Editor’s Note: This is Part II in my series on timing ODTE option contracts. Check out Part I here.

As you saw in Part I of this series, each call or put contract has a specific “expiration date.” So if you own a call contract or a put contract, you must either sell or “exercise” your contract before the market closes on that specific date.

The more time left until the contract expires, the more valuable that contract will be!

After all, if you can exercise the contract any time between now and the end of the year, there’s plenty of time for the stock to move in your favor.

But timing ODTE contracts is much more difficult because they expire in just one day. So there is much less time for the trade to give you profits.

Bottom line, short-term option contracts tend to be much more volatile (risky). So they’re much less attractive to me. It’s hard to make a reliable prediction on the market for a single day of trading.

Intrinsic Value and Time Premium

When you buy an option contract, you’re essentially paying for two things:

- The true underlying value (or intrinsic value) of your agreement.

- The potential for future profits (or time premium) that could occur.

Here’s an example. The DIS calls I mentioned in Part I have an intrinsic value of $10. That’s because the contract gives us the right to buy shares at $90. And we can sell them in the market near $100 — for a gain of $10.

But since I bought the April 21st contracts — which expire more than 6 weeks from today — I actually paid close to $12 for the contract.

The extra $2.00 per contract represents the time premium that I’m paying to hold the agreement for the next 6 weeks.

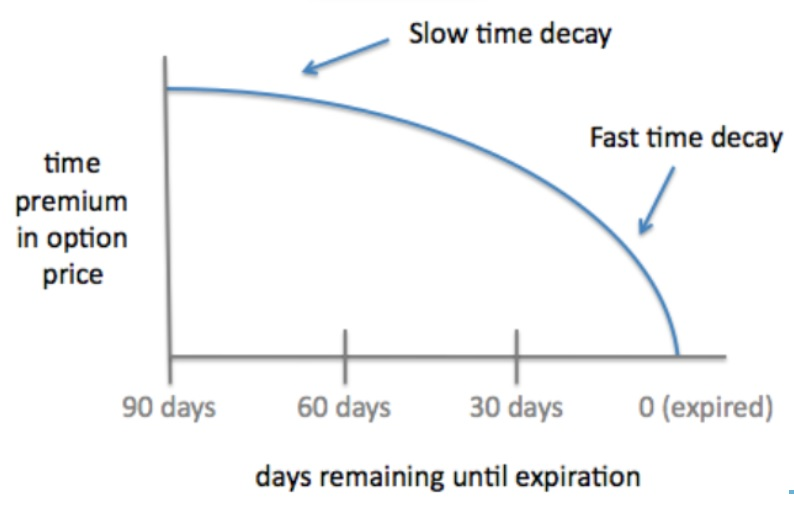

Over time, the value of this time premium steadily declines. And this is especially true during the last few weeks before an option expires.

So I typically like to sell my contracts at least a week or two before expiration. That way I’m not holding a contract that is steadily declining in value.

In-the-Money versus Out-of-the-Money Options

The options I buy for my family are “in-the-money” (or ITM) call and put contracts.

“In-the-money” means that the options can be exercised right away for a profit.

For example, the DIS April $90 contracts are “in-the-money” because I can buy shares at $90 with these contracts – and sell the stock in the market at $100. That gives me a profit of $10.

On the other hand, a DIS April $110 contract would be “out-of-the-money.”

Buying this option contract would allow me to buy shares of DIS at $110. But for now, that would be a bad trade. Because DIS is currently trading well below that level.

Many novice investors buy “out-of-the-money” contracts because they’re cheap. And IF shares of DIS were to trade sharply higher, investors COULD book a nice profit in percentage terms.

There’s a time and a place for this type of trade. But more often than not, “out-of-the-money” option contracts expire worthless. Which means investors lose the entire amount invested in these plays.

When you buy an “out-of-the-money” option contract, there is no intrinsic value (at least to start with). So the full amount you pay for your contract is time premium (which steadily declines until the contract expires).

ODTE Timing Versus In-the-Money Advantages

In-the-money options have two distinct advantages compared to the ODTE timing issues we’ve talked about.

The first advantage that in-the-money option contracts have a higher “delta.” This simply means that a one-dollar move in the underlying stock will result in close to a one-dollar move for the option contract.

Our In-the-money call contract for DIS is a good example.

If DIS were to move from $100 to $110, our DIS April $90 call contract will be worth a little more than $20. (Let’s say $21 to include a bit of time premium). That represents a $9.00 swing for our option contracts — or a delta of 0.9.

On the other hand, the out-of-the-money April $110 call contract would have less movement. Based on the current dynamics for DIS, we can expect the April $110 call contracts to move from a current price near $1.00 to a little less than $4.00.

That’s a higher percentage return of course. But you’re only getting a three-dollar profit for a $10 dollar swing for the price of DIS.

The second advantage of in-the-money options helps us out when the stock moves against our trade.

If DIS were to pull back to $95, our $90 call contract would lose $5 of intrinsic value. But the contract would actually gain additional time premium, helping to offset some of our loss.

In this case, we would likely lose $3.00 to $4.00 compared to the $5.00 pullback for shares of DIS.

But the challenge of timing ODTE options is on full display here. Because an ODTE call contract with a strike price of $95 would lose its entire value. After all, when an option expires, there is no time premium left.

I’ve found the extreme risk with timing ODTE options is too much of a hurdle to offset the potential advantages from these contracts.

Using Options for Speculative Profits

My Speculative Trading Program uses in-the-money option contracts to take aggressive positions on specific stocks.

I recommend call contracts on stocks that I expect to trade higher. And the program also buys put contracts for stocks I expect to trade lower.

This “long-short” approach gives us an opportunity to make money both when stocks are falling and also when stocks are surging higher.

Since its inception at the beginning of 2022, the model has generated net profits during a period when the broad market has been in decline.

Of course all investing and trading involves risk. And past results are no guarantee of future performance.

But the strategy of buying in-the-money call and put contracts has helped to lock in profits despite a challenging market.

The Speculative Trading Program reflects my own aggressive trades.

Each week, I send out trade alerts to subscribers before I enter (or exit) the trade in my own family’s account.

>> You can see more info on the program here <<

If you’re an active trader interested in learning more about option contracts, I’d love for you to give the program a try.

Each subscription comes with a 30-day refund period. So if the program is not for you, no worries. I’m happy to send back your subscription payment.

Hopefully you’ll find you enjoy this trading approach as much as I do. Because adding some aggressive trades to a balanced investment approach can be extremely rewarding.

Here’s to growing and protecting your wealth!

Zach