I read an interesting statistic this morning…

When inflation spikes above 8%, it typically takes about two years to fall back below 6%.

And from that point, inflation continues to hold in the 5% to 6% range for the next five years.

The statistic is based on the average of 318 different inflationary periods around the world. And the periods have all happened in the last 100 years. (A similar study since 1950 had almost the exact same results).

This tells me inflation is likely to be with us for a long time. And as investors we need to protect our wealth against this devastating force.

Today, I want to fill you in on a trade I’m making with my own family’s money, to set us up for success even if inflation continues for years to come.

It’s Time to Buy Some Gold

During high inflation periods, gold is supposed to be an effective hedge.

Historically, the yellow metal has held its purchasing power for centuries. So as the value of a dollar (or other currencies) falls, the price of gold (in those currencies) tends to rise.

But that hasn’t happened this time around.

Do you know why?

Because the U.S. dollar has been quite strong! And this is a theme you already know about if you’ve been following my alerts this year.

The strength of the dollar ties back to interest rate hikes from the Federal reserve. Since the United States pays higher rates of interest than many other developed countries, international investors have been moving capital into U.S. dollar denominated investments.

More demand for the dollar pushes the value higher. And this has been a counterbalance to inflation — helping to keep gold prices lower.

But take a look at the U.S. dollar chart today.

The dollar declined this week, breaking decisively below its 50-day moving average.

This is a major technical milestone that likely points to a trend reversal for the greenback.

Which means, a major headwind for gold may be lifting.

Betting on a Rebound for Gold

The probability for a gold rebound is now very high.

Inflation continues to be a major pain point in the U.S. economy. And inflation is likely to continue for many years to come.

To fulfill its role as an inflation hedge, gold has a lot of ground to make up. And with the dollar rolling over, the risk / reward scenario for owning gold looks very positive.

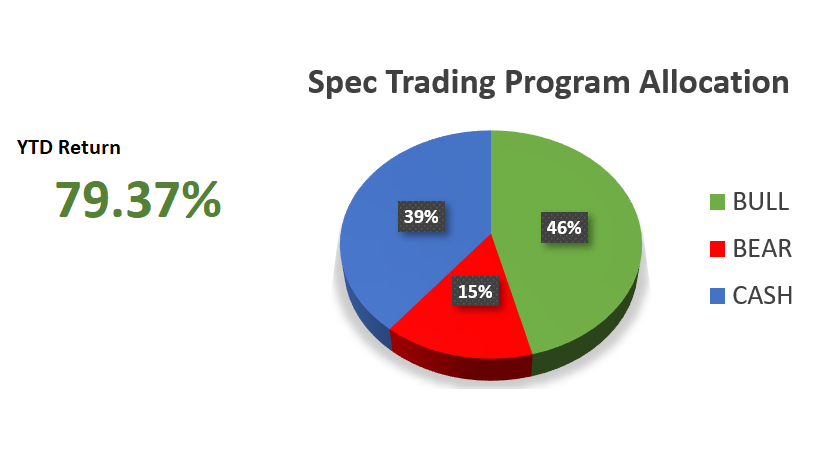

This morning, I initiated a new bullish position on the SPDR Gold Trust (GLD), buying call contracts in my Speculative Trading Program. If gold trades higher, this position could profit in a big way (thanks to the extra leverage from option contracts).

[Editor’s Note: Our Speculative Trading Program is a real-money portfolio of aggressive plays on various stocks. The model portfolio is up 79.4% for the year as of yesterday’s close. And while this is a high-risk / potentially high-reward approach to markets, the results have been strong during a challenging market period.

Past performance does not guarantee future results. All investments include risk. And this trading service is highly speculative. Find out more here.]

In addition to buying shares of GLD, you may also want to consider stocking up on physical gold.

Buying shares of gold miners is also an attractive option. Remember, gold miners own vast amounts of underground resources. So as the price of gold trades higher, the true value of these resources also rises.

One way to invest in multiple gold miners is by purchasing shares of the VanEck Gold Miners ETF (GDX).

Inflation continues to degrade the value of our savings. Owning gold (and precious metal investments) will be an effective way to protect your hard-earned savings.

Here’s to growing and protecting your wealth!

Zach