Don’t look now, but the U.S. stock market is starting to rebound!

After a brutal month for investors (on top of what has been a brutal year), the Dow is currently up more than 450 points as I write this.

Great news, right?

Well, not so fast…

Color me skeptical when it comes to this rebound. I don’t want you to get sucked in to another bear market trap.

And more importantly, I want to make sure you understand which areas of the market are most likely to do well when we eventually emerge from this bear market.

Don’t Fight the Last War

“Generals are always prepared to fight the last war” ~Winston Churchill

As we anticipate an eventual market turn (or even just a bear market rally), it’s tempting to buy the same stocks that have worked well in the past.

During the post-pandemic rally last year, technology stocks led the way.

And not just any tech stocks…

The names that gave investors the best returns were growth stocks of companies that had no current earnings (but huge potential for future earnings). At least investors expected future earnings.

That type of bull market works well when interest rates are very low and investors are willing to accept a tremendous amount of risk.

But that’s not the kind of bull market I expect in 2023.

Instead, an entirely different class of stocks will lead the way higher.

And investors who are “fighting the last war” — or buying the stocks that did well last time the market rallied — will be disappointed.

A Generational Transition to Value

Throughout decades of market action there have been extended periods when growth stocks are in favor. And those periods are followed by long stretches where value stocks outperform.

When capital is cheap (because of low interest rates), and economic growth is strong, it makes sense for investors to favor growth names. These stocks will typically surge higher as businesses expand.

But when interest rates are higher and investors face more risk, value stocks become much more attractive.

These stocks carry less risk because shares are cheap compared to company profits. And as more investors look for these bargains, stock prices for value stocks typically outperform.

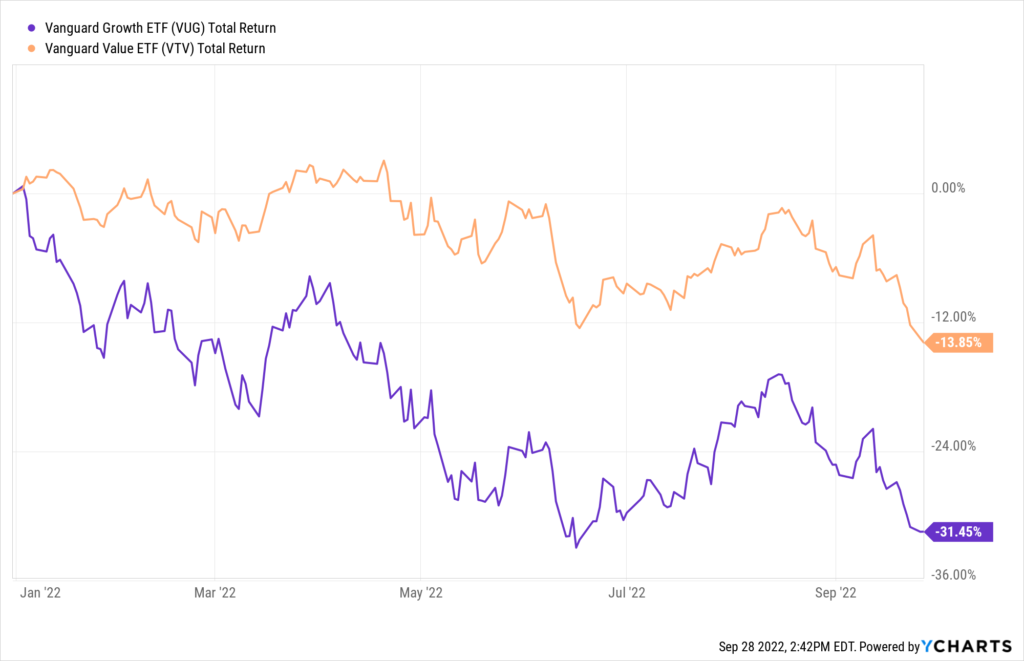

We’ve already seen that transition happening this year as value stocks have held up much better than growth stocks.

Just take a look at the Vanguard Value ETF (orange line) compared to the Vanguard Growth ETF (purple line).

Growth stocks are down more than twice as much as value stocks. And they could take much longer to rebound even when the bear market is finally over.

Instead of trying to make back losses with the same tech stocks that led the market lower, consider a different approach.

Many stocks in the energy, defense, financial, and medical industries are trading at very low valuations. In other words, investors are getting more “bang for their buck” (or earnings for their investment) from these plays.

Yes, these stocks can benefit from strong earnings. And they can also trade higher as capital moves away from tech stocks and into value stocks.

Here’s to growing and protecting your wealth!

Zach

Oh, One More Thing…

My Accelerated Income Model pulls payments from some of the highest quality stocks using a little-known Wall Street strategy.

I learned this tactic when I was a hedge fund manager. And it’s my favorite way to invest my own family’s money.

The cash payments come from an agreement to buy shares of stock. And you can choose which stock you prefer to use — along with what price you think is fair — when setting up your income play.

You can see all the details in my Accelerated Income Model.