Selling BABA puts for income.

Alibaba Group (BABA) is China’s largest online e-commerce company. In many ways, BABA is like the “Amazon.com” of China.

Shares have fallen sharply as Chinese regulations on profitable companies — along with covid lockdowns have pressured Chinese stocks.

But now that many Chinese stocks are oversold and the Chinese economy is hurting, there are signs that regulations will be eased. This could ignite a strong short-covering rally for many Chinese stocks. And BABA is one of the primary beneficiaries of any positive political action.

Shares appear to have found support above $80. Meanwhile, the volatility in this stock creates a good opportunity for us to collect income while still protecting our capital.

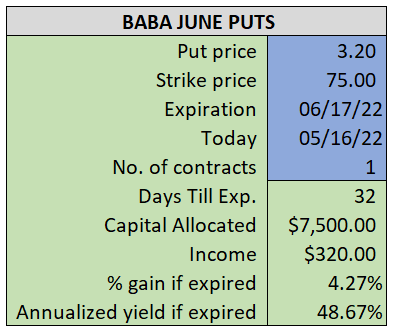

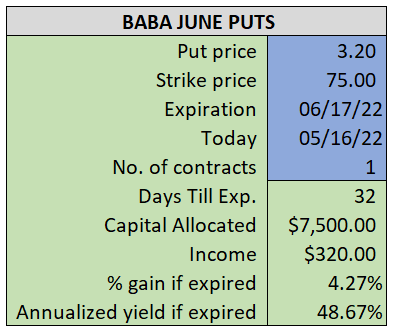

By selling the June $75 puts near $3.20, we’re able to collect an annualized yield near 49%, while also giving us roughly $12.00 per share in cushion between the current market price for BABA and our strike price.

- Sell (to open) 1 BABA June 17th $75 put

- Limit: $3.20 or more

- The new position will represent roughly 8.5% of our model.

~~~~~~~ - 9:57 Executed

- Sold 1 BABA Jun 17th $75 Put @ $3.25