“Why should I care about interest rates? I’m investing in TECH STOCKS!“

My friend Jeff and I were sitting at lunch. A financial news station was on in the background and a reporter was blaming a weak stock market on a tick higher for interest rates.

“What do rates have to do with it anyway?! These companies are making robots, computer chips and self-driving cars!“

He had a point…

Most tech stock investors buy shares because they’re excited about the company… Because they believe in the story… And because they’re looking forward to years and years of growth ahead.

These investors often don’t even care about profits!

Not to mention interest rates.

But if you’re serious about growing and protecting your wealth, it’s important to understand why interest rates actually do matter when it comes to growth stocks you’re invested in today.

The Critical Wall Street Equation

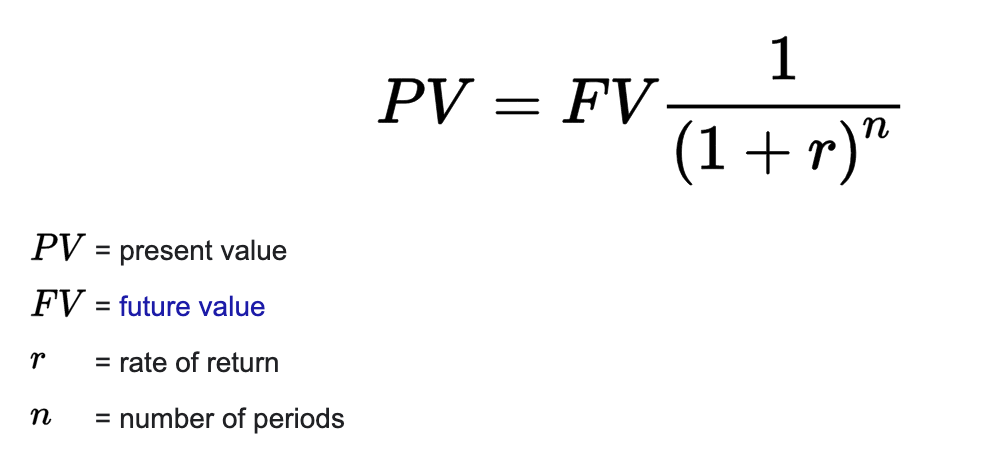

There’s one formula on Wall Street that supersedes all the rest:

It’s called the “present value” formula and it’s used by institutional investors around the world. They use this formula to determine the “fair value” for everything from stocks to bonds to real estate and even private company buyouts.

Don’t worry, I’m not going to ask you to pull out the calculator and start crunching numbers. But I do want you to understand the basics behind this formula.

That way you can understand what the professional investors on Wall Street are looking at. Because their buy and sell decisions can often move stocks in one direction or another — regardless of what’s happening with the growth company you’re invested in.

The equation above simply tells us the the present value of a stock (or any other investment) is equal to the future value of cash payments discounted at a certain rate.

In other words, investors look at future payments they expect to receive from this investment (including the price they hope to sell it at), and then decide what they should be willing to pay today for those future payments.

It helps to look at a more simplified example.

What is an Investment Worth Today?

Let’s take a look at a simple investment you might make, and see how different interest rates could affect that investment.

We’ll start by making an investment that we expect to pay us $1,000 in exactly one year.

What would you be willing to pay to secure that $1,000 in the future?

If the current interest rate for a savings account is 2% you should only be willing to pay about $980. That’s because at a 2% interest rate, your $980 would grow to $1,000 over a year’s time.

If we assume you are highly confident that this investment will pay the $1,000, it might be reasonable to invest $980 and get that 2% return. And if there was more risk involved, you’d need to be able to buy this investment for a cheaper price.

That way your total percentage return would be higher to compensate you for the extra risk you are taking.

Now, let’s see how this same investment would be priced if interest rates were higher…

If interest rates moved higher and you could get a 5% rate of return on a savings account, that changes what you would be willing to pay for our investment.

Now, you should only be willing to pay about $952 for the same investment.

Even though it is still paying you the same $1,000 at the end of the year, you wouldn’t want to invest unless you were getting at least a 5% return. And to get that return, you would need to buy your investment at a cheaper price.

So whenever interest rates move higher, it naturally creates an incentive for investors to pay less for future profits.

More Time Means More Rate Sensitivity

So far, our example only looks at how interest rates change the current price for a one-year investment. But if you extend the amount of time for holding a position, the importance of interest rates increases exponentially.

The value of an investment expected to pay $1,000 in three years, depends once again on the interest rate during that time period.

With an interest rate of 2%, your three-year investment would be priced near $942. If you paid $942 today, and received $1,000 in three years, that would give you a 2% annualized rate of return.

With an interest rate of 5%, your three-year investment would be priced near $864. If you paid $864 today, and received $1,000 in three years, that would give you a 5% annualized rate of return.

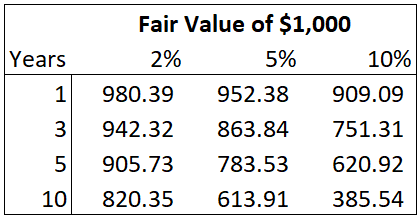

Here’s a quick table that shows different prices for an investment expected to pay $1,000. The prices differ based on the amount of time, and specific interest rates.

Remember, each of these investments is expected to pay $1,000. But today’s “fair value” for each investment can be dramatically different depending on the amount of time until you receive your payment, and the interest rate for that time period.

Looking at a 10-year investment, there is a dramatic difference in price when rates are 2% (the investment price is $820) and when rates are 10% (the current investment price drops to $386).

When institutional investors start using this formula to determine what they will pay for any specific tech stock, you can see how a change in interest rates makes a big difference with their equation.

Why Growth Stocks Are Particularly Vulnerable

Growth stocks ban be very attractive to investors because the long-term prospects are so great. It’s exciting to think about how much profit a dynamic tech company could produce ten years from now if all goes as planned.

But even with so much potential, most growth stock investors look several years into the future for the bulk of profits they expect to receive.

Unfortunately, the extended time period before profits start accumulating causes Wall Street’s “present value” calculation to discount the current value these investors are willing to pay. And as interest rates rise, that present value calculation becomes an even bigger challenge!

You might be much more interested in following a company’s progress on self-driving technology, the new app they expect to launch, or how blockchain technology will eventually secure cross-boarder payments.

And all of that information is important to keep track of!

But when you’re doing your homework on growth stock, don’t forget about Wall Street’s favorite formula. After all, institutional investors move billions of dollars in and out of different areas of the market.

Their calculations (along with their buy and sell orders) can affect how successful your stock position will be.