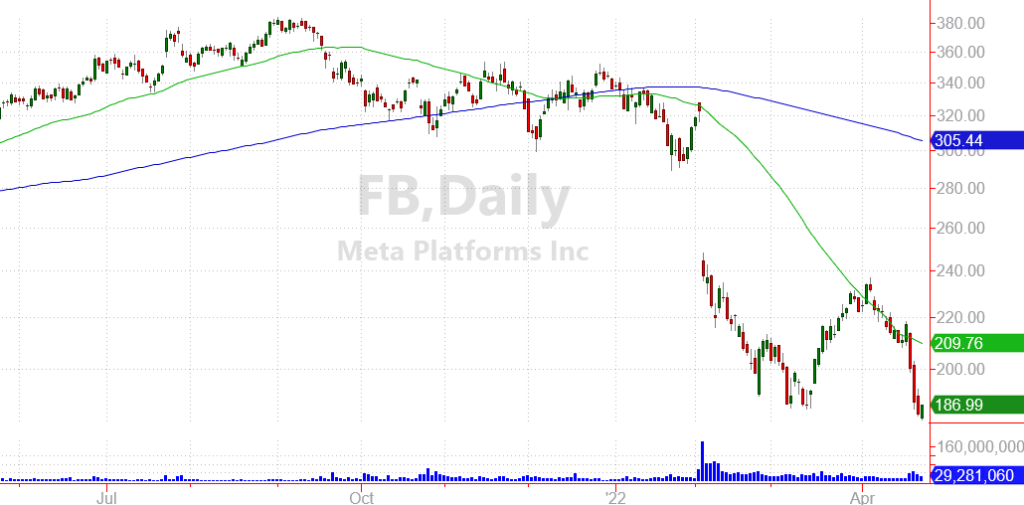

Take a look at Meta’s chart below:

The stock has had a tremendous decline over just the last seven months. Investors who bought near the peak have lost over half of their investment.

But at this point, the stock is so washed out that most of the “weak holders” have already sold. (These are investors who can’t stomach the declines and have now bailed out of their positions.)

The gap lower in February shook out many speculative traders who would normally buy the dip.

Then the steady decline into March punished anyone who purchased shares to take advantage of a cheaper valuation.

Finally, FB’s sharp selloff over the last 4 days now leaves us close to the March lows. This looks like a “double bottom” test. And when a pattern like this is successful, it can lead to big profits!

(That’s largely because the remaining FB shareholders are unlikely to sell. They already would have sold if they traded on fear. So with fewer sellers left, any new buy orders should drive the stock higher.)

A Speculative Play on FB

Facebook’s fundamental strength, cheap valuation, and oversold trading pattern gives me a lot of confidence in this stock.

I think FB will trade higher when the company reports earnings tomorrow. All of the potential bad news appears to be baked in, and any surprises are likely to be positive.

That’s why yesterday, I recommended buying a new position for FB in my Speculative Trading Program.

This trading model uses in-the-money option contracts to make speculative bets on stocks. I recommend call contracts for stocks I expect to trade higher (like FB), and put contracts for stocks I expect to trade lower.

After recommending these trades to subscribers, I also put my own family’s money to work with the same recommendations.

You should know that I’m long FB call contracts (the May $160 calls) — expecting shares to trade higher.

Of course, there are no guarantees in the market. Shares could trade lower.

But even if the recent lows are broken, that can signal an exit for our position and use our capital for new opportunities.

FB is currently at a spot where a break higher could lead to big gains for investors. And a break lower would give us a chance to exit our position quickly (since the technical trading pattern would then be broken).

That’s why FB is currently my favorite trading play for this week. And I’m excited to see how this position does for my readers and for my own family’s investment.

Consider taking a position today before the company’s announcement.

~~~~~

Editor’s Note: You can see all of my live speculative trades — along with real-time recommendations before I enter a new positions — with a subscription to my Speculative Trading Program.

For just $149 per month, you can get real-time trade alerts and access to my live real-money speculative trades.

There’s a 30-day money back guarantee. So feel free to check it out just to learn how the strategy works!