One of the most popular stocks in the world is rolling over, causing potentially catastrophic damage to many investors’ accounts.

Are you holding this popular play?

I hope not!

Today, I want to explain why I’m worried about this “death cross” stock — and how you can actually profit as the stock trades lower.

Tesla’s Fall From Grace

Shares of Tesla Inc. (TSLA) have been disappointing investors since the stock peaked in November of 2021. At the time, shares were trading above $400. Today, the stock’s price is less than half that level.

Yet, despite years of underperformance, TSLA is still a very popular stock and has even been included in the “magnificent seven” group of popular mega-cap stocks.

TSLA’s stock price has been dropping. And shares could have much farther to fall as the company’s fundamentals deteriorate.

The biggest concern for TSLA today ties back to pricing. Tesla has been reducing its prices across the company’s entire product line, and in markets around the world. Pricing in China has been of particular concern, especially given the economic weakness the country is experiencing.

At the same time, TSLA is facing rising competition from a rising number of auto manufacturers. In the early days, Tesla produced the only viable electric vehicle. And the quality level made Tesla vehicles a sought after commodity.

Today, traditional manufacturers are rolling out luxury models that rival Tesla’s level of quality. I personally saw several great vehicles from Mercedes, Audi and others at this year’s Consumer Electronics Show (CES).

As competition picks up, TSLA will have a hard time demanding premium pricing for its vehicles. So weak profit margins will likely continue to be a drag on the stock.

The Reliability Factor and a Declining Share Price

Over the last few weeks we’ve seen some troubling trends for electric vehicles.

As temperatures dropped across the United States, many electric vehicles were rendered inoperable. The cold weather naturally reduced battery life, and in some cases the batteries were too cold to recharge.

In some areas, Tesla charging stations were overrun by failing vehicles to the point where tow trucks were called in just to remove the disabled vehicles.

Of course this isn’t an issue just for Tesla. Other electric vehicles had the same issue.

But as consumers become aware of these events, the allure of driving an electric vehicle is starting to implode.

Tack on other concerns like the environmental damage from actually producing these vehicles (including the mining of lithium and other important materials), and you’ve got a scenario where Tesla vehicles — and the stock — are becoming less attractive.

So it’s no wonder shares are trending lower.

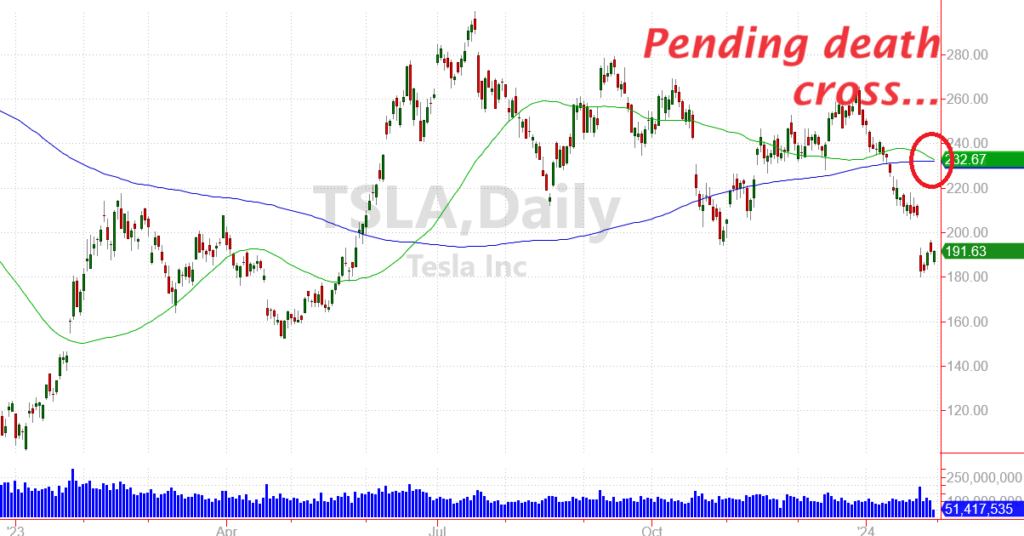

And as this bearish trend continues, TSLA’s stock chart is flashing a warning sign known as a “death cross”.

A death cross occurs when a short-term moving average (the green line in the chart above) crosses below a long-term moving average (the glue line in the chart above). I use a 50-day moving average and a 200-day average with my charting platform.

While there’s nothing magical about this death cross, the indicator shows that both the short-term and the long-term trend for TSLA is moving lower. And this pattern can often trigger new sell orders from short-term traders.

Profiting From TSLA’s Decline

My Speculative Trading Program has a bearish position on TSLA. Which means we’re set to profit if shares of TSLA move lower.

This trade makes sense on its own — because the stock is showing weakness at a time when the rest of the market is actually holding up well.

The trade also works as a “hedge” to help offset some of the more bullish positions I’ve got on the books.

So far this year, my Speculative Trading Program has generated a 16% return. This as of Tuesday’s market close. (Please remember past performance does not guarantee future results — and all investing involves risk.)

Much of this profit has come from bullish plays that have performed well in the first moth of 2024.

By adding a bearish play for TSLA, I’m able to reduce my overall risk. This way, if the broad market pulls back, my gains from a bearish TSLA position can help to offset some of the losses I may incur from bullish plays.

As a reminder, my Speculative Trading Program is a real-money portfolio that I use for my own family’s investments. If you subscribe to this program, you’ll receive real-time email alerts (and optional text alerts) before I enter each trade myself.

You can choose to mimic my trades in your own account, or simply pick the ones that make the most sense to you.

For just $147 a month, this program is a great source of new trade ideas that you can profit from in your own account.

>>More info on the Trading Program here<<

While I know TSLA is a popular stock — and still a popular car company — I’m concerned about the direction of the overall business and the potential for a drop in TSLA’s stock price.

Treat this investment with caution and consider a bearish play to help offset your risk in other areas of the market.

Here’s to growing and protecting your wealth!

Zach