Midway through my holiday weekend research, I’m kicking myself.

Because everything I’m reading about the stock market is downright terrible. And history tells us, when things are this bad, it’s actually a great time for investors to buy.

I’ve got a few bullish positions on the books. And these investments could certainly benefit from a bear market rally.

But I don’t have enough of these positions in my account right now. And at this point, I feel a bit sheepish for not being better prepared.

Stocks Are EXTREMELY Oversold

The goal for most investors is to “buy low and sell high.”

But of course, this is much easier said than done. After all, when stocks are low, it’s typically because investors are worried about something major. (Like a recession.)

As stocks entered a bear market last week, I couldn’t help but remember the famous Rothschild quote: “Buy to the sound of cannons and sell to the sound of trumpets.“

The cannons are getting pretty loud these days. And according to many statistical measures, things have become so bad that we’re well overdue for a major market rebound.

Just look at some of the recent charts posted by the ever-excellent Bespoke Investment Group. (Click the charts to see the original posts).

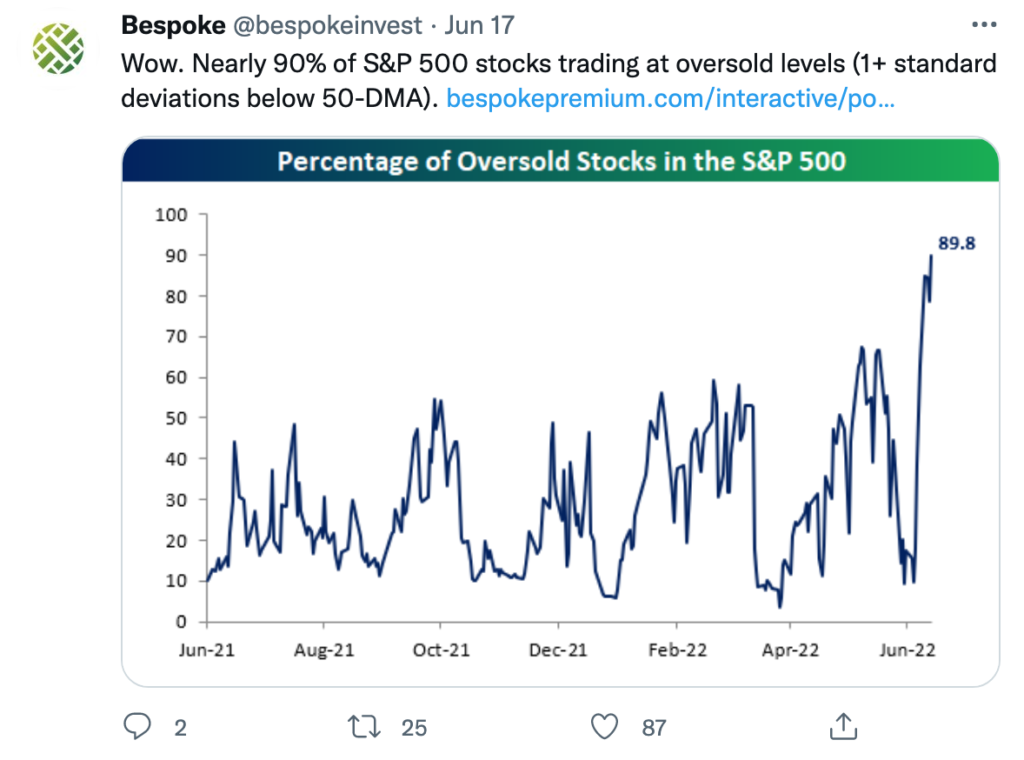

First, the percentage of “oversold” stocks is at extreme levels.

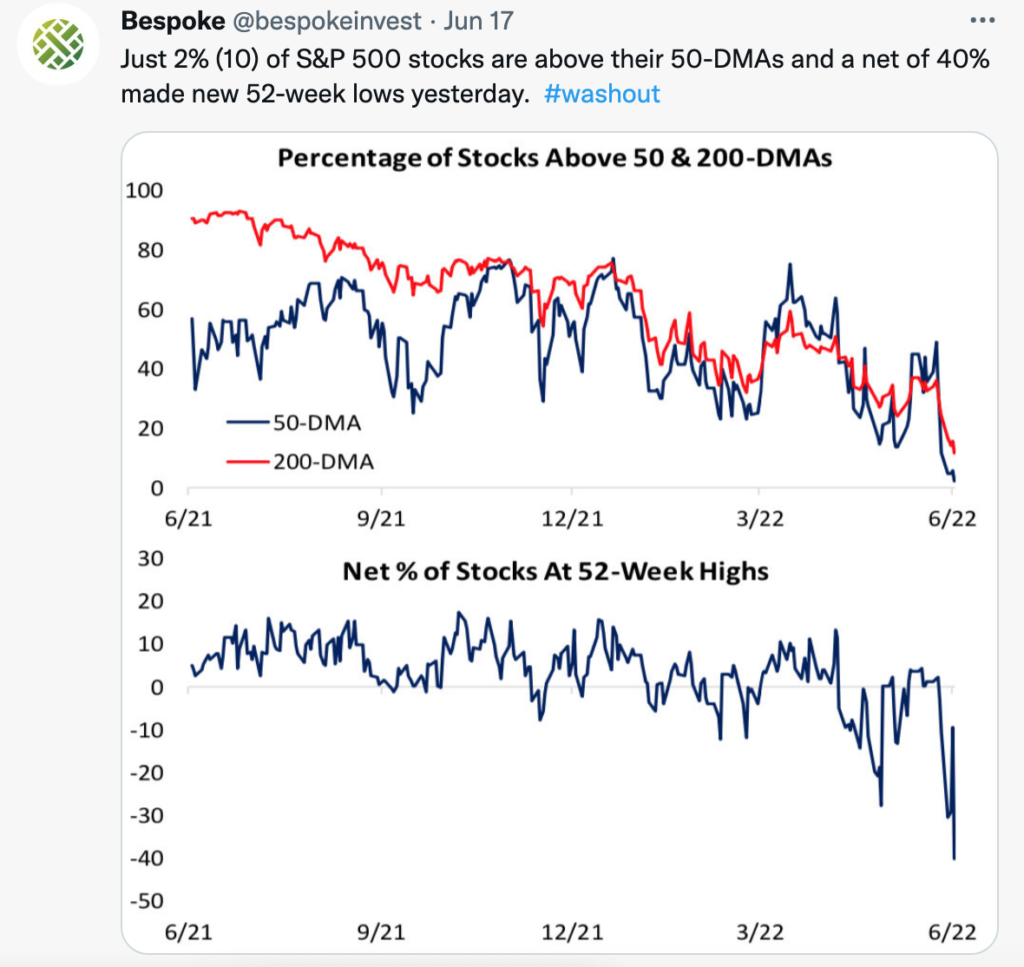

Similarly, the number of stocks trading below key technical levels is at historical lows.

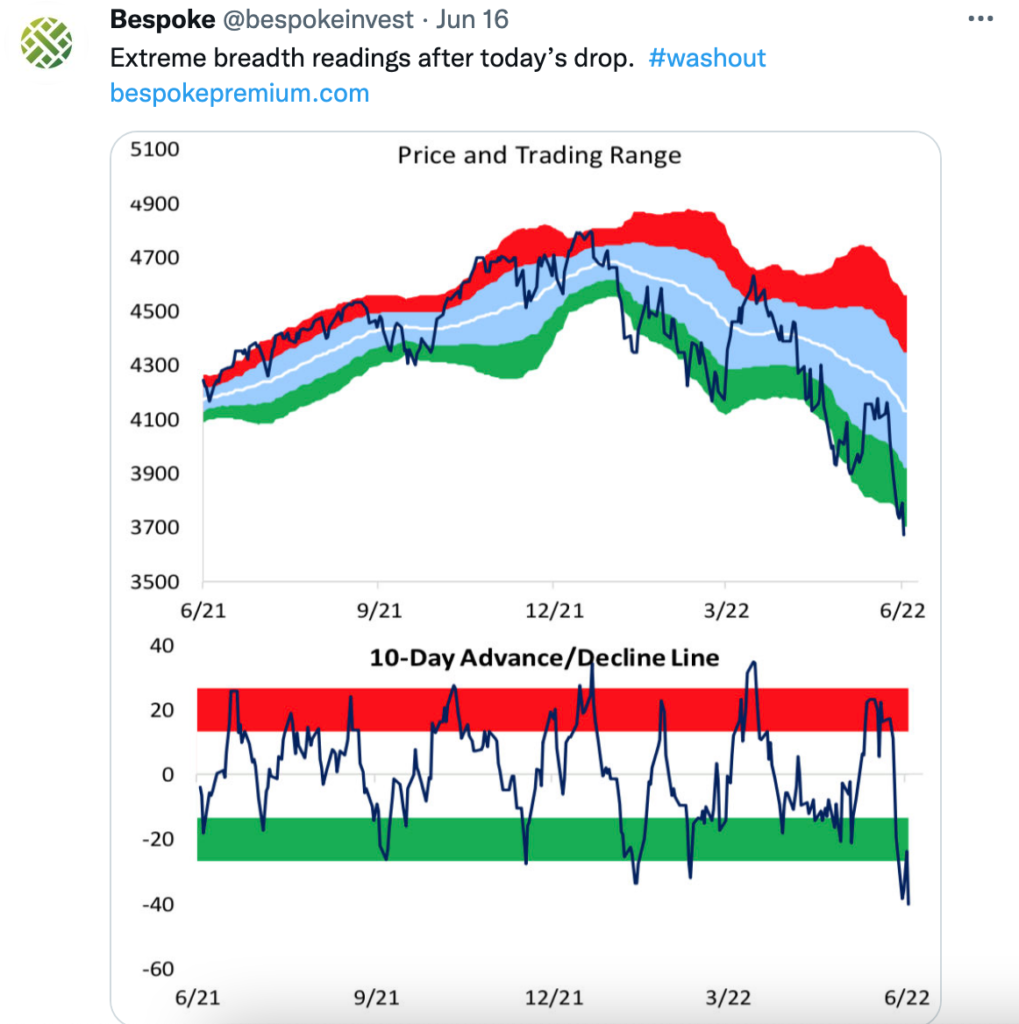

And the short-term advance decline line confirmed the market is “washed out.”

These numbers tell us the market’s recent action is so bad, it’s actually good news for investors.

Historically, readings like these have led to very strong returns in the following weeks and months.

Timing is Everything — And it’s High Time…

Bear markets are famous for periods of “capitulation” followed by sharp moves higher.

That’s because investors often get fearful at the same time, selling in a panic. This is the kind of action we’ve seen in the last couple of weeks. And it’s what has led to the extreme readings on the charts above.

Sentiment levels — such as the number of investors who consider themselves “bearish” — are showing a similar picture.

Once these investors are out of the market, there are fewer people left to sell.

And without sellers, any good news naturally drives stock prices higher.

Heck, even the lack of bad news can ignite a bear market rally.

As we wait for the market to open on Tuesday morning, I’m wishing I had bigger positions in my investment accounts.

I’ve already picked out new positions to add to my Put-Selling Income Model as well as my Speculative Trading Program.

To see my new investment positions before I add them to my own account, simply take a risk-free trial to one of these services. You’ll get an email each time I make a trade, and you’ll have time to add the position to your account before I put my own family’s money to work.

If you decide these trade alerts aren’t right for you, no worries. You can cancel in the first 30 days for a full refund.

Either way, I suggest picking out some investments to add to your account in the week ahead. Because given the oversold nature of this market, we could be in for a strong bear market rally over the next few weeks.

Here’s to growing and protecting your wealth!

Zach