“What are your thoughts on taking distributions from trading profits?“

This weekend I got some thoughtful investment questions from Mark — a subscriber to my Speculative Trading Program.

I quickly found myself writing out some thoughts “safe” versus “aggressive” investing… On balancing how much to invest in each area… And on when (and how) to rebalance as profits roll in.

July was the strongest month for investors since 2020. And if you invested in aggressive or speculative positions, you probably have some big gains on your hands right now.

So as we turn the calendar page and get ready for a new month of trading, I want to take a few moments to talk about some ways to protect your gains while still letting your winning positions run.

A Barbell Approach to Balancing Trades

This spring, we talked about using a barbell approach for stronger investment returns.

The idea is to have some of your investments in stable positions that carry less risk. Then invest a smaller portion of your wealth in more aggressive positions with potential for big profits!

Depending on your financial picture, you can add more or less “weight” to each side. Conservative investors can focus more on stable positions. And aggressive investors can put more capital into aggressive plays.

That’s the idea behind my Speculative Trading Program and my Accelerated Income Model.

The Aggressive Trading Program can have very large swings. Profits accumulate quickly when our speculative trades work out. And when positions don’t work, losses can also add up quickly.

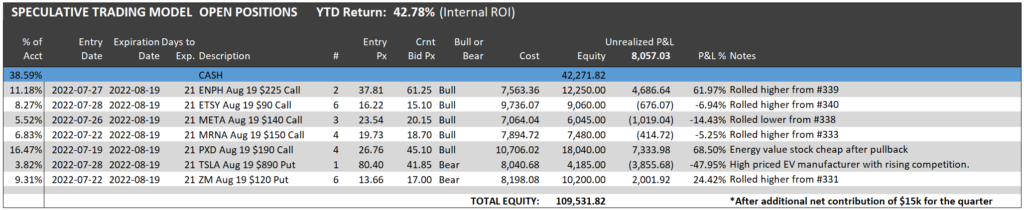

So far this year, the Speculative Trading Program is up 42.8% on the year. Here’s a snapshot of its positions at the end of July:

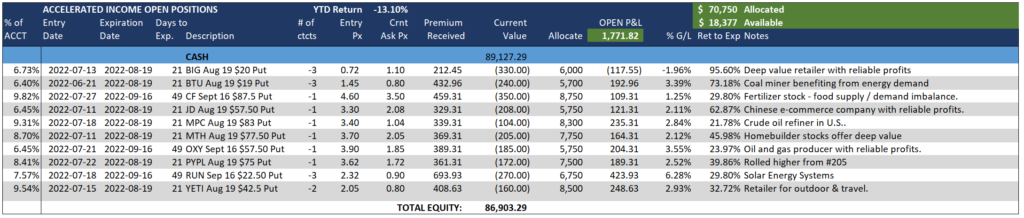

Meanwhile, my Accelerated Income Model is actually down 13.1% on the year.

This model tracks the broad stock market more closely. But in the current bear market, the Accelerated Income Model hasn’t pulled back as much as the Nasdaq Composite or S&P 500 Index.

As we book gains and losses in these models, I’ve got some unique thoughts about how to balance capital between the two.

Siphoning Profits to Maintain Balance

For both the Speculative Trading Program and the Accelerated Income Model, I start each year with a $100k balance. If you’re using these models with your retirement investing account, you can choose how many “units” of each you want to use.

(Of course you can follow the models however you like. Some investors decide to pick and choose which trades to place. While others follow each recommendation in their account.)

Since the Accelerated Income Model is a relatively stable investment program, I reset the $100k balance at the beginning of each year. I don’t expect the value for this model to stray too far from $100k in any given year.

But since the Speculative Trading Program is much more aggressive, the model can add (or lose) a lot of value in a short period of time.

For this program, I have chosen to siphon half of my profits out of the program. This helps to protect some of my profits in case the mode pulls back. But at the same time, it allows some of my profits to be reinvested for future gains.

So any time the program accumulates $10k in profits, I take $5k out. That capital can then be used for more conservative investments.

On the downside, any time the value for this mode drops below $95k, I add another $5k of capital to the account.

That way, the model continues to be large enough for proper management. At this level, there’s still enough capital to be able to diversify into several positions.

At the end of each quarter, I rebalance the Speculative Trading Program model portfolio to a base of $100k again.

Investors can once again choose at that time how many “units” of each model to use in their own account to meet their specific financial needs.

Balance Helps with Perspective

This barbell approach works well for my family’s investments because it helps me keep a balanced perspective.

If the Speculative Trading Program is generating lucrative profits, I can be comfortable knowing that some of those profits are being set aside. This way, I can continue to be aggressive, while knowing that a pullback is less likely to take away all of my gains from this period.

The majority of my family’s wealth invested in the more conservative Accelerate Income Program. And this program is less likely to have large drawdowns.

So it’s easier to sleep at night knowing that most of our savings are in a more stable program.

Depending on how aggressive I want to be, I can dial up my allocation to the Speculative Trading Program — or put more of our savings into the Accelerated Income Model.

From there, it’s just a matter of executing the trades for each model in my brokerage account.

If you would like to see how these models work — and how they interact with each other — feel free to give each a try!

Both models come with a 30-day money back guarantee. So you can learn about each program, test it out for yourself, and decide what makes the most sense for your family.

My Accelerated Income Model is available for $99 monthly, or $995 per year. You can find out more about the model here.

And the Speculative Trading Program is available for $149 monthly, or $1,495 per year. (It’s a bit more expensive because the program is more active and requires more work to recommend new trades and maintain the position records.)

Find out more about the Speculative Trading Program here.

Whether you decide to use one of these programs or not, I hope the discussion about balance, and managing different investment approaches is helpful!

Here’s to growing and protecting your wealth,

Zach