It’s been 36 years since America’s energy supplies have been this vulnerable.

Thanks to years of all-out political war on oil and natural gas producers… And the Biden Administration’s decision to deplete the Strategic Petroleum Reserve… U.S. energy reserves are running on fumes.

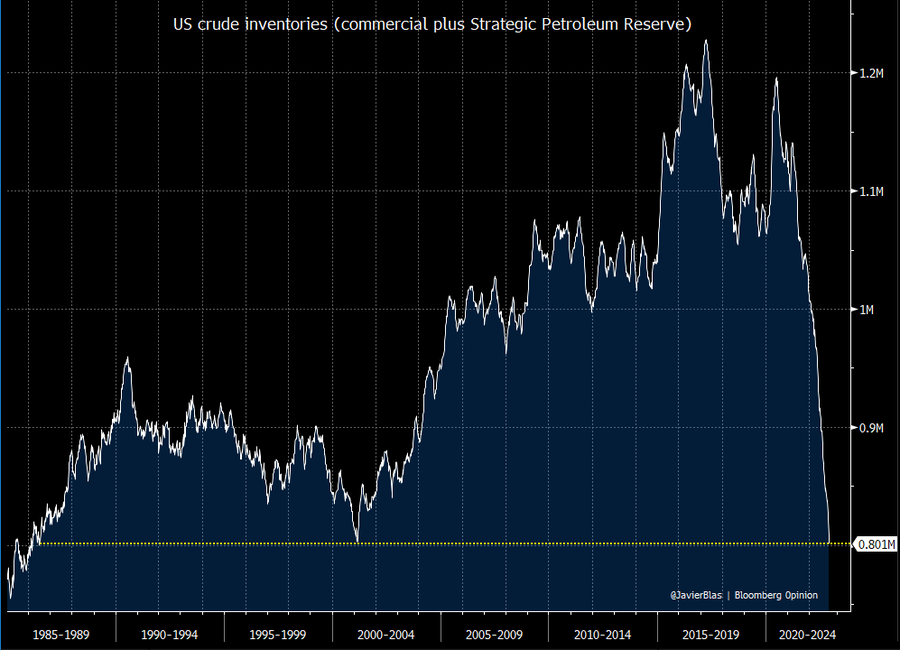

Just take a look at how sharply we’ve drawn down crude oil inventories:

As crude oil supplies hit a 36-year low, I’m concerned about how shortages could affect our overall economy.

And at the same time, I’m optimistic about the investment opportunities this situation creates.

Let’s take a look at how America’s energy crisis could play out.

Lower Prices and Shortages — What Gives??

At the moment, America’s depleted oil reserves are being largely overlooked by investors.

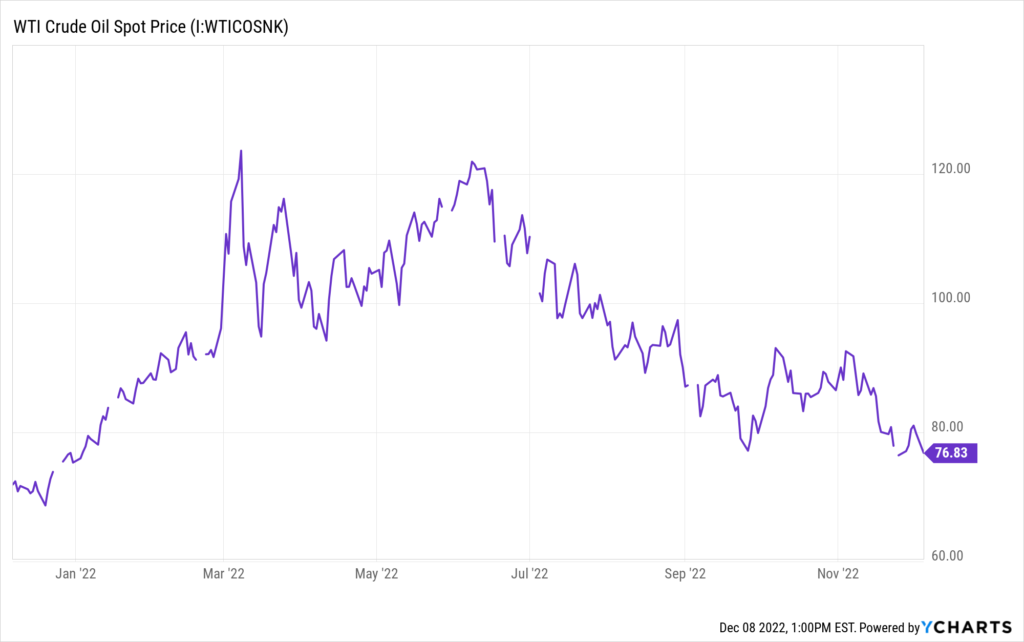

It seems counterintuitive. But despite severely low inventories, the spot price for crude oil has been trading steadily lower.

A big part of this pullback is tied to recession concerns here in the U.S. and Europe.

The thinking is, if the U.S. and European economies slow, it will reduce overall demand for oil. So prices are pulling back.

It also helps that the U.S. continues to sell barrels of oil from the Strategic Petroleum Reserve — adding temporary supply to the global energy market.

These concerns (and extra supply) have helped to push the price for a barrel of crude oil below $80 per barrel. And for now, the trend continues.

Three Catalysts to Drive Oil Higher

Despite the current pullback, there are three important catalyst that could soon drive oil prices sharply higher.

First, the U.S. can only deplete the Strategic Petroleum Reserve for so long.

The SPR was designed to give the U.S. an energy buffer in case of emergency. (Not to be used as a political tool to drive down inflation and buy votes — but that’s another discussion for another day).

Over the next several months, distributions from the SPR will wind down. And at some point next year, it’s likely the SPR will become a net buyer of oil to replenish reserve levels.

This shift will certainly take additional supply out of the market next year and could add significantly to demand.

Second, OPEC+ has a vested interest in supporting the price of oil.

Now that oil prices have pulled back significantly from peak levels, it’s likely that the cartel will keep production levels low to help support prices. Historically, OPEC+ has kept an effective floor below the price of oil, and the group has a vested interest in supporting oil prices headed into next year.

Finally, China is finally adjusting its “zero covid” policy. A relaxation of travel and lockdown policies will help to restart the Chinese economy — which in turn will drive significant demand for oil.

With these three catalysts on the near-term horizon, I’m expecting oil prices to rebound quickly.

How to Play a Crude Oil Rebound

With oil prices set to rebound, I’ve got my eye on a number of energy stocks that will benefit.

Energy producers like ConocoPhillips (COP) and APA Corp (APA) should be able to sell oil at higher prices next year. And when oil prices rise, the underground resources that these companies own also become more valuable.

Oil service companies like Halliburton (HAL) and SLB (SLB) should get more business from these energy producers. HAL and SLB offer technology, tools and expertise to help drillers maximize productivity and profits.

Energy pipeline and storage stocks like Enterprise Products Partners (EPD) and Cheniere Energy (LNG) will see business pick up as new production is transported and stored.

And finally, I’m watching refining stocks like Valero Energy (VLO) and Marathon Petroleum Corp. (MPC) as oil is converted to usable fuel like gasoline, diesel and jet fuel.

My Speculative Trading Program currently holds an aggressive position on COP.

After a short-term pullback I expect this stock to quickly charge back to all-time highs (and possibly much further).

This program is focused on high-risk / high-potential-return opportunities from stocks that have potential for explosive moves in the near future.

One of the benefits of this program is that it can take advantage of both rising and falling stock prices. So even in a bear market, this program has helped subscribers lock in some very attractive profits.

>>You can find out more about the program here<<

Don’t overlook the opportunities this short-term pullback has created! Make sure you’ve got some exposure to energy names before these catalysts kick in.

Here’s to growing and protecting your wealth,

Zach