“What does Warren Buffet know that we don’t know?”

That’s the question investors are asking themselves following an important announcement from the “Oracle of Omaha.”

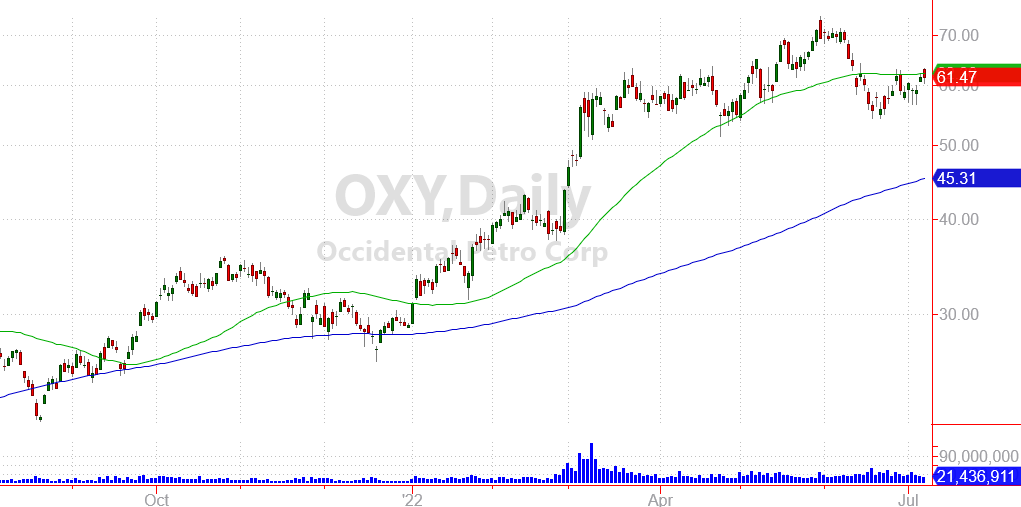

Late yesterday, Buffet’s Berkshire Hathaway Inc. announced that the investment company bought another 12 million shares of Occidental Petroleum (OXY) after a modest pullback.

Berkshire Hathaway now owns 18.7% of the oil & gas company and is by far the largest owner of OXY shares. (Reuters)

Warren Buffet is a legendary investor with one of the longest track records of success in the business! So when Buffet takes a large position in a stock like OXY, the rest of Wall Street pays attention!

Energy Stocks Are Still a “Bright Spot” for Investors

Occidental Petroleum is an “exploration & production” company with oil and gas reserves around the world.

At the end of 202, the company estimated these reserves at 3.5 billion barrels of oil equivalent, while producing roughly 1.2 million barrels of oil per day.

Energy has been one of the few bright spots for investors this year. Years of underinvestment in new oil reserves, a recovering economy, and Russia’s war on Ukraine have driven prices for oil and natural gas higher.

Higher prices naturally lead to bigger profits for companies like Occidental Petroleum. And those higher prices in turn attract the attention of iconic investors like Warren Buffet.

(Incidentally, we’ve used shares of OXY for our Put-Selling Income model this year, and the stock has done well for us so far. Sign up for a risk-free trial of this trading service here!)

Over the last couple of weeks, energy stocks have pulled back. Recession concerns caused the price of oil to drop from recent highs. And that decline naturally affected stocks like OXY.

But the pullback didn’t deter Warren Buffet from stepping in and buying more shares at a lower price!

Deep Value Even With Lower Oil Prices

While recession fears may continue to push oil prices lower, energy stocks like OXY still look like a good spot for investors.

That’s because energy stocks didn’t really as much as one would normally expect when oil prices moved sharply higher.

Instead, investors took a “wait and see” attitude, knowing there was a distinct possibility that crude prices would settle at a lower level.

By some models, these energy stocks are trading at price consistent with crude oil at $60 per barrel. So by this measure, there’s still plenty of room for energy stocks to move higher. (And this is true even if crude oil prices don’t advance.)

That’s why I’m comfortable setting up income plays with a number of different energy stocks. Even while the probability of a recession continues to grow.

Make sure you keep some energy exposure in your investment account.

And I encourage you to take a close look at my trading model to see which energy plays I’m personally invested in!

Whether you take the same trades that I’m setting up, or just use the model to give you ideas for your own investing, I think you’ll find the real-time trade recommendations valuable.

Here’s to growing and protecting your wealth!

Zach