Selling BBBY puts for income.

Bed Bath & Beyond (BBBY) has been very active this month after activist investor Ryan Cohen took a position and wrote a letter to the company’s board.

The company is a turnaround story and management has been working hard to update stores, improve the e-commerce platform and cut costs.

The future looks bright for BBBY and the stock is now trading at a reasonable price compared to expected earnings for the next two years.

Thanks to the volatility, put contracts for BBBY are very expensive. This allows us to lock in an oversized payment while agreeing to buy shares at a price well below today’s current market price.

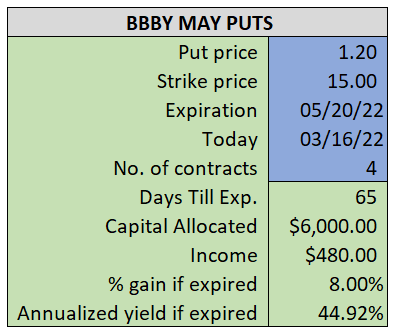

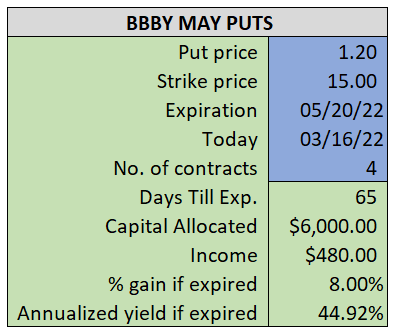

By selling the May $15 puts near $1.20, we’re able to collect an annualized yield near 45%, while also giving us roughly $5.50 per share in cushion between the current market price for BBBY and our strike price.

- Sell (to open) 4 BBBY May 20th $15 puts

- Limit: $1.20 or more

- The new position will represent roughly 6.3% of our model.

~~~~~~~ - 14:11 Executed

- Sold 4 BBBY May 20th $15 puts @ $1.26