The U.S. economy is 70% consumer spending. The other half is corporate.

With apologies to Yogi Berra, it can be easy to forget how much of our economy is tied to personal budgets.

When Americans spend money, the economy tends to hum along just fine. And when consumers stop spending money, that’s when problems arise.

For the economy – and also for the stock market.

This week, I’ve been doing some research on the state of the American consumer. And as I look through the data, there’s one particular warning sign I’m worried about.

Buy Now, Pay Later (BNPL) — Maybe…

You may remember the hottest new consumer trend from a couple of years ago: Buy Now, Pay Later — or “BNPL” as the Wall Street guys call it.

Startup companies in the BNPL industry worked with retailers to make it easier for shoppers to “afford” new purchases.

BNPL companies would foot the bill for anything from small apparel purchases to bigger ticket items like golf clubs, gaming consoles or other discretionary purchases.

Customers were able to “buy” an item right away, and pay for it over time. And the BNPL companies naturally charged interest on the balances, racking up lucrative income as consumers slowly paid for their past purchases.

Quite frankly, I’m not sure how “innovative” this approach is.

After all, credit card companies have been “helping” consumers buy things they can’t afford for years. And charging ridiculous fees and interest along the way.

But since BNPL companies had an online presence and worked directly with retailers to help consumers make bigger purchases, some investors considered this a disruptive technology.

Fast forward to today, and the buy now pay later industry is causing some big problems for investors.

And no, I’m not just talking about the stocks of companies that offer these services.

In today’s economy there could be a much bigger BNPL time bomb about to go off.

The Problem With Consumer Debt

As inflation drives prices higher, family budgets are getting stretched.

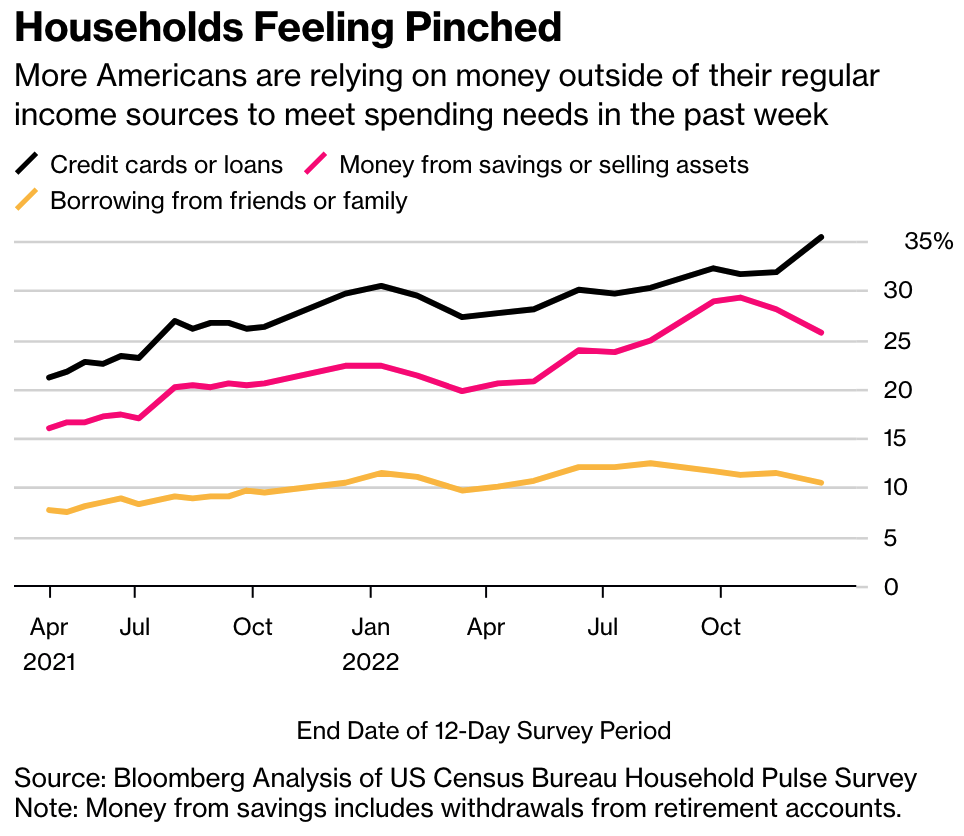

This weekend, Bloomberg reported that more than 35% of Americans are using credit cards or loans to cover day-to-day spending during the month of December.

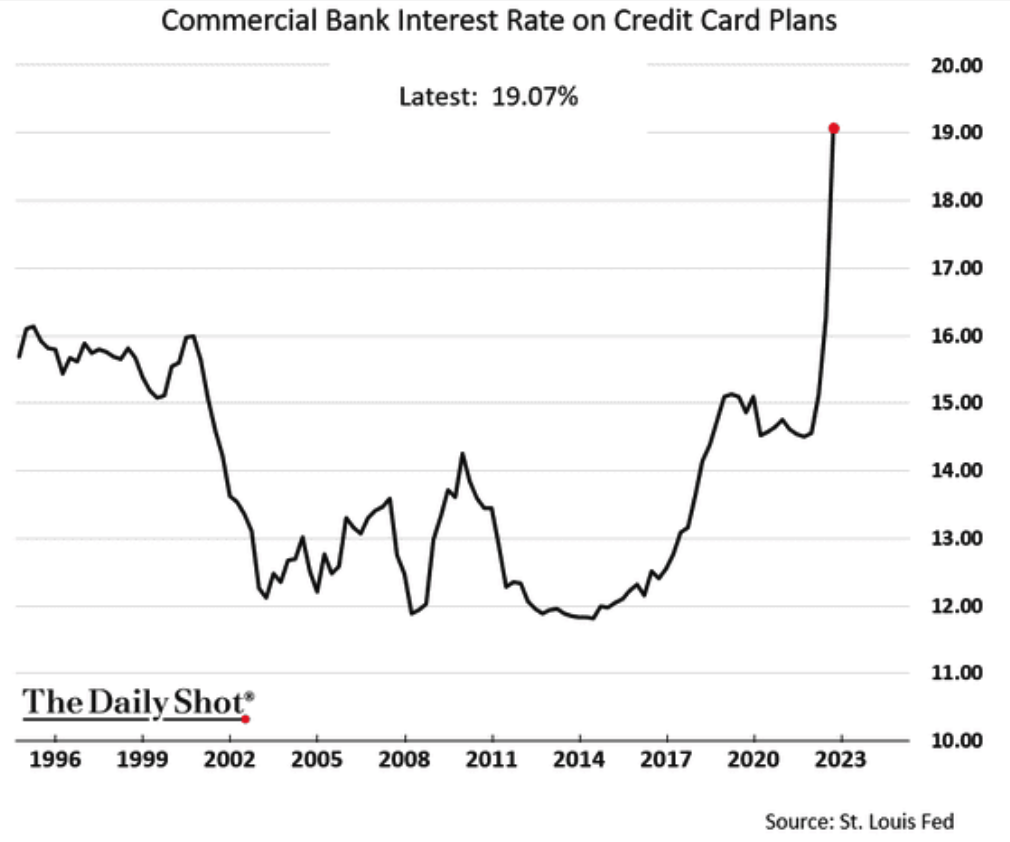

Meanwhile, interest rates on credit cards have been soaring. This makes it all the more difficult for financially-strapped families to keep up — not to mention getting ahead.

Here’s where the BNPL ticking time bomb comes into play…

As of right now, it’s unclear how much of the BNPL debt is being calculated in official statistics like the chart Bloomberg posted.

Many BNPL companies do not report debt to the credit agencies. And while this may be a feature that consumers appreciate, it certainly makes it much more difficult to judge the health of American consumers.

In some cases, shoppers have many BNPL accounts outstanding. And rising inflation and interest rates continue to make it more difficult for consumers to service debt.

This scenario can’t go on forever. And any hiccup in the job market could trigger a wave of defaults for vulnerable Americans.

Winners and Losers in a BNPL Blowup

Now to be clear, I’m not expecting the BNPL to create a meltdown like the Great Financial Crisis years ago.

On balance the U.S. consumer is relatively healthy. And only a small portion of Americans are using BNPL loans to spend more than they can afford.

But as some lower-class and middle-class consumers struggle with consumer debt, we could see some big shifts in where consumers spend money.

In particular, I’m watching for consumers to “trade down” when it comes to certain purchases.

For instance, instead of going to a designer apparel company like Lululemon Athletica (LULU), shoppers may browse the discount racks at Ross Stores (ROST) and TJX Companies (TJX).

Or maybe instead of buying a coffee tumbler from Yeti Holdings (YETI), more shoppers will favor simple gifts from Five Below (FIVE).

Late last year, we talked about how inventory gluts created new opportunities for discount retailers. And today, crimped budgets may drive shoppers that used to rely on BNPL funding to shop more at these discount shops.

For now, BNPL looks like a big risk for struggling consumers.

But this risk also creates opportunities to invest in more affordable retailers.

Keep these stocks in mind as we get this new year of investing up and running.

And if you can use more stock ideas this year, consider subscribing to my Profit Watch service. This is a regularly updated list of at least stocks on my radar. And for just $27, you’ll have access to the list for an entire year!

>> Check out my Profit Watch watch list here <<

Here’s to growing and protecting your wealth!

Zach