Quantum computing is a revolutionary new technology, and an exciting frontier for investors! Over the next few years, traders and investors will experience both big wins and potentially big losses as quantum computing stocks swing back and forth.

Today, I want to share an investor’s overview of the industry. The purpose is to give you the basic information you need to successfully INVEST in the stocks that will profit from quantum computing.

Don’t worry… We’re not going to dive too deep into the science behind this technology. You don’t need a PhD in quantum physics to make money from these stocks.

Instead, I’ll share the three main factors I’m studying as I place my own trades in this emerging area of the market. And of course, I’ll share the stocks that I’ve been trading in my own personal account.

[Quick Note: If you want to see the actual trades I’m making in real time, be sure to subscribe to my Speculative Trading Program]

Quantum Computing — An Overview

Quantum computing is a type of computation that utilizes quantum mechanics to solve complex problems. These quantum processes are fundamentally different from the ways traditional computers process information and could dramatically change the way technology works in the coming years.

While classic computers use bits which are either “0” or “1”, quantum computers use qubits which can exist in a superposition of both “0” and “1” simultaneously. This allows quantum computers to explore a vast number of possibilities at once.

Scientists point to exciting use cases for quantum computing including:

- Drug discovery: Simulating the way molecules interact with each other to design new drugs and materials.

- Financial Modeling: Analyzing investment strategies and managing risk for various scenarios.

- Cybersecurity: Designing new encryption methods (and potentially breaking existing ones).

- Artificial Intelligence: Enhancing developments for machine learning and AI applications.

And we’re probably just beginning to scratch the surface!

Of course as with any new technology, there are growing pains. While the academics behind quantum computing are promising, it has been difficult — if not impossible — to apply quantum computing processes to real-world applications. (So far…)

Some thought leaders in the field even dismissed quantum computing as irrelevant at first, only to revise their opinion later and pour resources into exploring how the technology could actually work.

For example, Nvidia CEO Jensen Huang initially stated that quantum computing would have no use case for decades (if not longer). But recently Huang has changed his tone and Nvidia is now building a research center in Boston that will combine leading quantum computing hardware with AI supercomputers.

My Favorite Quantum Computing Stocks

When it comes to quantum computing stocks, I’ve got some bad news and some good news…

The bad new is that the quantum computing technology is incredibly complex. If you want to fully understand the intricacies of each companies’ technology, you’ll probably need to quit your full time job and devote all your time to studying quantum physics.

Even then, you’ll probably find it difficult to pick the right stock and the right timing to make the largest investment return.

Fortunately, the good news is that you don’t NEED to have a full working knowledge of quantum physics to invest in this area of the market. Instead, I’ll introduce you to a few key metrics for each company that will help you make an informed decision about which stock to invest in, and when you will have the highest probability of success with your investment.

For today’s report, we’ll be looking at the following companies. And please note, this report is being published in early July of 2025. The quantum computing market is extremely dynamic so new players will most certainly be added to the scene as the industry evolves.

- IonQ Inc. (IONQ)

- D-Wave Quantum Inc. (QBTS)

- Quantum Computing Inc. (QUBT)

- Rigetti Computing Inc. (RGTI)

Full Disclosure: I actively trade these names in my own personal account. So depending on when you read this report, I may have a personal position in one or more of these stocks or in option contracts for one or more of these stocks. Subscribers to my Speculative Trading Program have real-time access to my trading positions and recommendations.

Variations on Quantum Technology

While you don’t need to know the minute details of each company’s quantum computing technology, it can help to understand the basic approach that each company is taking.

That way if you see that a breakthrough has occurred with one specific type of quantum technology, you’ll know which company is likely to capitalize on the scientific advancement

IONQ primarily uses a “trapped-ion” technology which uses lasers to suspend individual atoms in a vacuum. A key advantage of this approach is that the qubits can maintain their quantum state for longer and have low error rates. This approach also does not require extreme cryogenic temperatures which can be difficult to maintain.

RGTI focuses on “superconducting qubits.” This method uses circuits that are cooled to extremely low temperatures. A key advantage is that this approach can scale to larger numbers of qubits allowing for the combination of multiple quantum processing units (QPUs). But the challenge of extreme cryogenic cooling adds complexity and costs to the process.

QBTS has a unique approach that focuses on “quantum annealing”. This is a more specialized approach to quantum computing that solve all types of problems that a full quantum approach theoretically could. But the quantum annealing approach is uniquely designed for a specific class of problems.

QUBT focuses on photonic (light-based) quantum machines that use quantum digits or “qdits” instead of qubits. These machines are designed for solving optimization problems and are able to be used in room temperature settings and designed for low power consumption.

Fundamentals of Quantum Companies

The majority of quantum computing companies offer “Quantum-as-a-Service” (QaaS) access to their own quantum computers. This allows customers to access their own company resources and allows the quantum computing companies to continue to keep close tabs on their own intellectual property.

- IONQ offers its services on Amazon Bracket, Microsoft Azure Quantum and Google Cloud.

- RGTI offers its own Quantum Cloud Services (QCS) platform.

- QBTS provides cloud-based services through its Leap platform and also integrates with major cloud providers.

- QUBT has its own “Dirac” system along with related services.

While none of the quantum computing companies listed currently turn a profit, the industry is still very young and growing. And each of these companies still have true economic value because of the intellectual property they are building.

Of course it is difficult to model a definitive valuation for what each stock should be worth because we can’t use a standard multiple of sales or multiple of profits. So in today’s market it makes a lot more sense to trade these stocks based on technical factors such as support and resistance areas, momentum, and trendlines.

Technical Patterns of Quantum Stocks

IONQ is currently an $11 billion company with a very attractive chart pattern.

The stock is trading above its 200-day and 50-day moving average, and has formed a textbook cup-with-handle formation.

This bullish pattern often shows up when investors are fearful during a selloff like we saw during the spring market pullback and then regain confidence as the market rebounds. The “handle” portion occurs when the stock hits resistance near its old high. A break above $50 would be a clear sign that IONQ is ready for its next leg higher.

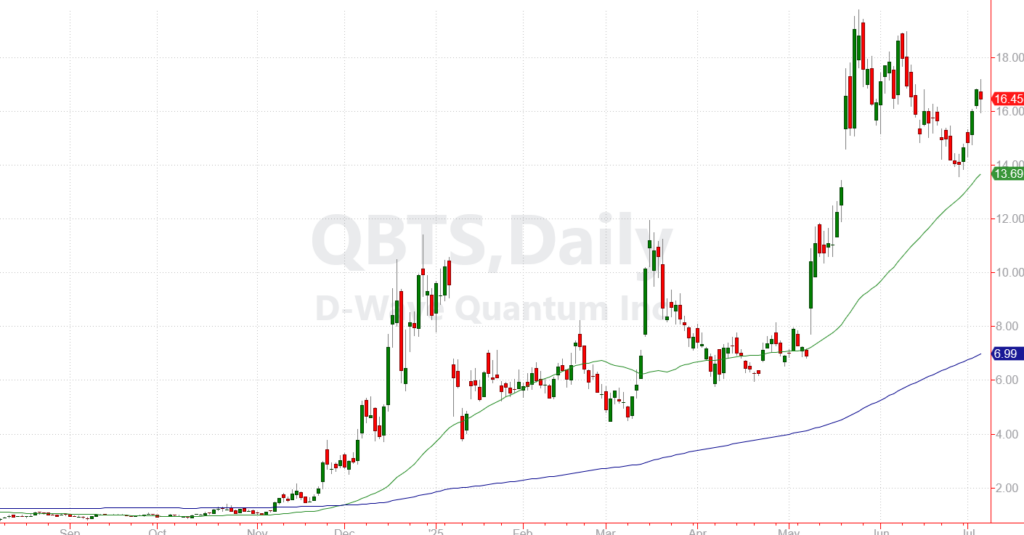

QBTS is smaller with a $5 billion market cap. The stock has performed very well this year and recently hit a new all-time high.

The stock has plenty of momentum and the recent pullback to its 50-day moving average (green line on the chart above) looks like a good buying opportunity. Given the rich amount of premium in the stock’s option prices, I’m interested in selling put contracts for income on this stock.

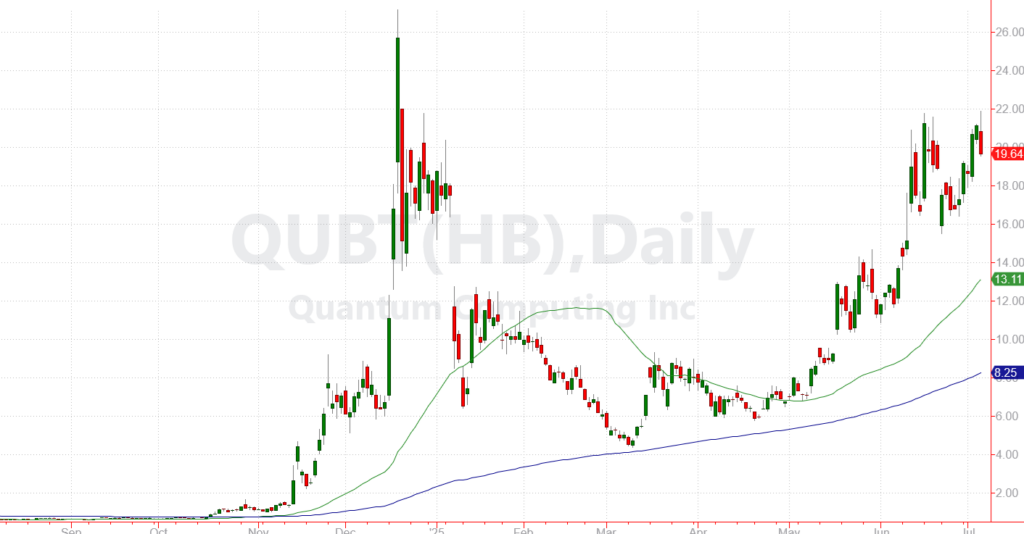

QUBT is smaller still with a $2.8 billion market cap. This smaller size makes the stock extremely vulnerable to large buy or sell orders.

Please use caution when trading this stock. I’m more inclined to take long-term positions with this name versus short-term trading positions. At least until the company grows a bit in size so that a single institutional buy or sell order doesn’t completely alter the stock’s trajectory.

RGTI is still on the small side with a $4 billion market cap.

The stock surged late last year as investors got excited about the prospects for quantum computing. Since then, shares have been trading in a sideways pattern. But now that the stock is above its 50-day moving average (green line in the chart above), there’s a higher probability that RGTI could be primed to challenge its 2024 highs.

It certainly helps that the broad market has been climbing steadily higher and investors have been embracing growth stocks.

I anticipate plenty of ups and downs for these names over the coming months. If you’re an active trader, these four stocks definitely deserve a spot on your watch list. And if you’re a long-term growth investor, I think it’s an important area to start building some exposure!

Here’s to growing and protecting your wealth!

Zach