Welcome to a new week on Wall Street!

We’ve got an important week ahead and investors will be focusing on a number of important issues:

- Earnings season is ramping up.

- Oil prices are moving back toward $100 per barrel.

- Reports will give us more information on inflation & the economy.

- And traders are positioning ahead of next week’s Fed meeting.

There are a lot of cross-currents to track. And it’s important to remember that we’re still in a bear market. (That means our biggest priority should be on protecting your wealth.)

So as we kick off this week, I wanted to show you an important chart of which stocks are holding up, even when the broad market has been weak.

Stocks Holding Up Best

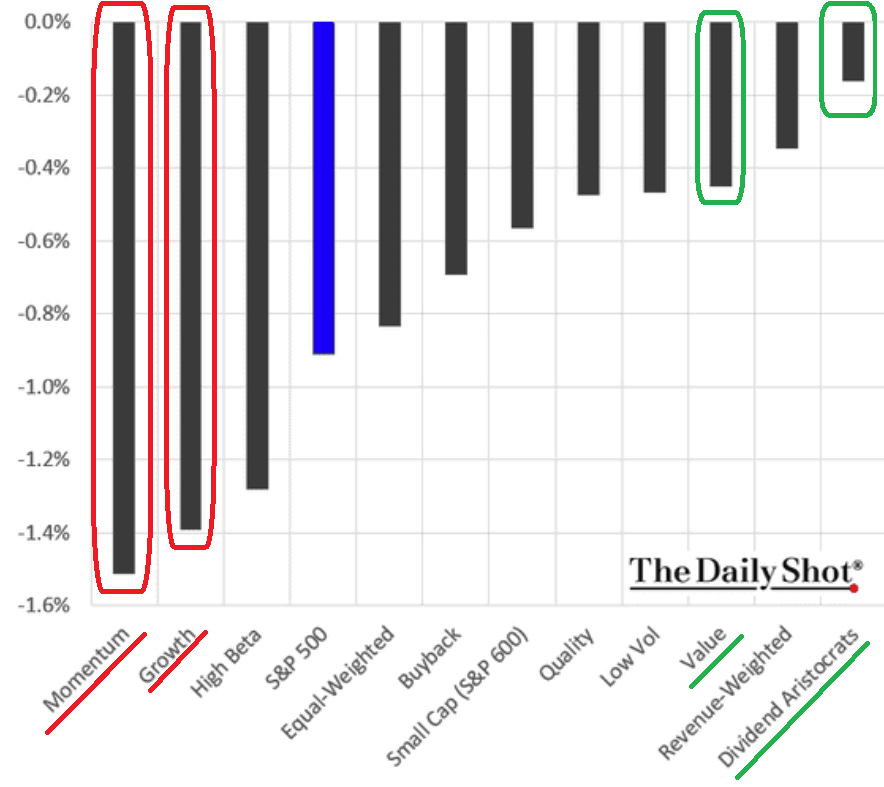

The table below comes from The Daily Shot — a charts-based research publication I highly recommend.

It shows how different investment styles have performed in recent days when the overall market was selling off.

As you can see, momentum stocks and growth stocks have been extremely weak. And these areas are responsible for the lion’s share of the overall market’s losses.

These stocks typically do poorly when interest rates are rising. Growth and momentum stocks often represent companies that need to borrow money for growth. And the cost of borrowing that money is very high now.

Also, investors are less attracted to companies that generate future earnings, when high-interest rates make present earnings much more valuable.

On the other hand, value stocks and reliable dividend stocks have actually held up very well!

This is because stocks in this category represent companies that generate reliable profits. And that reliability is especially attractive when other areas of the market have become unpredictable.

One thing you’ll probably notice is that these stocks have still traded lower over the past few weeks. And it’s true, in a bear market, even good stocks pull back.

But these stocks still helped investors keep more of their wealth.

And remember, dividend stocks (and most value stocks) pay investors along the way. So even if stocks pull back a bit, you can still wind up with a positive total return.

What I’m Watching For the Week Ahead

As we kick off a new week, stocks are set to trade higher (at least to begin with).

Many investors have become extremely frustrated with their stocks. And believe it or not, that’s a good thing!

Sentiment levels are very bearish. This means a lot of investors have pulled money out of the market and are now watching from the sidelines.

If the selling pressure from these fearful traders is now over, any good news could send stocks sharply higher. That’s the kind of thing that can ignite a powerful bear market rally.

As sidelined investors see stocks trading higher, fear of missing out (or FOMO) kicks in. And many of these investors will jump back in — driving stock prices higher.

That’s a distinct possibility for this week. And it’s one my Speculative Trading Program will be looking to profit from.

Of course, there’s still a lot of risk (and uncertainty) in today’s market.

And for long-term investors, I love the idea of adding steadily to these outperforming value and dividend stocks.

But for more aggressive short-term traders, watch for a bear market rally to push up some of the most beaten-down stocks. And this rally could last a couple of weeks as we head through earnings season.

You can see which stocks I’m watching — along with my personal notes on each play — by subscribing to my 20/20 Watch List.

For just $49 per year (or $15 every three months) you get access to at least 60 stocks that I’m watching carefully.

- 20 stocks I expect to trade higher

- 20 stocks likely to trade lower

- 20 stocks to help generate income

Take a look at the 20/20 Watch List today and make sure you don’t miss out on a bear market rally!

Here’s to growing and protecting your wealth,

Zach