Selling CHK puts for income.

Chesapeake Energy (CHK) produces oil and natural gas from some of the best shale reservoirs across the U.S.

The company’s natural gas resources are especially valuable in today’s market.

The U.S. is exporting as much natural gas as possible to Europe, helping to support energy prices.

Higher oil and gas prices naturally lead to more profit for producers like CHK.

The stock currently trades for less than 5 times next year’s expected profits. This valuation should keep a floor under the stock price and even help to push shares of CHK higher into the end of the year.

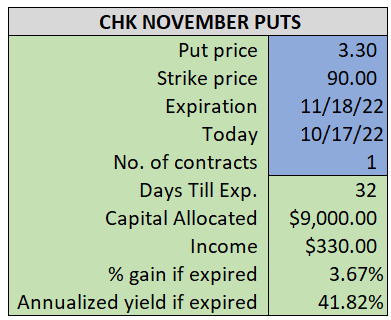

By selling the November $90 puts near $3.30, we’re able to collect an annualized yield near 42%, while also giving us roughly $7.30 per share in cushion between the current market price for CHK and our strike price.

- Sell (to open) 1 CHK November 18th $90 put

- Limit: $3.30 or more

- The new position will represent roughly 10.5% of our model.

~~~~~~~

- Executed 13:43

- SOLD 1 CHK Nov 18 $90 put @ $3.50