This morning, an analyst at Wolfe Research upgraded Roku (ROKU).

In his report, Peter Supino noted that there is “less downside risk for arguably the best in-class gatekeeper to streaming TV.”

Shares of the streaming media company are up 3.5% in early trading as I write this note.

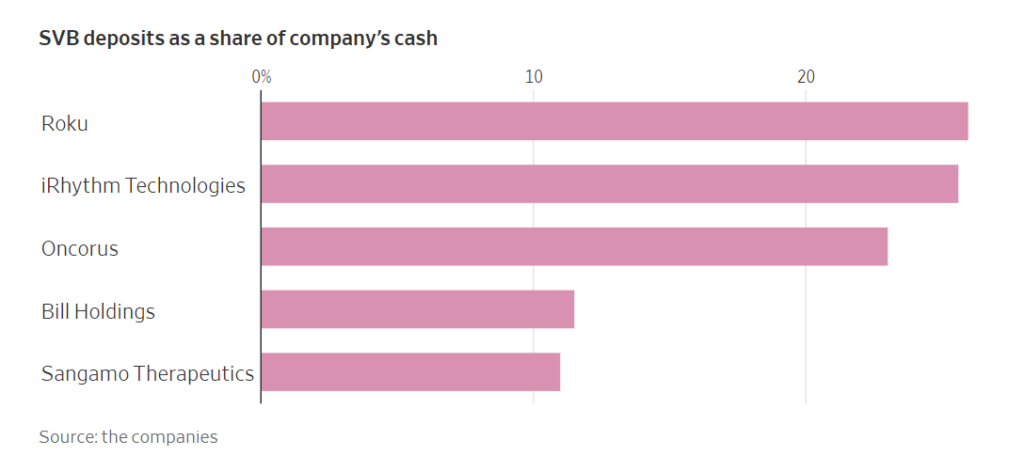

You may have seen ROKU headlines this weekend as the company had considerable exposure to the Silicon Valley Bank collapse.

According to the Wall Street Journal, ROKU had an estimated $487 million in deposits at SVB. And as one of the largest depositors, ROKU had a huge amount of risk when the bank went under!

Fortunately for ROKU, all SVB deposits were backstopped by the Fed. So even though the vast majority of ROKUs cash was uninsured, the company still has access to this cash.

(Thanks American taxpayers!!)

Investors breathed a sigh of relief when the backstop was announced. But I’m still very skeptical about this stock — and watching for a good spot to set up a new bearish position.

Here’s why…

Profits Matter, ROKU Eyeballs Don’t

I’m old enough to remember the dot-com bubble days when investors lost their minds and threw out the fundamental playbook for valuing stocks.

At the time, analysts created any number of new “metrics” to justify sky-high valuations for stocks.

Some looked at the number of customers… Others measured daily clicks…

My personal favorite was the “eyeball” metric which attempted to determine how many eyeballs viewed a “dot-com” company’s website. (I can’t remember if the standard practice was to divide the eyeballs by two — to come up with the number of actual visitors.)

Ultimately most of these “dot-com” dream investments ended in tears. Because the true valuation of any company is ultimately tied to it’s long-term profitability.

And therein lies the problem with ROKU.

Wall Street analysts have fixated on a specific metric for ROKU’s success. They’re analyzing the “number of hours of content streamed” over the company’s platform.

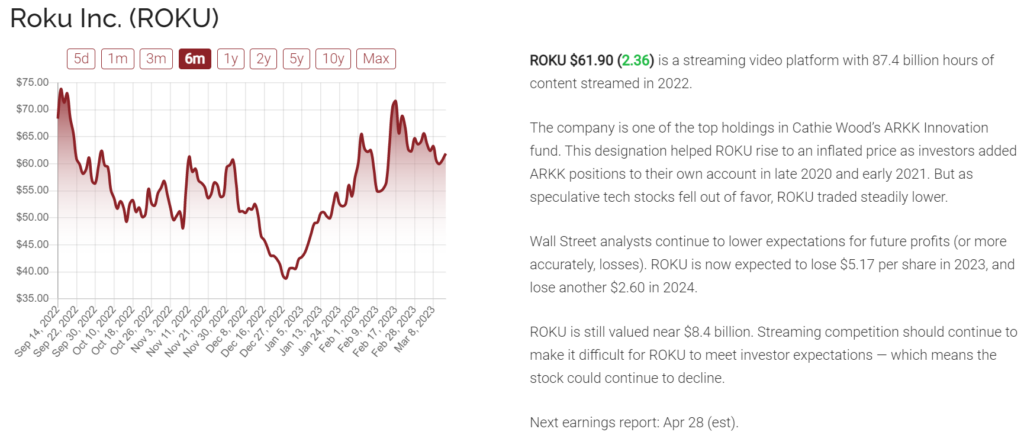

In 2022, ROKU streamed an estimated 87.4 billion hours of content.

SO WHAT???

That number sounds impressive on the surface. But it hides the true nature of this company.

Losing Money and Getting Worse

The truth is, ROKU is a money losing enterprise with virtually zero chance of recording a profit in the next several years.

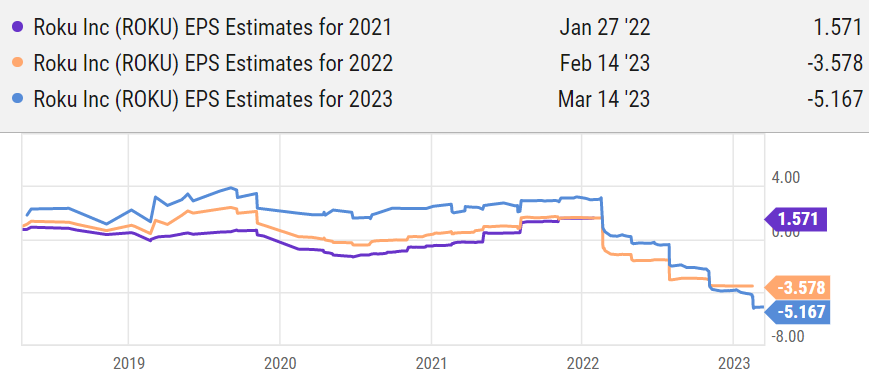

In fact, despite the company’s “success” in streaming more content, Wall Street analysts continue to revise profit (or more accurately LOSS) forecasts lower!

Take a look at this chart from YCharts… The light blue line shows estimated losses for 2023. It seems that every week or two, analysts adjust their models to show even bigger losses.

Losses are a problem for any serious investor at any time in an economic cycle.

But losses are even more damning during periods of rising interest rates.

That’s because it is more expensive for companies like ROKU to borrow cash (that is essentially being lit on fire). And investors also pay less for future profits because higher interest rates give them an incentive to focus on current profits.

So it’s a challenging period for ROKU no matter how you look at the company. And the fact that the company managed to avoid losing $487 million in the SVB collapse doesn’t offset the investment risk for this stock.

Watching For A Bearish Entry Point

As I write this note, I don’t currently have a position in ROKU.

But the stock IS one of the top names on my bearish watch list.

ROKU’s rebound following the bullish analyst report may set up the perfect opportunity to buy put contracts on this stock in my Speculative Trading Program.

(If I do, subscribers to that program will be notified before I set up the trade in my own account.)

ROKU is just one of the 20 bearish names on my watch list.

The list also includes 20 bullish plays (stocks I expect to trade higher), and 20 income plays (stocks I use with my put-selling income approach).

You can get access to all 60 of these picks by subscribing to my “Profit Watch” service. It’s only $27 per year and you get a constantly updated list of stocks to consider for your own investment account.

Each pick comes with a quick writeup like you see in the image above.

And each weekend, I send you an email with my thoughts on the broad market and how our specific plays are setting up.

I don’t think you’ll find a better value for this type of research. And once you browse through this list of stocks, you can pick which ones you want to place in your own account.

You can find more information on the watch list here.

In the meantime, please keep ROKU on your radar — I think it’s got a long way to fall before it officially bottoms.

Here’s to growing and protecting your wealth!

Zach