Rolling our KSS puts to a higher strike price and January expiration.

Shares of KSS are moving higher as the holiday shopping season gets underway. The company appears to be working through inventory issues from earlier in the year and consumer spending is still relatively strong.

Our December put contracts are now very cheap, which gives us a chance to “buy out” of our current income play at a cheap price.

This allows us to lock in profits from our original income play, and also frees up capital for a NEW income play for KSS.

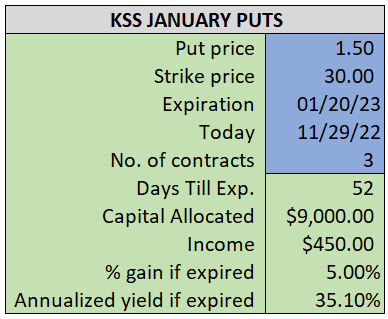

By selling the KSS January $30 puts near $1.50, we’re able to collect an annualized yield near 35%, while also giving us roughly $2.60 per share in cushion between the current market price for KSS and our strike price.

- Buy (to close) our KSS December 16th $27.50 puts

- Limit: $0.25 or less

ALSO

- Sell (to open) two KSS January 20th $30 puts

- Limit: $1.50 or more

- The new position will represent roughly 6.7% of our model.

~~~~~~

- Executed 13:09

- BOT 2 KSS Dec 16th $27.50 puts @ $0.24

- SOLD 2 KSS Jan 20th $30 puts @ $1.59

- Net CREDIT: $1.35