As I write this alert, the internet won’t let me connect to Facebook. And that’s both a GOOD thing and a BAD thing (both for investors and for the public!)

We’ll get to the investment idea in just a moment. But first, a quick thought about how today’s outage is affecting our culture.

Facebook’s Outage Is More than an Inconvenience

The popular social media site is down — across most of the world from the tweets and articles I’ve read.

And while I don’t use Facebook that much I do post some of my content to the site. And I enjoy sharing the occasional picture of an adventure with the kids or a scenic trail run. Ironically, if you follow me on Facebook (shameless plug I know) you may have even stumbled on to a link of this article on Facebook — after the outage was resolved of course.

Today’s outage gives us a chance to evaluate how our day-to-day lives are heavily influenced by social media. Even though I’m not on Facebook that much, the idea that I can’t log in triggered some kind of urge in my brain to keep checking if the site was back up.

Sure, it was partly due to the fact that I’m beta testing a trading program with a few close friends and family — and using Facebook to distribute the trade alerts. I’m sure I’ll be sharing more about this idea with you in the future.

I can’t imagine how frustrated I would be if I was one of those people who is constantly scrolling through social media the way many teens and young adults do these days.

And if I were managing a team of employees, I’d be worried about their productivity! I wonder how many man-hours of work has been lost today as workers keep pulling their phones out to check if service has been restored.

While the outage is certainly bad news for Facebook as a company — and another frustrating catalyst if you’re an investor in FB — there are definitely some silver linings to be thankful for.

On the personal side, just being aware of how my brain reacts to this shutdown is helpful. Paying attention to how many times I pick up my phone — or type “faceb…” into the browser that knows exactly where I’m headed — alerts me to at least some level of addiction.

From there, it’s up to me to decide how to be more purposeful with my time. After all, time is one of the only resources that is precious to ALL of us!

No matter how rich or poor you are, you can’t buy time, you can’t horde time, and we all have reasons to be responsible with our time.

Alright, enough introspection… Let’s take a look at the cloud — and silver lining — for investors!

Facebook’s Pullback Sets up a good Reward to Risk Play

Quick disclaimer here… Before we get in to today’s play, you should know that I don’t know where shares of FB are headed. It would be foolish of me to say that I did.

Short-term market movements can be unpredictable. And individual stocks — especially popular stocks like FB — can be even harder to gauge.

But as investors and traders, we can often make trades where the balance between potential profits, and the potential risk, are skewed in our favor.

That’s exactly what I see when I look at the situation with FB.

Over the last several weeks the company has been hit with plenty of bad news. Today’s whistleblower testimony and the company’s outage are certainly affecting the stock today. But the decline has actually been going on for some time

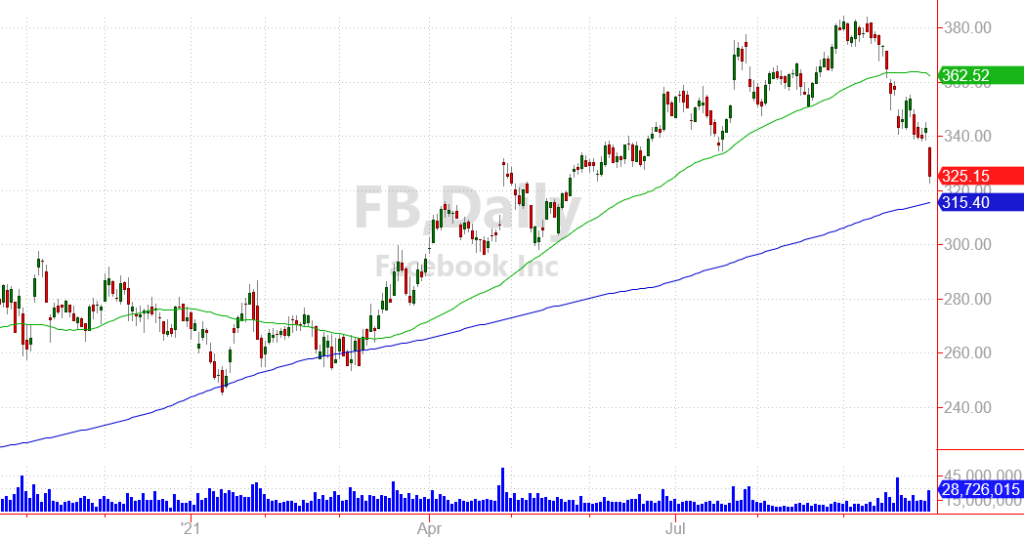

Just look at the chart!

If you’ve been holding shares of FB through the entire period, it’s been frustrating to watch. And yet, if my numbers are correct, the stock is still up roughly 23% over the last 12 months.

Not bad for a large-cap tech company that’s going through a public relations crisis!

Here’s where the situation gets interesting…

Today’s “Washout” Sets the Stage for a Rebound

With today’s sharp drop, shares of FB are close to the 200-day moving average (the blue line on the chart above). And while there’s nothing “magical” about that line, it’s an indicator that shows up on a lot of traders’ chart platforms.

It’s also a key long-term trend indicator. So large institutional investors who have a material stake in the company may want to defend that line to keep other investors from bailing out if the trend is broken.

(Notice how the stock bounced off the 200-day average line this spring — the last time shares of FB ent through a “rough patch.”)

Also, today’s public testimony and platform outage may wind up being “the last straw” for investors who have become increasingly uneasy holding this stock. When I was at the hedge fund, we’d call this “capitulation” — or a complete “washout.”

When a true washout is complete, everyone who might sell out has already sold out. And that leaves most shares in the hands of long-term investors who are less likely to panic. (After all, they’ve held their shares this long… so what else could scare them?)

Stocks that have survived a washout like this often rebound — sometimes very sharply — for at least the next few weeks. If you catch the situation right, you can book a big profit as the stock trades higher!

Now I’m not telling you that FB WILL trade higher.

But I am telling you that this looks a lot like a capitulation situation that has potential for a sharp rebound.

One thing I like about a capitulation trade like this, is that you know right away whether it’s a good trade or not.

If this truly is the final washout for FB, the shares should bounce pretty quickly. (Like maybe today — or in the next few trading sessions). So buying shares for a trade in here could start generating profits this week.

And if it’s not the true washout, we can close our position out quickly. If the stock closes more than a buck or two below the 200-day average, you could sell your shares and wait for a better opportunity.

The key is to manage your risk and cut your investment quickly if shares keep moving lower and this turns out not to be the end of the pullback.

I like this type of trade because it gives us an “asymmetric return profile.” That’s a fancy term that just means “potential gains are much larger than potential losses.”

I love situations where the odds are stacked in my favor. And you should too!

But remember, all investments involve risk and there is no “sure thing” in markets. So stay balanced and diversify into many different opportunities. Never bet the farm on any one situation.

I’ll wrap this up so I can get it out to you before the market closes.

Here’s to growing and protecting your wealth!

Zach

P.S. I “only” checked Facebook three times while I was putting together this alert — ugh!!