The Federal Reserve will be cutting interest rates in 2024. Here’s how to profit.

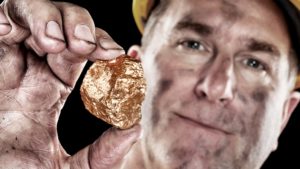

gold

My Hedge Against the Silicon Valley Bank Crisis

The Silicon Valley Bank meltdown has triggered extreme challenges for investors. Here’s one way to protect your wealth.

How I’m Positioned for Today’s Fed Announcement

Today’s Fed announcement could be an important turning point for the market. After a January stock market rally, Powell has some work to do!

Three Ways to Play Gold’s 2023 Surge

Gold is surging higher to kick off the new year. Here are three ways to invest in gold and gold stocks to profit from the trend.

More Dollar Weakness — Here’s What to Buy

A weak dollar is creating new opportunities for investors. Here’s where to invest as the U.S. dollar falls..

Crypto’s Meltdown is Good News for Gold

The crypto meltdown is a serious risk for Bitcoin investors. But it’s creating opportunity for gold — a reliable inflation hedge!

Inflation is Here to Stay — Just Look at the Stats

Once inflation crosses above 8%, it stays high for a long time. Here’s how I’m protecting my family’s savings.

Three Charts to Watch This Week

Here are three charts to watch for a new week in the market. Now that earnings season is over, investors will be watching these indicators.

Time for Gold to Rally!

The gold rally has been held back by two important factors. But now that these two challenges are going away, gold could surge!

What I’m Watching as an Official Bear Market Looms

Stocks are just a couple percentage points away from official bear market territory. Here’s how I’m positioned heading into next week.